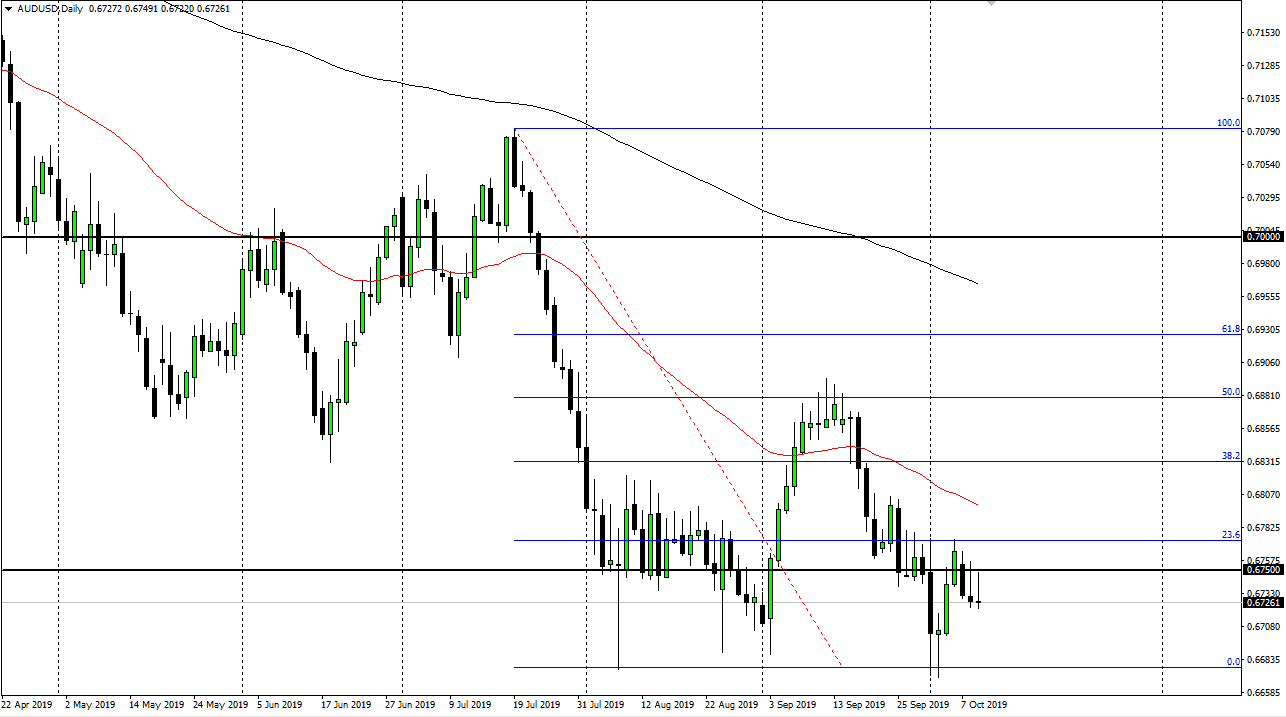

The Australian dollar has initially tried to rally during the trading session on Wednesday but found resistance again at the 0.6750 level in rolled over to form a shooting star. This is a second day in a row we have seen this, so I think at this point it’s very likely that rallies will continue to be faded as the Australian dollar is so highly sensitive to the Chinese economy. As we have the Chinese and the Americans talking in Washington DC over the next couple of days, there will be a certain amount of headline noise out there that could throw this market around. However, the one thing that has been clear is that there will still be plenty of sniping between the two countries, meaning that an actual deal seems unlikely at best.

We have been in a long-term downtrend for quite some time, so at this point it doesn’t make any sense to try to fight it. The most reliable trade that I have had for some time has been simply fading short-term rallies every time they appear in this market, especially near the 0.6750 level. Before that, it was fading rallies towards the 0.6780 level. In other words, we are simply grinding away to the downside. That’s the point here, it isn’t necessarily a market that is going to break down drastically, it’s more of a grind lower that we should continue to see.

Obviously, if the United States and China come together with some type of trade deal, then it would be very good for the Aussie as they supply so much of the commodities to China that are needed for manufacturing and construction. With that being the case, the market would probably break out to the upside and change the overall trend, and at the very least go looking towards the 50% Fibonacci retracement level where the market fell from near 0.69.

However, it’s more likely that we get more warlike rhetoric and lots of noise, so the 0.6680 level will probably be tested, and perhaps even broken through. If that happens it’s very likely that the market would then go looking towards the 0.65 handle underneath which has been crucially important on longer-term charts and of course has a certain amount of psychological attachment to it due to the fact that it is a large, round, psychologically significant figure. Fading short-term rallies continues to work.