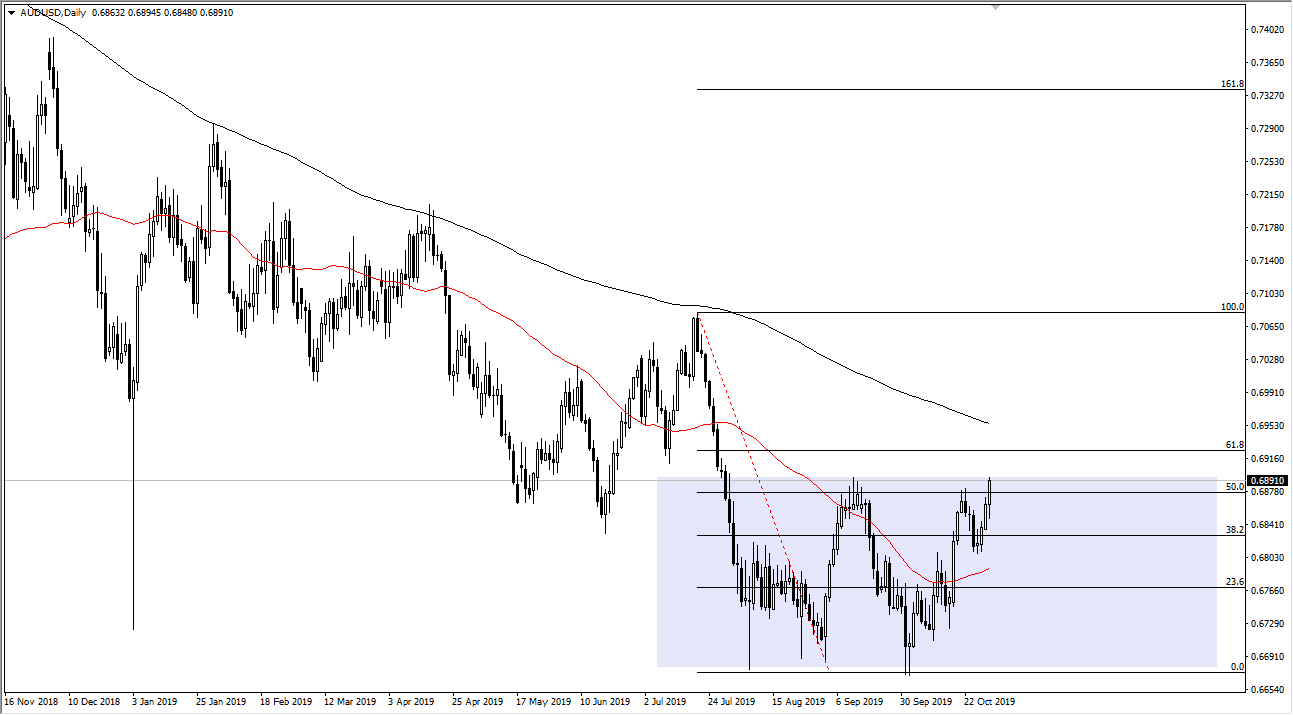

The Australian dollar initially fell during the trading session on Wednesday but has turned around to show signs of strength again. This started before the FOMC Statement but has continued after that. We have not broken above the 0.69 level and therefore we are still dealing with the massive resistance above. If we were to break above their door a couple of hours, then I believe that the market should continue to go much higher. At that point, I would anticipate that this market probably goes looking towards the 0.70 level, via the 200 day EMA which is currently trading near the 0.6950 level.

With the Aussie dollar reaching towards this level and staying there later in the day, it suggests that the market is trying to break out to the upside and reach towards the 0.70 level. After that, the market could even go as high as the 100% Fibonacci retracement level which is about 70 pips above there. This breaking above would be a “W pattern” kicking off, which is a very bullish pattern. On the other hand, if we were to break down from here the 0.68 level offer support based upon the candlesticks from last week. A breakdown below there could send the Australian dollar much lower. All things being equal, it looks as if the fundamental situation is starting to turn a little bit in this market.

The Australian dollar is highly sensitive to the Chinese economy, and therefore the headlines involving the US/China trade situation. As that situation is getting a bit better and at the very least much more consolatory, it’s likely that the Australian dollar will be one of the first beneficiaries to this pact getting closer to being reality. Australia is one of the biggest providers of raw materials to China, so the currency in Australia tends to follow the strength or weakness of China.

All things being equal, the market is going to continue to react to those trade headlines, and of course economic figures coming out of the Chinese mainland. If the Chinese economy starts to pick up a little bit or at the very least, we start to see progress being made on the US/China trade deal, that should send this market much higher. If we do pull back significantly from here the 0.67 level will continue to offer a “floor” in the market.