The Australian dollar has fallen hard during the trading session after initially trying to rally on Tuesday. In fact, we tested the lows again but bounced a bit after the ISM numbers in the United States were lighter than expected. That being said though, the Australian dollar is highly sensitive to the US/China trade relations and of course global growth. Right now it looks as if global growth is on its back foot, and if that’s going to be the case the Australian dollar will of course suffer as a result. Beyond that, the US/China trade talks probably won’t produce much and that will continue the downward pressure on the Aussie as well, considering that Australia supplies China with so much of its raw material for not only construction but also manufacturing.

Going forward, the one saving grace of the Aussie will be the fact that gold has been rallying, but the Reserve Bank of Australia had suggested in its statement that perhaps it is shifting more dovish, and that of course will weigh upon the Aussie regardless. The US dollar of course is also a safety currency, so the fact that we got a little bit of a bounce due to ISM could very well be washed out by Treasuries being bought due to a safety factor.

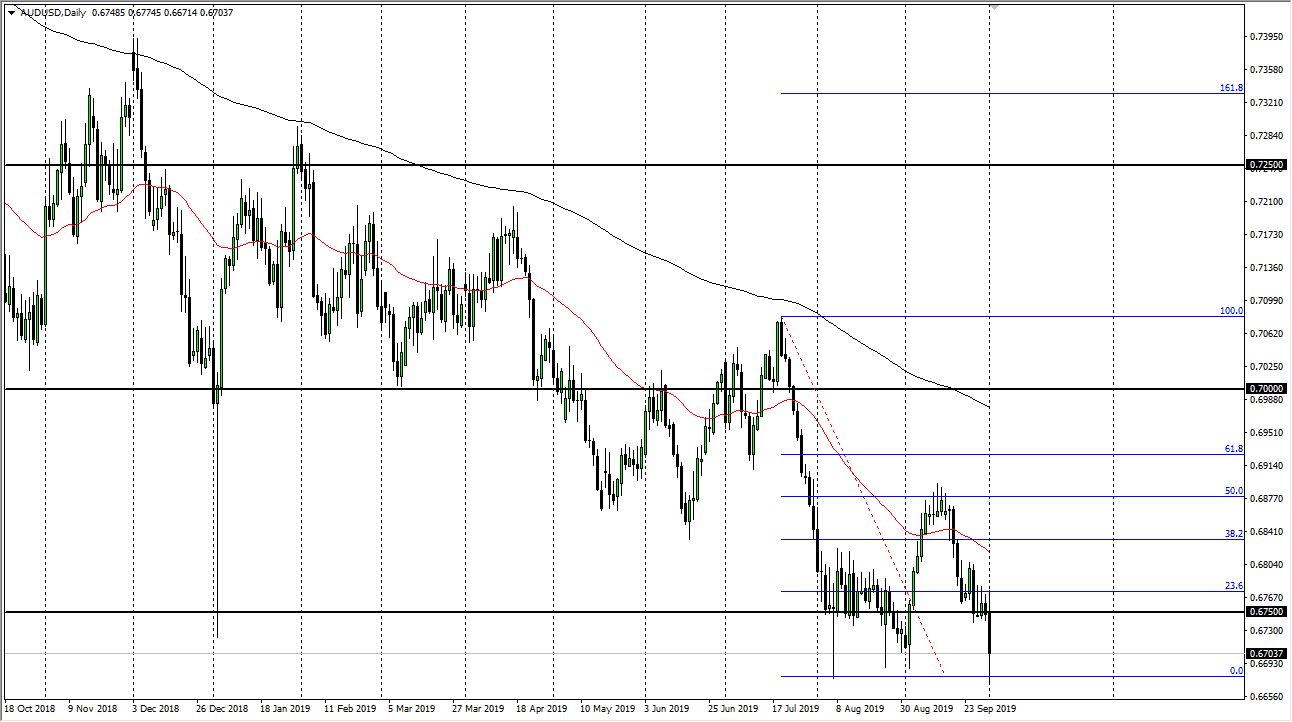

Just above at the 0.68 handle, we have seen a significant amount of resistance on short-term charts and the 50 day EMA is starting to tilt in that direction. The fact that we did break to a “lower low”, at least temporarily during the day, suggests that the sellers still have the market under their control. At this point I expect the Australian dollar to eventually go looking to the 0.65 handle but we may get a short-term bounce before building up the momentum again. I like the idea of fading rallies on short-term charts that show signs of exhaustion as the Aussie has essentially been “dead money” for a while. There may be the potential for a little bit of hope between now and October 11, but once those talks are out-of-the-way between the Americans and the Chinese, it’s very likely that hope will disappear and the Aussie will probably be the first place people start selling. Rallies at this point are to be looked at with suspicion as they simply have not been able to hold up under scrutiny.