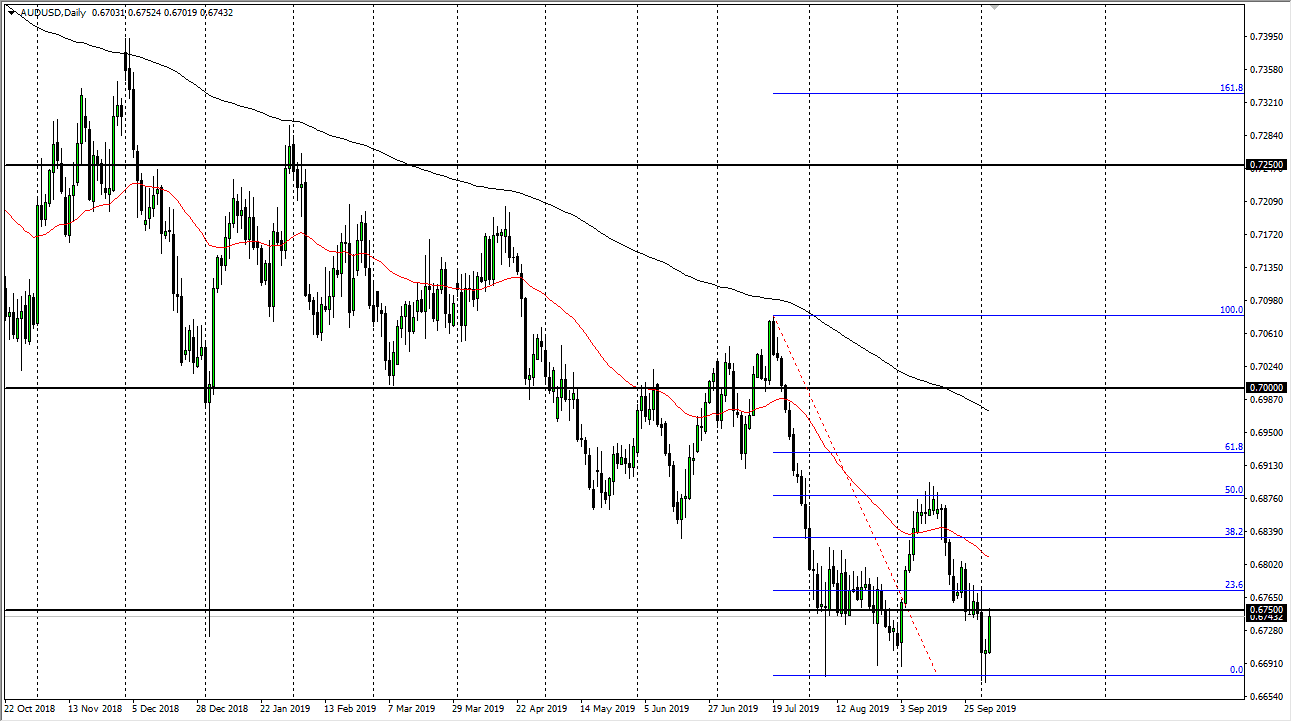

The Australian dollar has rallied a bit during the trading session on Thursday to break the top of the hammer from Wednesday. This is a good sign, but when looked at in the larger context of the market, you can see that we are simply at the “fair value” area. The 0.6750 level is an area that the market seems to be attracted to, so it’s not a huge surprise to find that we are here heading into the jobs figure of the United States. That of course will have a major influence on the greenback, and that is half of the equation here.

The Australian dollar of course is highly sensitive to China, because Australia is a major supplier of raw materials to that economy. As the Chinese economy has been suffering and slowing down, it makes sense that the Australian dollar is doing the same. All things being equal, the market is likely to be very noisy heading into the jobs figure, and at this point it could offer a nice opportunity for a “reversion to the mean” type of trade.

What I mean by that is that if we get some type of major pop higher, especially considering a port number, it is probably only a matter of time before we run into exhaustion, and then start selling off again. After all, it would take a major shift in overall sentiment to send the Australian dollar to the upside. The 50 day EMA is drifting lower and just above, and as a result I think that could be a nice benchmark from which to start selling if that happens.

To the downside, if we were to break down we could go testing the lows again but the lows being broken to the downside should open the door to the 0.65 handle. That obviously is a large, round, psychologically significant figure, so I think as we reach towards that area we will probably run into a bit more trouble. In the meantime, I prefer to fade rallies as they occur. The US dollar should continue to strengthen even with poor economic data because it would show that the world is heading into a recession everywhere, with the US being one of the last holdouts. I have no interest in buying this pair, as we simply have no reason to think that the US/China situation is going to get drastically better anytime soon.