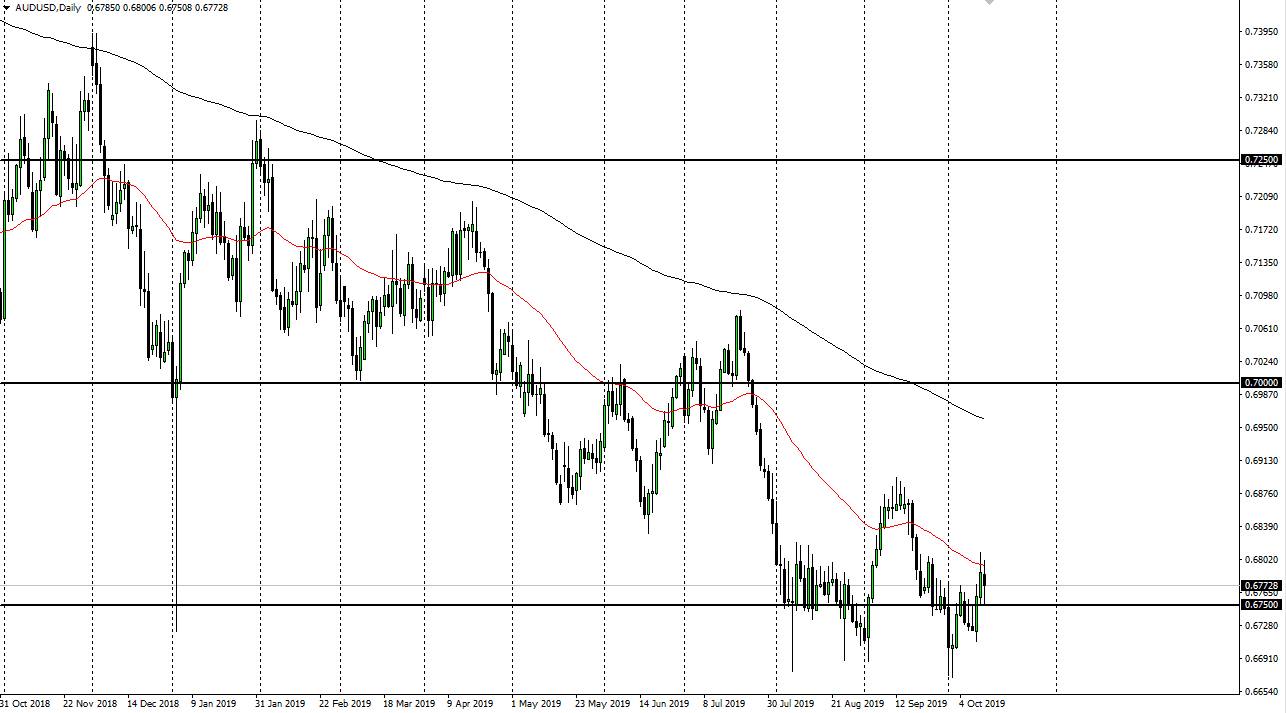

The Australian dollar has gone back and forth during the trading session on Monday, as the market is testing the 50 day EMA. Keep in mind that the US and China had the trade talks last week, which essentially went nowhere. After all, the Chinese are already talking about the talks as just the beginning, and that they want to talk more before signing on to the first phase of the agreement. If that’s going to be the case, that means nothing has changed and the Aussie dollar will continue to be weighed upon by the possible weakness in the Chinese economic situation.

At this point, the 50 day EMA is starting to offer a bit of resistance, just as the 0.6750 level has offered support. If we were to break down below that level, then it’s likely that the market will go towards the bottom of the overall consolidation, possibly opening up the idea of trading down to the 0.67 level. That is a significant support level that will continue to attract a lot of attention. All things being equal it’s likely that the market will continue to simply chop around as the Aussie is a representation of China. The Australians send raw commodities to China, so if the Chinese export market opens up and is doing well, there’s more demand for Australian commodities such as iron, aluminum, and of course copper. With that, pay attention to the Chinese economic numbers as it could give a bit of a “heads up” as to how the Aussie should do.

At this point, the market should be trading from a short-term perspective, going back and forth in this overall range. Ultimately, it’s a scenario where the market is simply looking for some type of catalyst to start moving, and now that the Americans and the Chinese have not come to any type of an agreement, there’s really nothing there to move the Aussie. I suspect that we are going to continue to bounce around in this area, collecting 20 to 30 pips at a time. All things being equal, I believe that unless you have the ability to trade this market from the short-term perspective, you probably will be trading in at all as there is no real reason to get involved. This is all about the United States and China, which is essentially standing still.