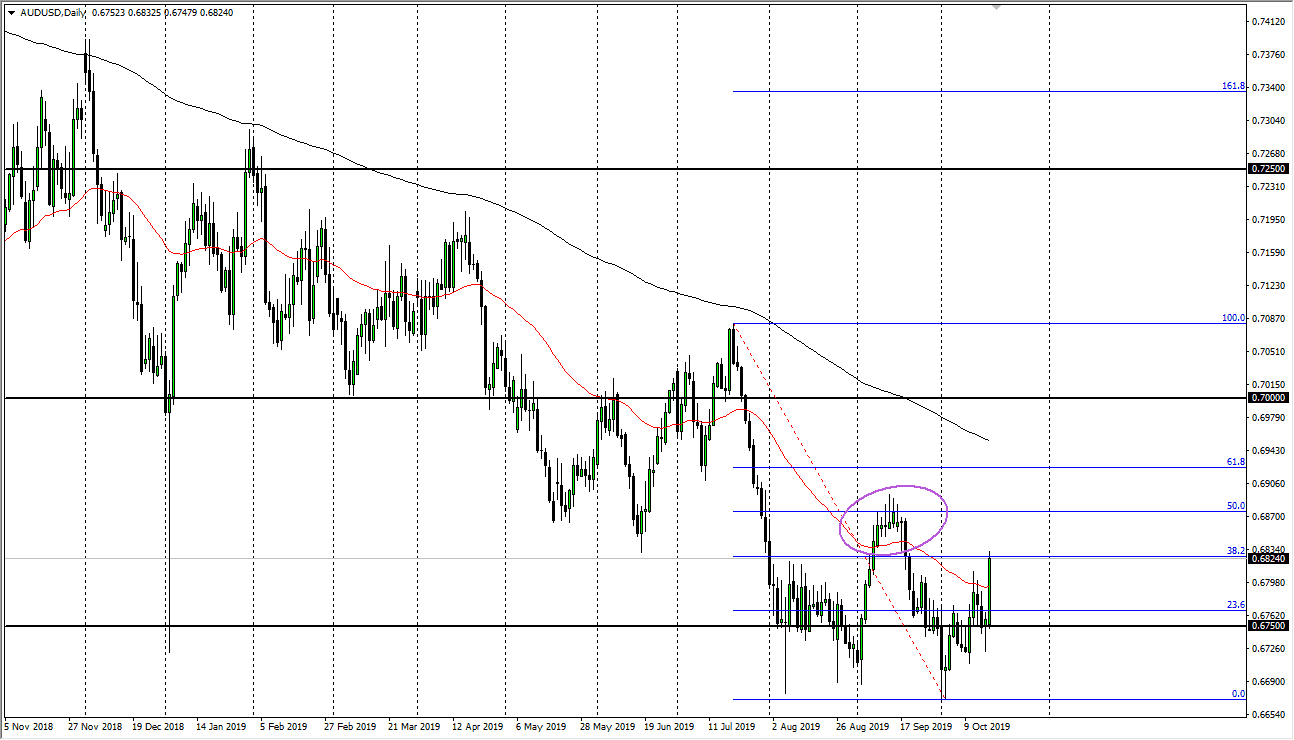

The Australian dollar has shot straight up in the air during the trading session on Thursday, reaching towards the 0.6825 handle late in the day. We have wiped out quite a few negative candlesticks, but at this point there is a significant amount of resistance above near the 0.69 level. This also coincides with the 50% Fibonacci retracement level that sent the market back down to the 0.6750 level, so I think that’s the next barrier that will have to be overcome.

If the market were to test that area it’s likely that there would be a lot of selling pressure. At this point in time, the 50% Fibonacci retracement level has held previously and one would have to think that it will again. However, if we were to break above that level then it’s possible we could go to the 0.70 level with a potential pushback at the 200 day EMA between here and there. Ultimately, I am looking for some type of resistive candle that I can take advantage of, because I do believe that the Australian dollar will continue to struggle longer term.

The size of the candle stick is of course rather important, as it does show that there is a lot of strength, but at this point in time it is obvious that we are still very much in a downtrend. Overall, the market does continue to favor selling as the Australian dollar does of course move right along with the US/China trade situation. Australia provides China with most of its raw materials for both construction and manufacturing, so at this juncture it’s very unlikely that Australia will take off for the longer-term. That being said, if we were to break above the 0.70 level then you have to stand up and pay attention. The 200 day EMA of course attracts a lot of attention as well as it is a longer-term trend defining indicator. I suspect in the short term we will probably see a failure sooner rather than later, and then give us an opportunity to reach back towards the 0.6750 level which has been very sticky when it comes to trading action. I have no interest in buying this pair yet, but don’t have a signal to start selling. Essentially I have to wait to see what the 50% fib ends up going to the market once we reach there.