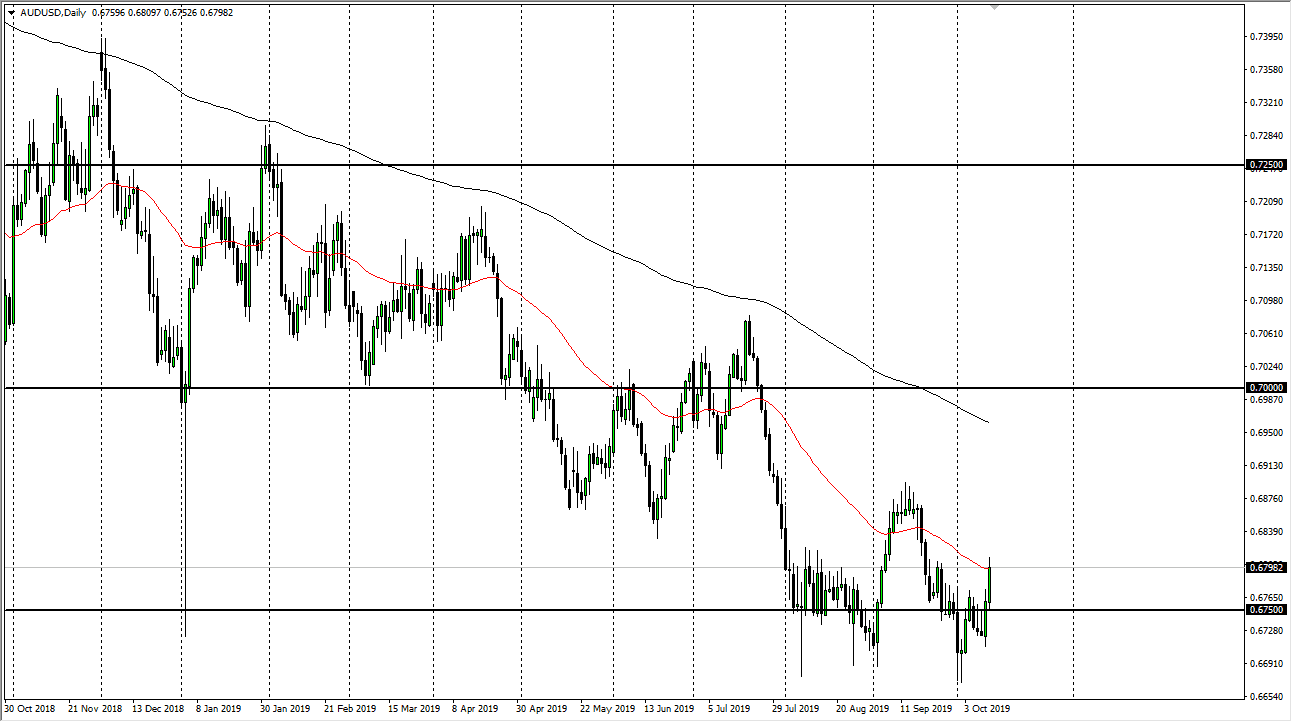

The Australian dollar has had a strong move during the trading session on Friday as traders anticipate some type of deal between the Americans and the Chinese. At the very least, a delay in tariffs is more likely than not, so that does give the market the ability to put more of a “risk on” move on. However, the news and results of the US/China talks almost certainly are going to be released either after market close on Friday, or over the weekend, so it’s very difficult to imagine a scenario where you can go into the weekend with money put on in the AUD/USD pair.

The Australian dollar is highly sensitive to the Chinese economy, and as the US/China situation continues to cause major issues, it’s obvious that the market will continue to pay attention to that trade talk situation, and of course tariffs. The Chinese numbers have been rather soft as of late, so the question then becomes whether or not this argument continues? I do think that it does, so it’s likely that sooner or later we will see a certain amount of sellers come in and push this market lower. However, I also recognize that the 0.69 level above could be targeted in the short term as it was the most recent barrier and rollover that we have seen in this market.

To the downside, the 0.67 level is massive support, so I don’t think we break down below there but if we do it is almost certainly likely to be a scenario where the US/China trade situation breaks down drastically. I don’t think that’s going to happen anytime soon, but I would not also be looking for some type of “big deal” coming out of DC either. I anticipate that we are more likely than not still in a “sell the rally” type of situation, as the market is most certainly in a major downtrend, and I just don’t see that changing anytime soon. All things being equal, I believe that we are simply going to grind back and forth overall as the world tries to figure out what’s going on with the trade negotiations, or perhaps even more importantly the global slowdown that seems to be going on. As the Aussie dollar is so highly levered to commodities, it makes sense that it is going to be sensitive to all of this noise.