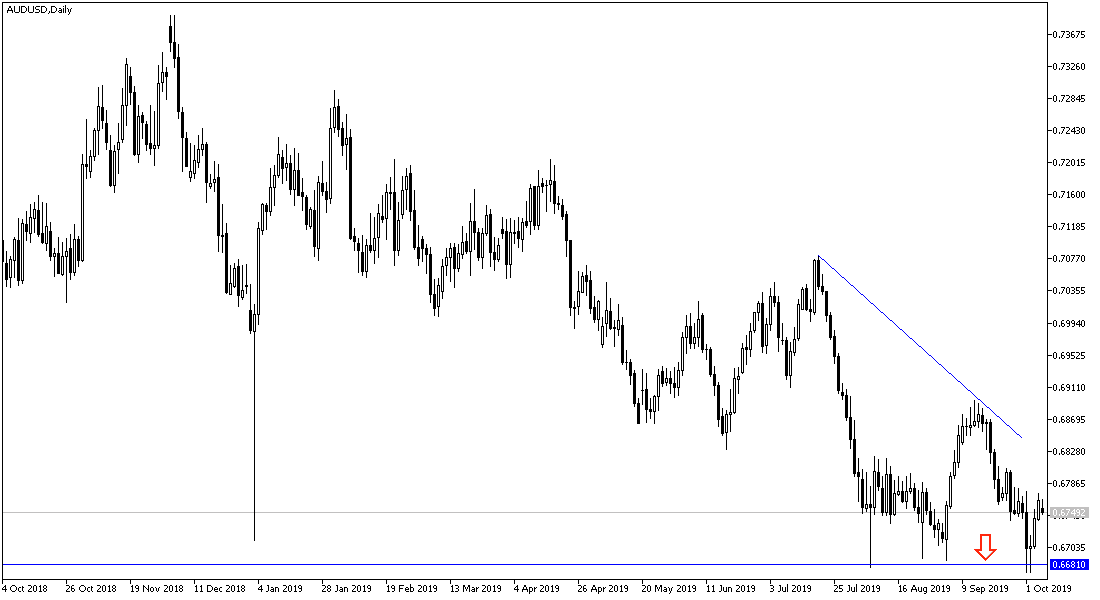

Continued downward pressure on AUD / USD contributed to the decline to the 0.6670 support level, the 10 years low, before settling around 0.6760 at the beginning of this week's trading. Risk Aversion and Continued World Trade Wars are still causing strong pressure on the Australian dollar, which remains a risk currency. The Reserve Bank of Australia cut interest rates for the third time since June, increasing the lack of trust in the Australian dollar. On the economic front, the Building Approvals index fell 1.1%, marking a third consecutive decline. Australian retail sales rebounded with gains of 0.4%, below expectations of 0.5%.

US economic indicators began to point to a slowing economy. The ISM manufacturing PMI for September fell to contraction for the second consecutive month. The Services PMI reported growth, but fell to 52.6, the lowest reading since August 2016. US employment data also disappointed, as the US economy created a total of 136,000 new jobs in the non-farm sector, short of expectations at 145,000. The hourly wage growth also fell strongly and suddenly to 0.0%, down from 0.4% the previous month. The unemployment rate fell to 3.5%, the lowest since 1969.

Learn about the most important economic data and events that will affect the Australian dollar this week:

Tuesday. NAB business confidence will be announced. The National Bank of Australia's index fell sharply to one point in September, down from a reading of 4 a month ago. Business remains highly concerned about the economy, despite the RBA's rate cut over the past few months.

The Australian dollar will be affected by the announcement of new Chinese loans next Thursday. In August, Chinese banks lent 1.21 trillion Yuan ($ 170 billion), a figure higher than July. The upward trend is expected to continue in September, with an estimated 1.35 trillion Yuan ($ 189 billion).

Learn about the most important data and events that will affect the USD this week:

At the beginning of the week, the US dollar will be on a date with the first remarks by Federal Reserve Governor Jerome Powell. Powell is expected to confirm on recent occasions that the bank will monitor economic developments and external risks to determine appropriate monetary policy. Emphasizing the independence of the Bank's decisions away from the political management of the country.

On Tuesday, the US producer price index (PPI) will be released, which is a measure of inflation, with expectations of a drop in prices, confirming that US inflation will continue to fall despite tow US rate cut decisions this year. Later, there will be new remarks by Federal Reserve Governor Jerome Powell.

Wednesday. It will be the most important and most influential on the US dollar with comments by US central bank governor Powell and the release of the Fed meeting minutes, in which, as expected, they cut US interest rates for the second time in 2019. Any pessimistic signals from the minutes regarding a split will increase expectations of a third rate cut before the end of the year.

Thursday. The release of US consumer price figures, and if dropped as expected, will increase downward pressure on the US dollar as it reinforces expectations that US interest rates could be cut soon.

AUD / USD technical outlook for this week:

The general trend of AUD / USD remains bearish and will remain so as long as it remains stable below the 0.7000 resistance level. The RBA has cut interest rates three times in the past four months, in a desperate attempt to boost economic activity. Weak global demand has hampered manufacturing and export sectors, and there may be more headwinds for Australia, especially if the US-China trade dispute continues.

The most important support levels for the AUD/USD this week are: 0.6680, 0.6590 and 0.6485 respectively.

The major resistance levels for the AUD/USD this week are: 0.6830, 0.6920 and 0.7070 respectively.