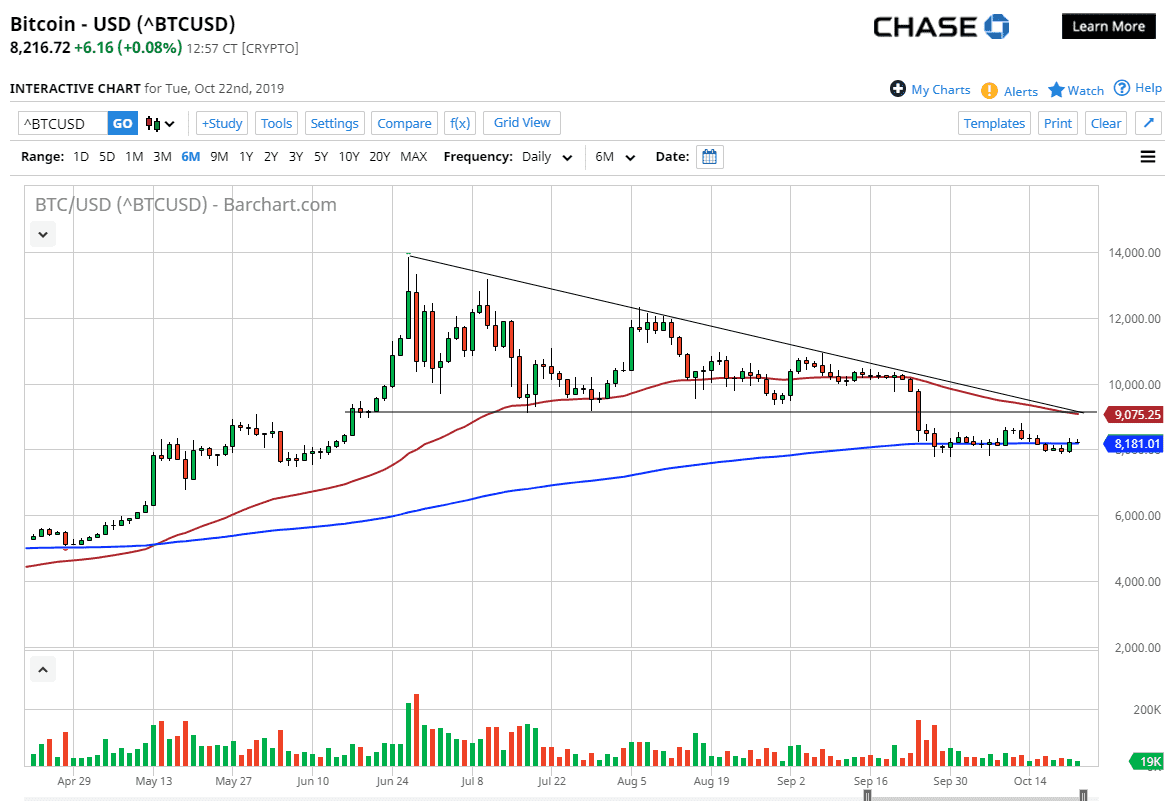

Bitcoin markets have done very little of the last couple weeks, which is quite typical of Bitcoin for long periods of time. At this point, it’s obvious that we are in one of those stretches where crypto simply dies off. However, looking at the chart you can see that we have certainly seen quite a bit of bearish pressure over the last couple of months. After all, the market has initially tried to rally but started to compress lower, forming a massive descending triangle. Now that the descending triangle is broken to the downside, it suggests that we have further to go to the downside.

At this point, the measured move from the descending triangle suggests that the Bitcoin markets could go down to the $4800 level. However, that doesn’t mean that will get there soon. In fact, it would not be surprising at all to see Bitcoin do nothing for a while. Quite typically you can see this market go sideways for a couple months at a time before some type of catalyst comes along to move the markets.

The 200-day EMA is slicing through the candlesticks that make up this short-term consolidation, and it will of course attract a lot of attention. That being said though, once we break down below the recent lows of the last couple of weeks, that will open up the door for a move down to the psychologically important $7000 level. The 50-day EMA is also starting to put pressure on the Bitcoin market as well, and if you look at the historical charts, the 50-day EMA does seem to attract even more attention. In other words, there’s nothing good-looking about this chart.

Over the last six months or so, Bitcoin has not participated in a rally that was supposed to be tailor-made for it. Fiat currencies around the world continued to suffer at the hands of central banks cutting interest rates and quantitative easing, while Bitcoin just drifted sideways to slightly lower. This shows just how weak the market is. There is a simple lack of adoption, and quite frankly Bitcoin loses most of its utility when each coin become so expensive. If you cannot have a stabilized market, you simply don’t have any use for this other than speculation. The biggest driver of Bitcoin to go higher over the last year seems to have been money flowing out of China.