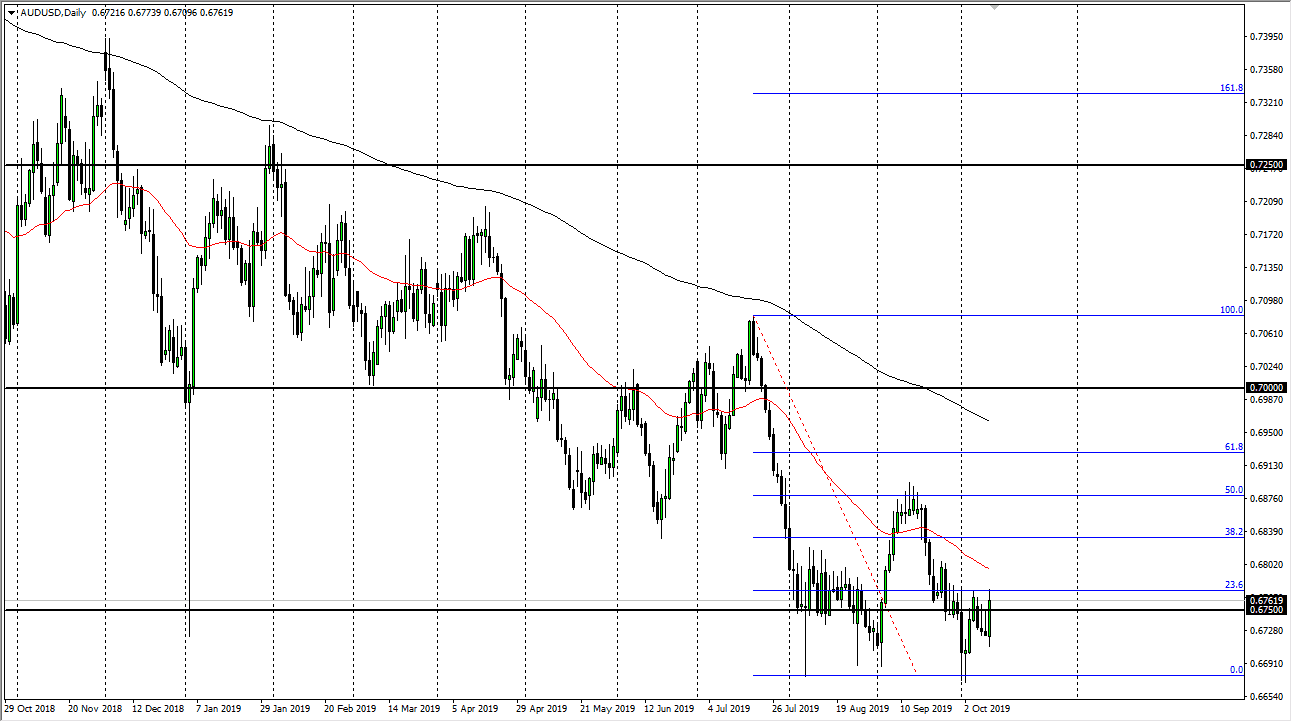

The Australian dollar has initially pulled back during the trading session on Thursday, but then rallied rather significantly to break above the 0.6750 level again. The 0.6775 level continues to be resistance, and that’s exactly where we stopped. In other words, although it was a very bullish day it was still well within the range of the consolidation that we have seen for quite some time. Ultimately, not much has changed but unfortunately for the Australian dollar, it is highly levered to the Chinese economy.

Looking at this chart, it looks like we are ready to sell off again, as the 50 day EMA is starting to reach towards the markets now. Ultimately, I would anticipate a lot of back-and-forth and choppy trading, so at the first signs of exhaustion on a short-term chart, I’d be looking to reach down towards the 0.6725 level. Obviously, being so highly levered to the Chinese situation is going to be particularly tough over the next couple of days as the Americans and the Chinese sit down to talk. There will be rumors, there will be tweets, and there will be volatility. As the trade negotiations go well, then it’s very likely that the Australian dollar will rally significantly as it could give a bit of a “risk on” feel. Obviously though, if the market gets a negative outcome from the meetings, then the Australian dollar will fall in value as money goes looking towards the US dollar for safety and of course away from anything related to Asia.

Looking at the bottom, I suspect that there is plenty of support near the 0.67 level, but if we were to break down below that area, then we could be looking at the 0.65 handle given enough time as the large, round, psychologically significant figure will be an attractive target. However, if we were to break to the upside and above the red 50 day EMA we could go looking towards the 0.69 level which is substantively the 50% Fibonacci retracement level where the market fell from last time. I think at this point it’s very difficult the gas where the Aussie is going to go, because it could be thrown into disarray at any moment. The next two days are probably going to be some of the more difficult days to trade anything, and this could be the epicenter.