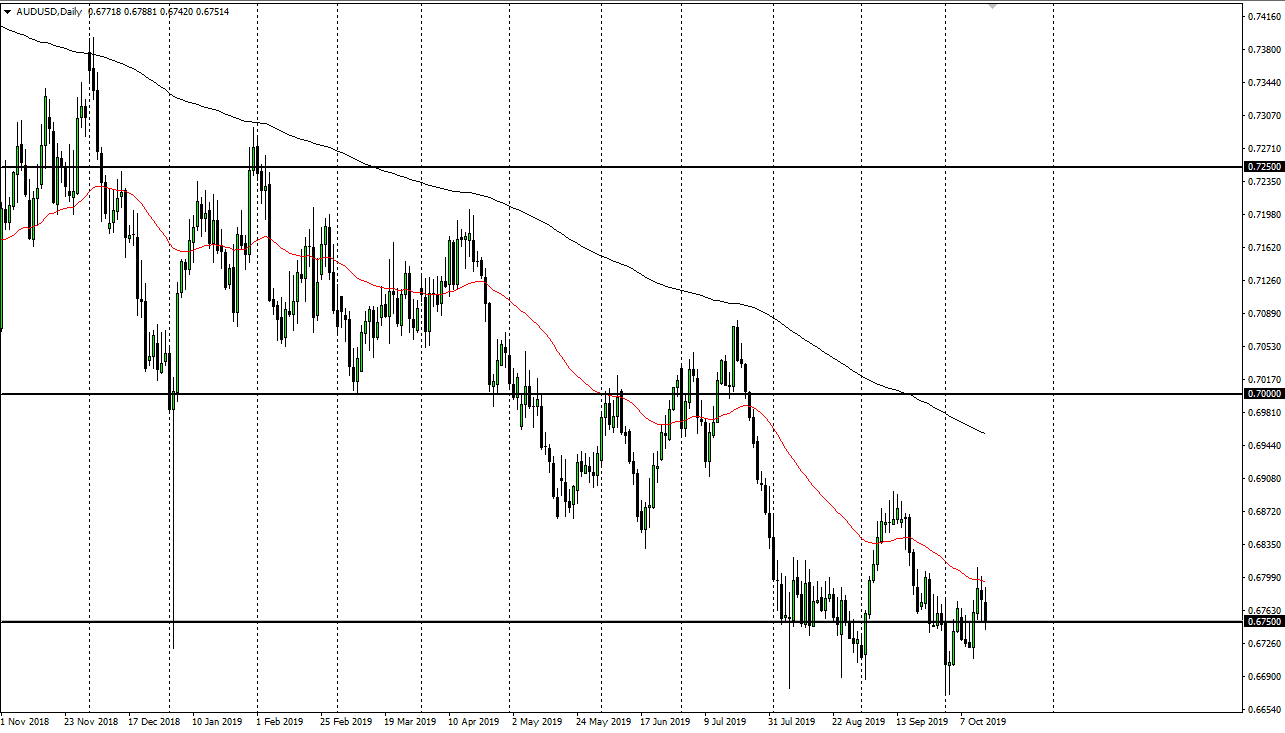

The Australian dollar initially tried to rally during the trading session on Tuesday as the market continues to see a lot of resistance above. Ultimately, the 50 day EMA causes quite a bit of technical damage, and at this point the fact that the market is hanging around the 0.6750 level yet again. Ultimately, the market is essentially looking at the 0.6750 level as “fair value”, so with that being the case it’s likely that we will revert to the mean any time we get too far away from this yet again.

Looking at this negative candle stick, it suggests that we simply return to where we want felt comfortable. After all, the Australian dollar continues to be driven by the Chinese situation, which right now is still up in the air when it comes to the US/China trade negotiations. All things being equal, the market should continue to get thrown around by the occasional headline, as the negotiations between the Americans and the Chinese are going nowhere. The market will continue to suffer at the hands of algorithm trading reading headlines. With that being the case, it’s very likely that the market will continue to be noisy, so therefore it’s difficult to imagine a scenario where you would go “all in” into the market.

The 50 day EMA being broken to the upside could bring in more buyers in what could be a big ‘risk off’ scenario for the overall markets. Because of this, there might be more significant moves in other markets as well. At this point, the 0.67 level offers support, extending down to lower levels, but I think at this point the bottom could fall out relatively soon if we don’t get good news. After all, a level can only hold up for so long, and therefore it’s going to take one really bad headline to break this thing down. Rallies at this point are to be sold, and it’s possible that the market could simply bounce around with more of a downward slant than anything else. I don’t have any interest in buying the Australian dollar but I do recognize that those who are short-term traders will perhaps be able to take advantage of this, but ultimately the market is still more negative than positive, because quite frankly there is nothing out there that looks along the lines of hopeful when it comes to China.