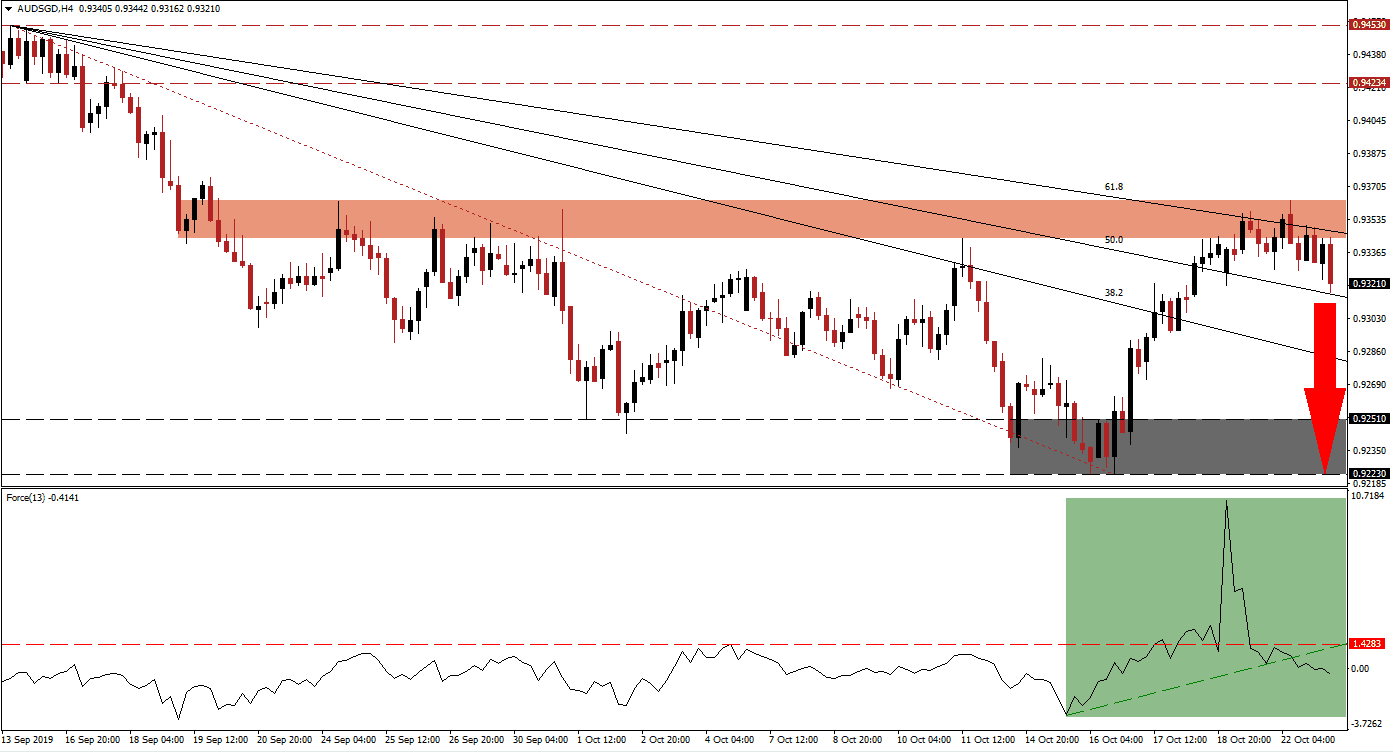

Bearish momentum started to rise as the AUD/SGD advanced into its short-term resistance zone which has rejected price action on three previous occasions. Enforcing this zone is the 61.8 Fibonacci Retracement Fan Resistance Level and after a brief spike above it, this currency pair started to reverse. Singapore continues to receive capital inflows from Hong Kong as the protests drag on and companies diversify; this is providing a bullish fundamental factor for the Singapore Dollar and more downside should be expected from the AUD/SGD.

The Force Index, a next generation technical indicator, indicates the loss in bullish momentum after a sharp increase was quickly reversed. This volatility occurred as the AUD/SGD drifted into its resistance zone and the reversal took the Force Index below its horizontal support level, turning it into resistance. Momentum was sufficient to extend the slide in this technical indicator below its ascending support level and into negative territory as marked by the green rectangle; bears are now in charge of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the resistance zone, located between 0.93437 and 0.93634 as marked by the red rectangle, rejected price action for a fourth time, selling pressure started to increase. The descending 61.8 Fibonacci Retracement Fan Resistance Level added to the rise in bearish momentum and a breakdown sequence is expected to follow. Forex traders should monitor the intra-day low of 0.93199, the last time the AUD/SGD dipped below its 50.0 Fibonacci Retracement Fan Resistance Level, as a sustained move below this level is expected to attract fresh net short positions in this currency pair.

Volatility is expected to remain elevated as the next breakdown is shaping up. This currency pair is expected to descend back into its next support zone which is located between 0.92230 and 0.92510 as marked by the grey rectangle; the end point of the Fibonacci Retracement Fan sequence is located inside this zone from where a further breakdown in the AUD/SGD would require a new fundamental catalyst. Since the Australian Dollar remains the top Chinese Yuan proxy currency, developments out of China and Hong Kong should be followed closely. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.93250

Take Profit @ 0.92250

Stop Loss @ 0.93550

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

In the event of a reversal in the Force Index which will lead to a double breakout, above its ascending support level and above its horizontal resistance level, the AUD/SGD may attempt a breakout above its short-term resistance zone for a fifth time. This could extend into its next long-term resistance zone which is located between 0.94234 and 0.94530 from where further upside potential, given the current fundamental scenario, remains limited.

AUD/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.93700

Take Profit @ 0.94350

Stop Loss @ 0.93400

Upside Potential: 65 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.17