A breakout above its short-term resistance zone was not sustained and the AUD/NZD quickly reversed back into its support zone from where the advance originated. Bearish momentum started to fade and price action stabilized, despite economic data out of Australia which showed a deterioration across all three PMI reports. This was the latest sign that the global economy is slowing down faster than most economists anticipate; the latest spat between the US and China, this time in regards to how the US is weaponizing its visa program, could derail the trade truce negotiated between both sides.

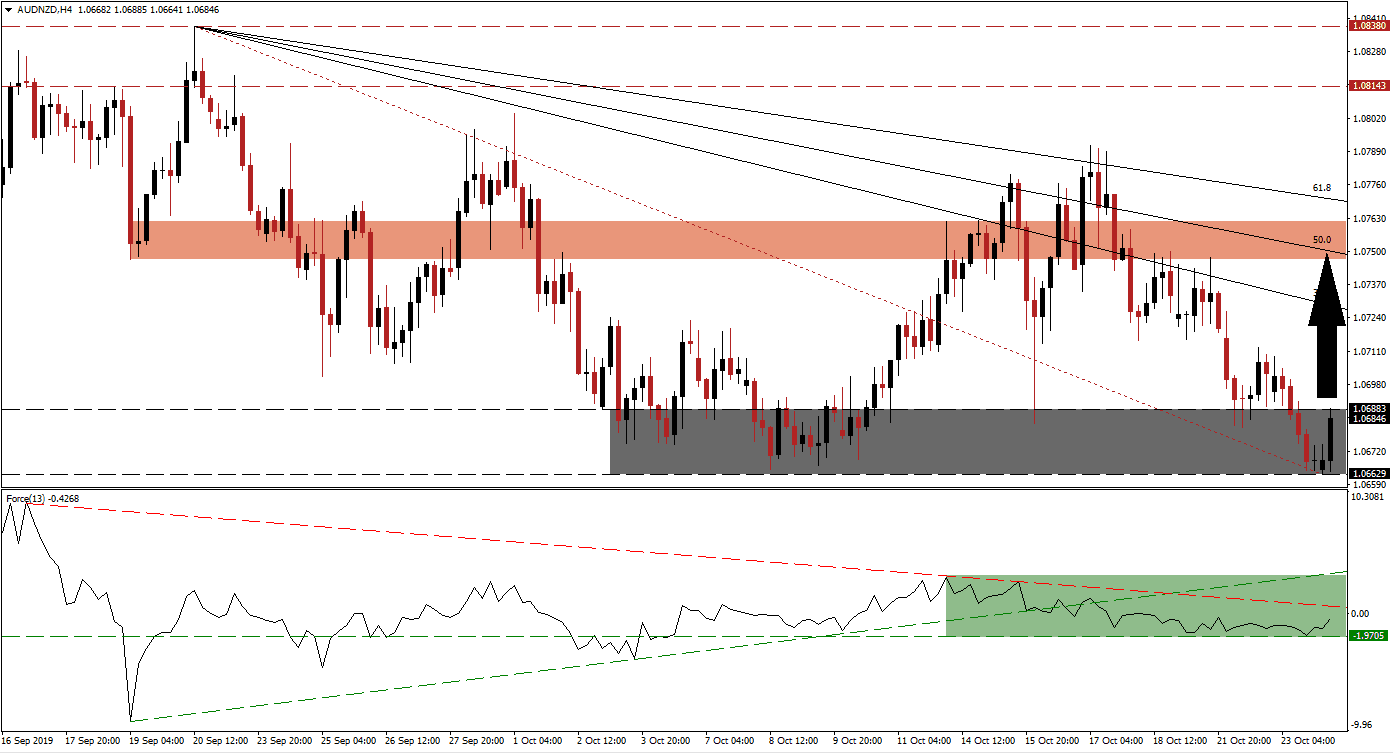

The Force Index, a next generation technical indicator, indicates the build-up in bullish momentum as the AUD/NZD started to pressure the top range of its support zone. The horizontal support level, located in negative conditions, allowed the Force Index to advance and this technical indicator is now approaching its descending resistance level as marked by the green rectangle. A breakout is expected to lead price action into one of its own; the previous contraction left the Force Index below its ascending support level which currently acts as resistance. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Following a confirmed breakout in the AUD/NZD above its support zone, located between 1.06629 and 1.06883 as marked by the grey rectangle, forex traders should monitor the intra-day high of 1.07124. This level marks the peak of the previous push higher, but was eventually reversed into the support zone with a slightly lower low than before; the Fibonacci Retracement Fan sequence was re-drawn as a result. A successful move above this level is expected to close the gap between this currency pair and its descending 38.2 Fibonacci Retracement Fan Resistance Level.

Given the Australian Dollar’s position as the top Chinese Yuan proxy currency and the increase in tension between the US and China, bearish momentum is likely to expand one the AUD/NZD reaches its short-term resistance zone. A previous rally faltered just above this zone which is located between 1.07470 and 1.07616 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through this zone and enforcing it while the 61.8 Fibonacci Retracement Fan Resistance Level is closing in on the top range. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.06800

Take Profit @ 1.07600

Stop Loss @ 1.06550

Upside Potential: 80 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.20

Failure by the Force Index to complete a breakout above its descending resistance level could pressure the AUD/NZD into a breakdown below its support zone. The next support zone is located between 1.05818 and 1.06158 from where further downside would require a fresh fundamental catalyst. The current technical picture suggests a breakout as long as the Force Index will remain above its horizontal support level.

AUD/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.06450

Take Profit @ 1.05850

Stop Loss @ 1.06700

Downside Potential: 60 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.40