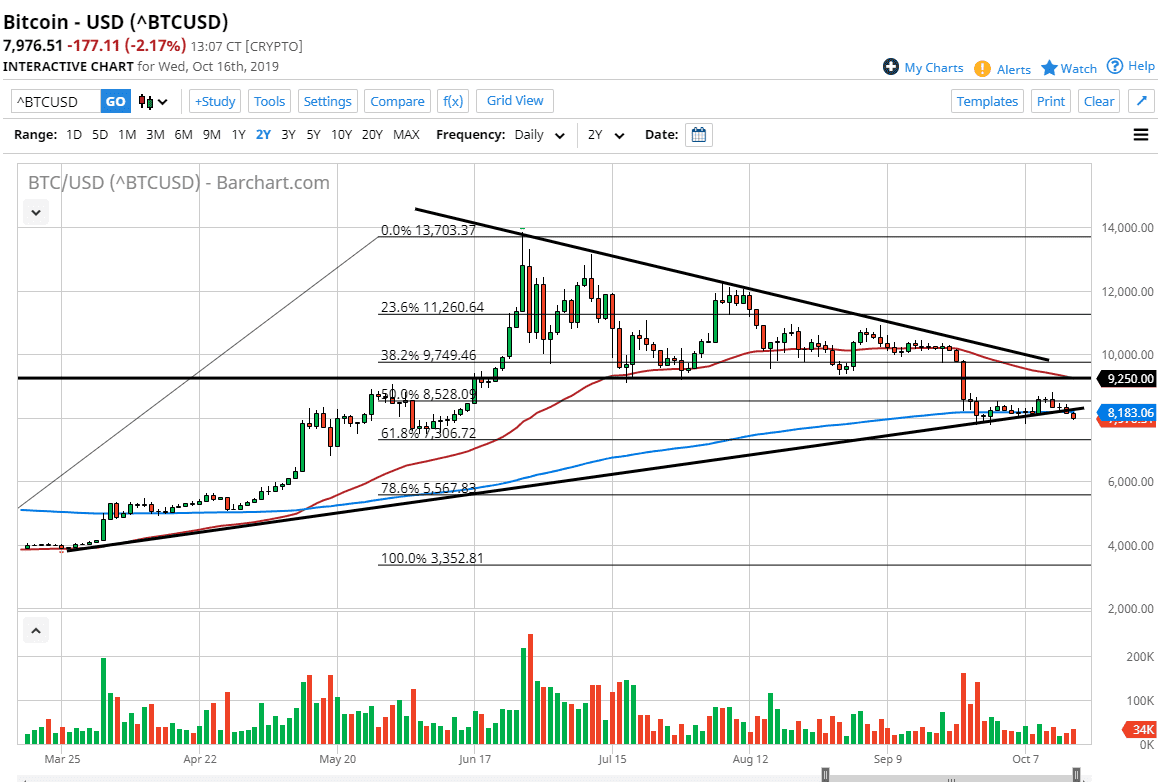

Bitcoin has finally broken through the uptrend line and rolled over through the 200 day EMA. This is a market that has refused to participate in the idea of central banks cutting interest rates and going deeper into quantitative easing. In the past, bitcoin has been used as a conduit for money trying to go from fiat currency into something else that can avoid the central banking system. Obviously, that has not been happening and it suggests that current conditions could only exacerbate to the downside as we have further weakening and dovish comments coming out of central bankers around the world, and yet bitcoin simply continues to wilt.

The $8000 level being broken to the downside is a major turn of events as well, and it’s likely that we could break down even further. Looking at the wedge, more importantly we can look at the top of it and see that the descending triangle has broken down, which was essentially the top of the wedge. Based upon that descending triangle, it looks as if the market could break down towards the $4800 level, and this most recent break through the uptrend line looks to be kicking off the next leg lower. This is something that I have been warning about for several days now, and it looks as if we finally are starting to make some progress to the downside.

Obviously, we won’t get to the $4800 level overnight, but obviously this is a market that will grind its way to the downside. Rallies at this point should be sold into on signs of exhaustion, especially on shorter-term charts. Even if we were to rally from here, the $9250 level should offer quite a bit of resistance. It was after all the bottom of the descending triangle.

The previous uptrend line should also offer resistance on the way back up, as it should offer plenty of market memory due to the previous support. Market memory is something that should always be paid attention to, because there is a lot of order flow in this area. The 200 day EMA being broken below also has longer-term algorithms firing off short positions in a market that is obviously changing its overall attitude towards the underlying asset. At this point, I have no interest in buying and I do believe it’s only a matter of time before the sellers overwhelm any attempt to rally.