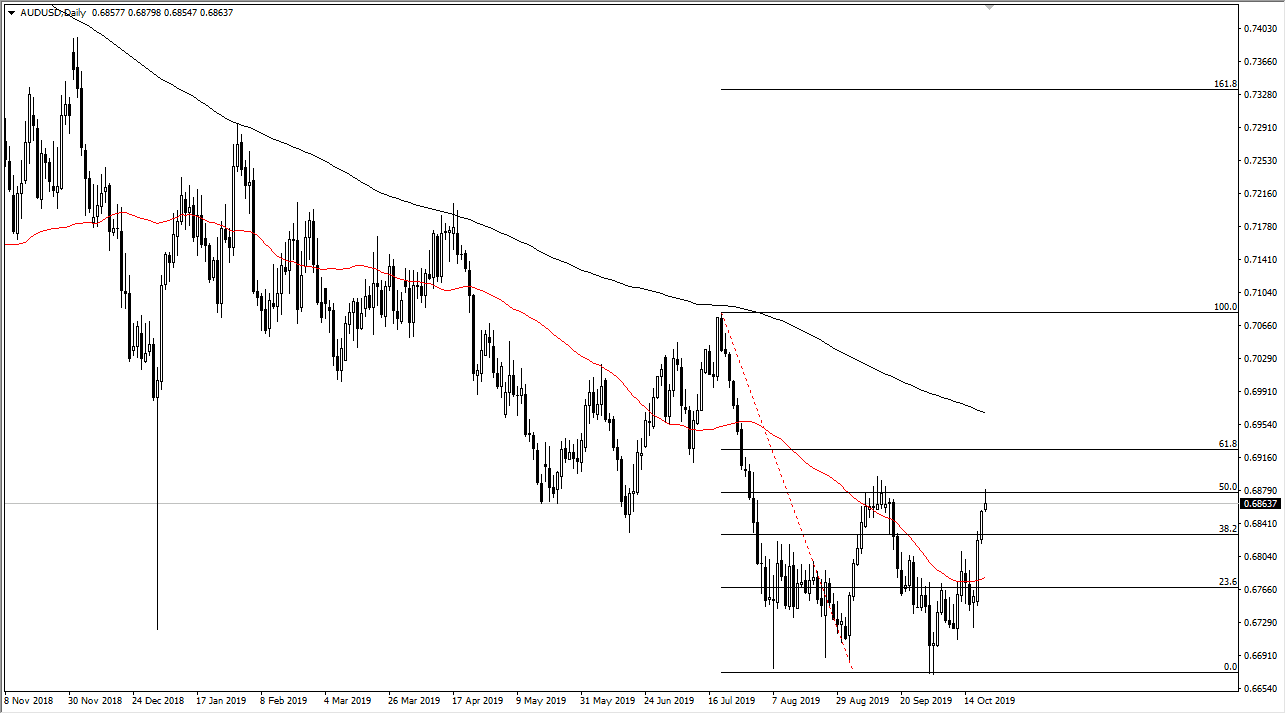

The Australian dollar looks very exhausted at the end of the day on Monday, reaching towards the 50% Fibonacci retracement level before selling off again. By having that issue, it looks very much like a market that is ready to roll over in this general vicinity, and as the Americans are closing out the trading session, it should be noted that the daily candlestick is starting to look like it’s going to be a shooting star. This is exactly where the market ran into trouble last time, so it makes quite a bit of sense that we could rollover from here and pull back. Adding more fuel to the fire is the fact that the market is overbought by just about any metric you use.

Keep in mind that the Australian dollar is going to be held hostage by the US/China trade situation which seems to be going nowhere. Part of the reason that this pair has rallied a bit more than likely is going to be that there hasn’t been a whole lot of bad rhetoric coming out of either side, but ultimately at the end of the day not much has changed. After all, the market is simply waiting on some type of movement out of either the Americans or the Chinese, neither of which are willing to budge from what I can see. With that in mind, it makes quite a bit a sense that we are eventually going to see some type of volatility come back into this market, or more to the point: negativity. With that being the case it’s likely that the market will probably rollover to reach towards the red 50-day EMA which is closer to the 0.6770 level.

If we did break out to the outside, it would be a good sign as the 50% Fibonacci retracement level will finally be broken, and then perhaps open up the door to the 61.8% Fibonacci retracement level, followed by the 200-day EMA. Both of those could cause some issues, but I think at this point it’s obvious that the market is trying to form some type of range. We are in the longer-term downtrend, so it makes quite a bit of sense that we see this market react to headlines if and when they come out. At this point though, it’s hard to imagine that buyers will be coming back in to pick this market.