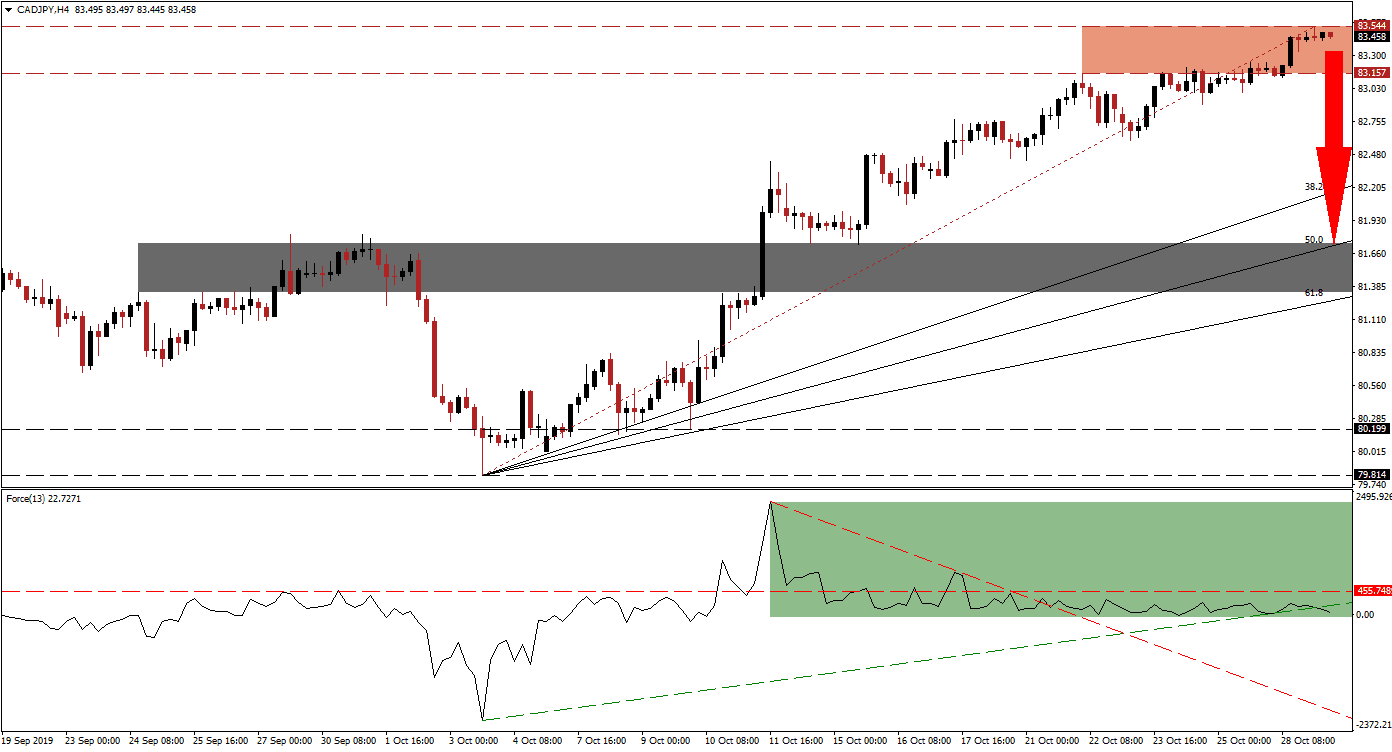

With the global economy on recession watch, the oil market has been largely depressed which is posing a headwind for the Canadian Dollar; last week’s election results out of Canada left PM Trudeau with a minority government after losing the popular vote. Despite this, the CAD/JPY managed to extend its advance while bullish momentum is fading which left this currency vulnerable to a sell-off. The risk-on mood across global financial markets has also contributed to the advance as the Japanese Yen, a safe haven currency, came under selling pressure. The advance also created a big gap between price action and its Fibonacci Retracement Fan.

The Force Index, a next generation technical indicator, is flashing multiple sell signals and the CAD/JPY is expected to come under a fresh wave of selling pressure. As price action advanced, a negative divergence formed; this bearish trading signal occurs when an asset pushes higher while its underlying technical indicator contracts. After the negative divergence formed, the Force Index remained below its horizontal resistance level and the sideways trend with a bearish bias resulted in a move below its descending resistance level. Now this technical indicator moved below its ascending support level in the latest bearish development as marked by the green rectangle. You can learn more about the Force Index here.

With bullish momentum receding further inside the resistance zone, located between 83.157 and 83.544 as marked by the red rectangle, risks of a breakdown are increasing. Another bearish development emerged as the CAD/JPY moved below the Fibonacci Retracement Fan trendline, and a breakdown is expected to close the gap between this currency pair and its Fibonacci Retracement Fan sequence. Forex Traders are advised to monitor the intra-day low of 82.600 as the sell-off unfolds, this level marks the low from the first reversal after price action reached the bottom range of its resistance zone; a push lower is expected to further fuel the corrective phase.

Another minor support level awaits price action at the intra-day high of 82.425 which marks the peak of the first breakout above its short-term resistance zone which turned it into support. A reversal of this peak lead to the acceleration which took the CAD/JPY to its most recent intra-day high. A breakdown below the 82.425 level will clear the path for this currency pair down into its short-term support zone which is located between 81.334 and 81.739 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level just moved above this zone while the 61.8 Fibonacci Retracement Fan Support Level is closing in on the bottom range of it. You can learn more about a support zone here.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 83.450

Take Profit @ 81.600

Stop Loss @ 83.950

Downside Potential: 185 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.70

Should the Force Index reverse and manage a double breakout, above its ascending support level which acts as temporary resistance and above its horizontal resistance level, the CAD/JPY may try to extend its advance. The next resistance zone is located between 84.349 and 84.841, any advance into this zone should be viewed as an excellent short-selling opportunity in this currency pair.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 84.100

Take Profit @ 84.550

Stop Loss @ 83.900

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25