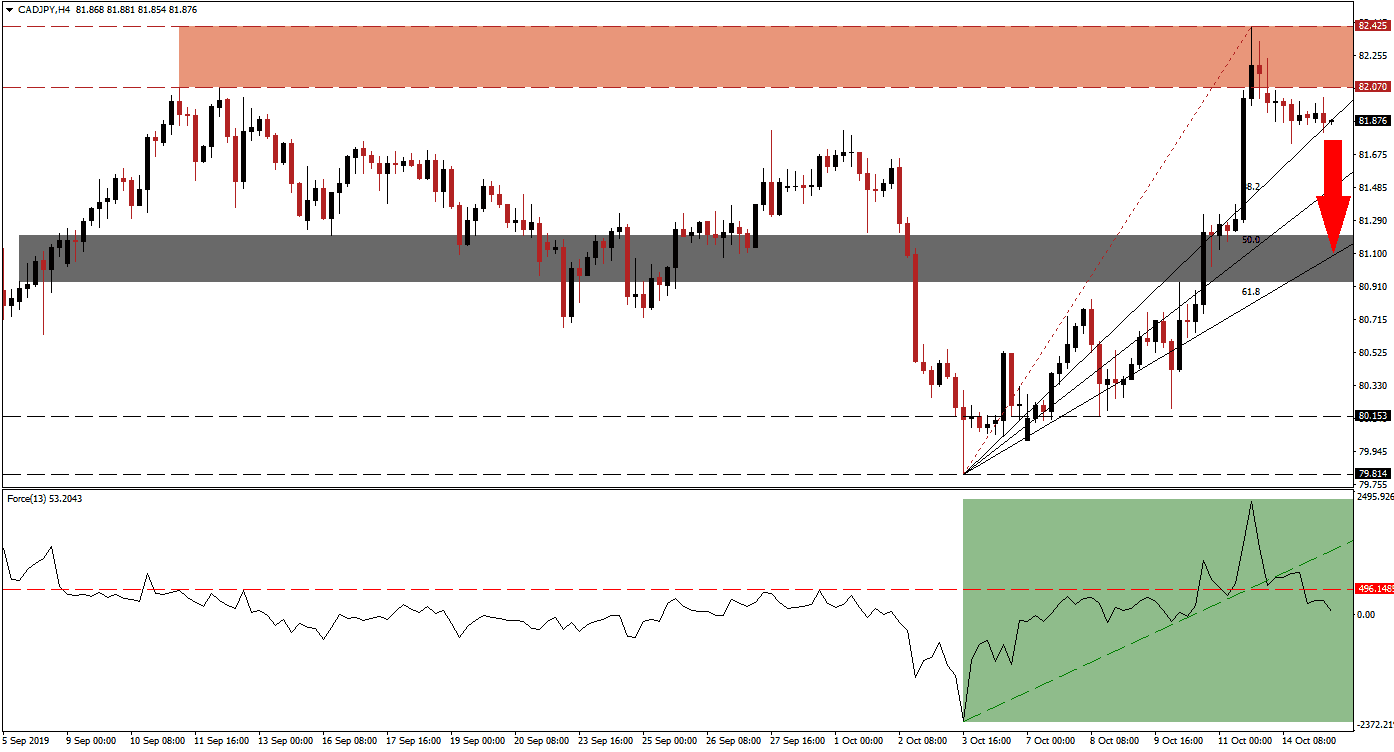

Risk-off sentiment is slowly returning after the initial euphoria that a partial trade deal has been announced between the US and China. As markets realize that the announced deal lacks substance, has not taken December tariffs off the table or rolled back existing tariffs, economic reality sets in and is expected to drive price action. The CAD/JPY spiked over the past few trading sessions and a steep Fibonacci Retracement Fan sequence emerged, but this currency pair already completed a breakdown below its resistance zone from where more downside is expected to follow.

The Force Index, a next generation technical indicator, accelerated to the upside together with price action. As the CAD/JPY completed is breakdown, the Force Index quickly plunged as bearish pressures mounted; this took it below its ascending support level as well as below its horizontal support level and turned both into resistance. While this technical indicator remains in positive conditions as marked by the green rectangle, the magnitude of the reversal is expected to quickly take it below the 0 center line and place bears in control of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the breakdown below its resistance zone, located between 82.070 and 82.425 which is marked by the red rectangle, the CAD/JPY has now moved below its ascending 38.2 Fibonacci Retracement Fan Support Level and is turning it into resistance. A move into negative territory by the Force Index is expected to attract fresh sell orders and push this currency pair further to the downside. A sustained move below the intra-day low of 81.742, the low of the current breakdown, is also expected to spike bearish pressures and drive price action below its 50.0 Fibonacci Retracement Fan Support Level.

As risk-off sentiment is on the rise, the Japanese Yen is set to outperform markets in-line with its safe haven status. The next short-term support zone is located between 80.934 and 81.207 which is marked by the grey rectangle; the 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone. Uncertainty over the outcome of Canadian elections, held on October 21st 2019, is expected to drive the Canadian Dollar to the downside, further fueling a sell-off in the CAD/JPY. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

CAD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 81.850

Take Profit @ 80.950

Stop Loss @ 82.150

Downside Potential: 90 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.00

A reversal in the Force Index above its horizontal resistance level could result in the CAD/JPY attempting a breakout above its resistance zone. This remains an unlikely event given the current fundamental picture as well as technical indicators and a new catalyst would be required. The next resistance zone is located between 82.890 and 83.229 from where a previous sell-off emerged. Any advance into this zone should be taken advantage of as it represents a great short-entry opportunity.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 82.450

Take Profit @ 83.100

Stop Loss @ 82.150

Upside Potential: 65 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.17