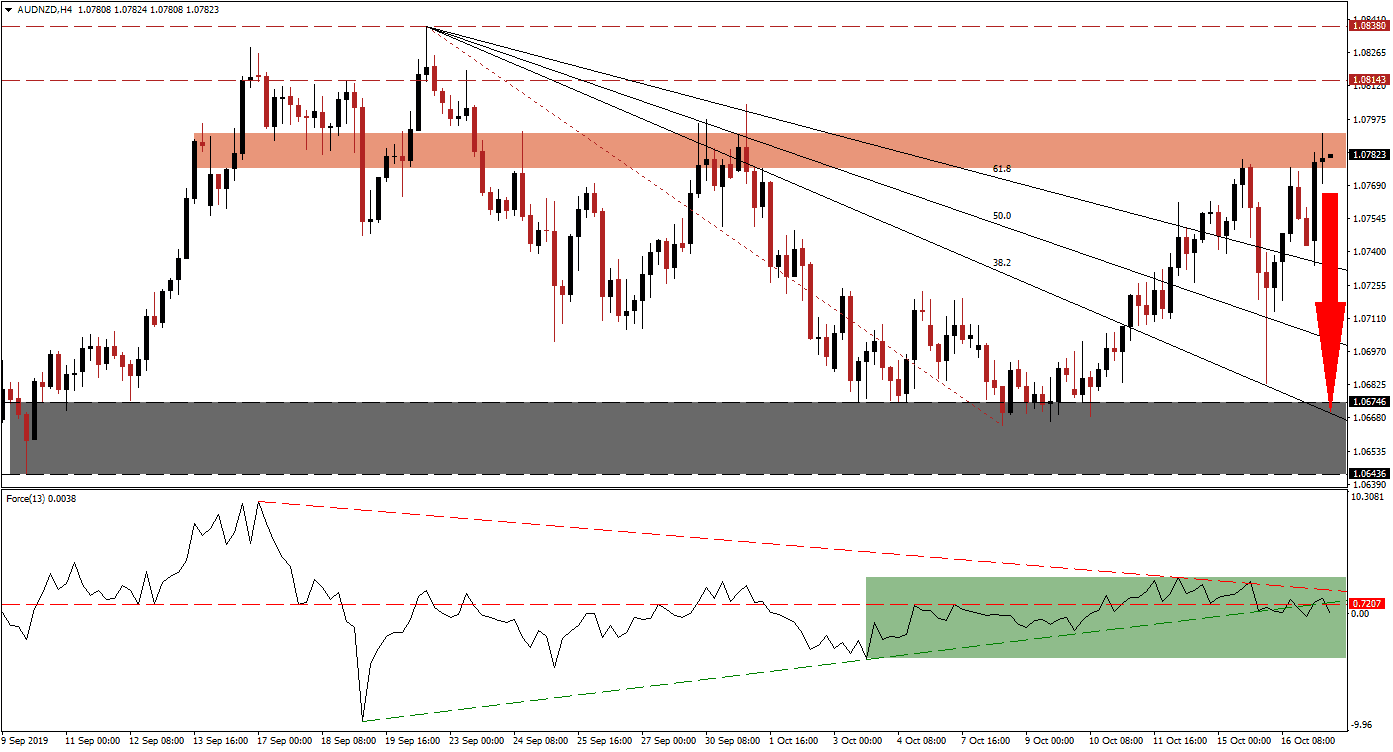

Following the release of the Australian employment report, which came in roughly in line with expectations, the Australian Dollar drifted to the downside. Uncertainty over details of the partial US-China trade deal added to mild selling pressure and the AUD/NZD reversed direction and is now in the process of attempting a sustained breakdown below its short-term resistance zone, ending its current advance. The preceding rally took price action from its support zone through its entire Fibonacci Retracement Fan sequence before bullish momentum petered out at resistance. More downside is now likely to follow.

The Force Index, a next generation technical indicator, points towards the loss in bullish momentum as it started to decrease while the AUD/NZD recorded its intra-day high of 1.07915 which marks the peak of the current advance and the top range of its short-term resistance zone. A descending resistance level pressured the Force Index below its horizontal support level, turning it into resistance, while its ascending support level has also been violated in a major bearish development. While this technical indicator remains in positive conditions, as marked by the green rectangle, more downside is likely to emerge. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Forex traders should now monitor the Force Index as a move into negative territory is expected to lead the AUD/NZD to the downside and complete a sustained breakdown below its short-term resistance zone. This zone is located between 1.07763 and 1.07915 which is marked by the red rectangle. A move below its intra-day high of 1.07616 is expected to result in the addition of new net sell orders in this currency pair; this level represents the peak of the initial breakout above its 61.8 Fibonacci Retracement Fan Support Level which turned it into resistance.

After US President Trump hailed the partial trade deal between the US and China, conflicting messages have hit markets and China has neither confirmed the agricultural purchases nor any time line on them. After the US House of Representatives passed a bill in support of Hong Kong protesters, the atmosphere quickly soured once again. This could result in a breakdown in price action as the Australian Dollar is the top Chinese Yuan proxy currency. The next support zone is located between 1.06436 and 1.06746 as marked by the grey rectangle; the descending 38.2 Fibonacci Retracement Fan Support Level is currently passing through this zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.07800

Take Profit @ 1.06650

Stop Loss @ 1.08000

Downside Potential: 115 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 5.75

Any positive news in regards to the partial trade deal, which many analysts refer to as a temporary trade truce which lacks substance, could result in a breakout by the AUD/NZD above its short-term resistance zone. Upside in such a development is expected to remain limited to its next long-term resistance zone which is located between 1.08143 and 1.08380 from where a breakout is unlikely unless the fundamental picture will experience a positive shift.

AUD/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.08050

Take Profit @ 1.08350

Stop Loss @ 1.07900

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00