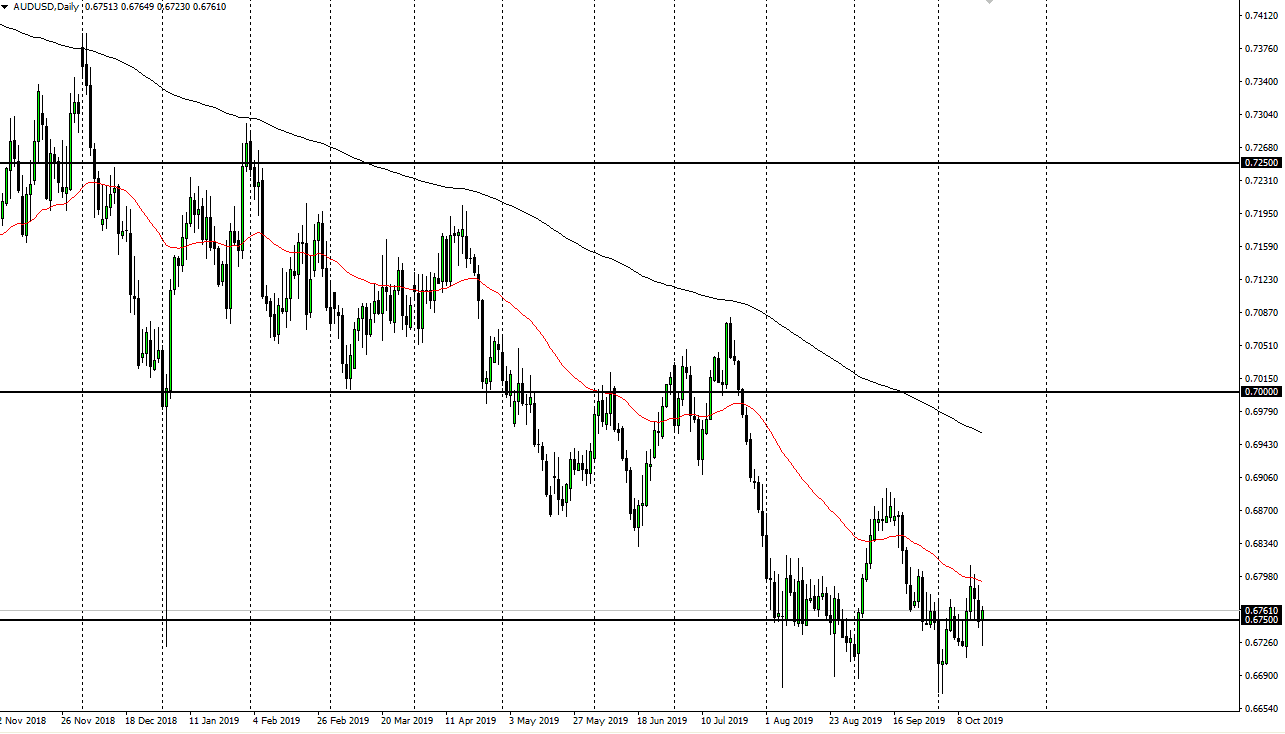

The Australian dollar initially fell during the trading session on Wednesday, breaking below the 0.6750 level. At this point, the market has turned around to show signs of strength, and a break above the 0.6750 level yet again. All things being equal, this pair will continue to be very choppy as we have seen over the last couple of months. This makes perfect sense, because the Australian dollar is unfortunately held hostage to the US/China trade talks. In fact, it’s very difficult to find a scenario where you could buy or sell for any real length of time.

The pair has been reacting to the occasional headline coming out of the United States or China, having very little to do with the Australian economy itself. Yes, there is a bit of a housing issue in Australia at the moment, but really what it comes down to is whether or not the Australians will be supplying the Chinese with a large amount of commodities for both construction and manufacturing. As long as the Americans and the Chinese continue to bicker, it’s going to be difficult to imagine a scenario where the Australian economy thrives.

To the downside I see the 0.67 level as significant support, which extends quite a bit. If we can break down below the candle six at the beginning of the month of October, then it’s likely that the Australian dollar will drift towards the 0.65 handle underneath which is the next large, round, psychologically significant figure and of course an area that has seen interest in the past. To the upside, the 0.68 level has offered resistance and of course we have the 50 day EMA in that scenario. I think at this point it should continue to offer resistance. If you want to be bothered trading the Australian dollar, you need to accept the fact that you will be trading on short-term charts. That’s not a bad thing, it’s just a thing.

Ultimately, this is a market that favors short-term choppy action, so if you have the ability to trade these types of charts, it gives you quite a bit of opportunity and has been relatively reliable. Even when we did break out, we found the 50% Fibonacci retracement level of the meltdown offer significant resistance at the 0.69 level. All things being equal, I think unless you have the ability to watch the five minute charts, this is a market that you should probably pass on.