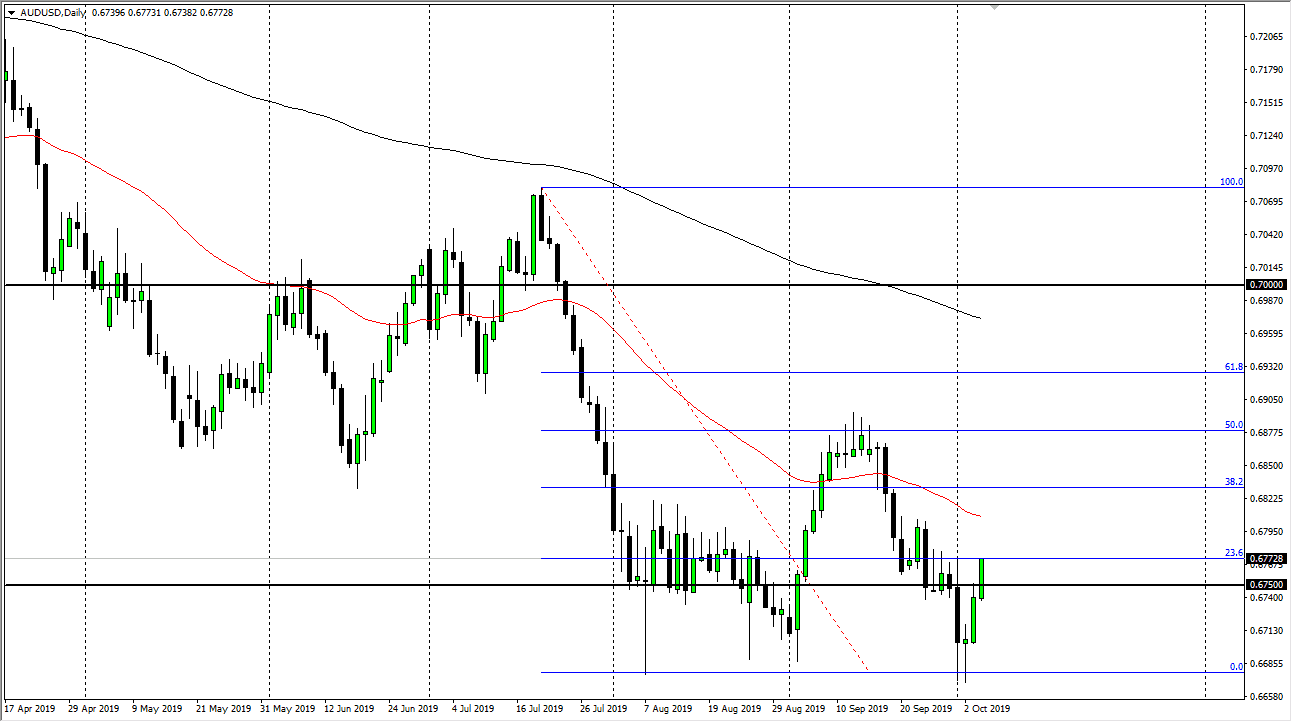

The Australian dollar had a good session on Friday, reaching above the 0.6750 level, and aiming towards the 0.68 handle. However, there is so much in the way of resistance above that I feel that it is only a matter of time before we start to sell off again. The 50 day EMA is right about there as well, painted in red. That’s a technical level that should start to push downward pressure on the market yet again, as the Aussie dollar has gotten a bit extended over the last couple of days. Overall, it’s a market that has been dancing around this overall vicinity for some time, so I don’t see any reason why it would change as we head into the US/China trade talks.

Speaking of the trade talks, as the Chinese show up in Washington DC on Wednesday and Thursday, headlines coming in that meeting will continue to influence the Aussie dollar as it is so highly levered to the Chinese economy. If there is some type of major progress in those meetings, then it’s likely that the Aussie dollar will be a beneficiary as the Australian economy sends so much in the way of raw materials to China. Alternately, if the headlines coming out of that meeting are relatively negative, then it’s likely that the US dollar will continue to pick up strength against the Australian dollar as people will be looking to buy US Treasuries and US stocks in order to avoid global asset exposures.

At this point, if we were to turn around and break down below the hammer that formed on Wednesday, it’s likely that we could go down to the 0.65 level given enough time. That’s a large, round, psychologically significant figure, and this is an area where I would expect to see buyers step back in and try to pick up the Aussie based upon historical charts. Ultimately, if we do break out above the recent highs at the 0.69 level, it could be the beginning of a “W pattern” as the market may be trying to change the trend. However, I don’t think that happens unless we get some type of good movement out of the US/China situation. I still believe in fading rallies until something changes in those meetings, something that I’m not holding my breath for at this point. Simple exhaustion will be my trigger.