As the US and China continue to negotiate the details of their trade truce, traders were reminded that not all is as great as it appears. The spat in the UN in regards to how China is handling minorities, especially in the Xinjiang province. China pointed out that interfering in domestic affairs is not a healthy development in regards to the trade negotiations. The Australian Dollar, the top Chinese Yuan proxy currency, posted a strong advance since the trade truce was announced, but bullish momentum in the AUD/CHF is currently being depleted inside its resistance zone.

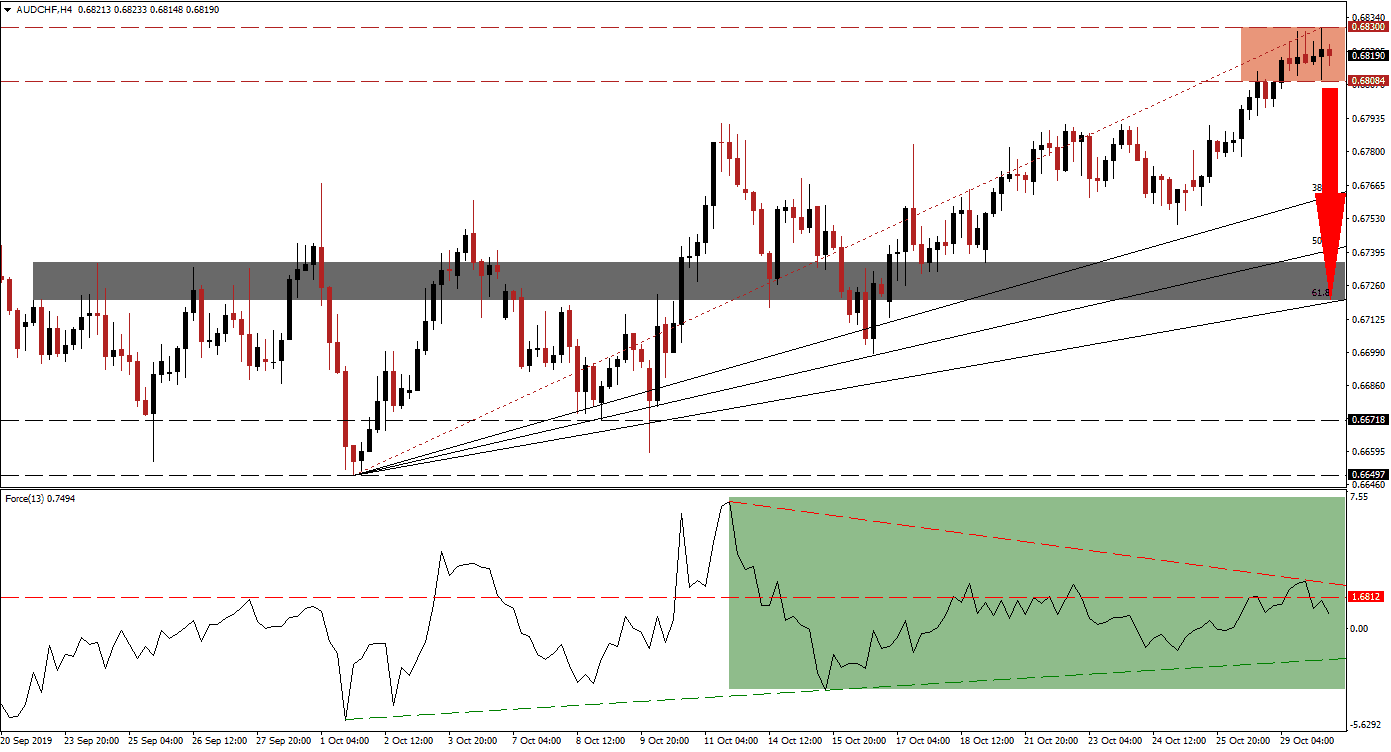

The Force Index, a next generation technical indicator, shows the formation of a negative divergence. This bearish trading signal represents a major red flag and suggests that the current advance in the AUD/CHF is nearing its end. After the Force Index briefly eclipsed its horizontal resistance level, it reversed and is now trading back below it in another sign that bullish momentum is fading; its descending resistance level is further applying downside pressure as marked by the green rectangle. A move into negative territory by this technical indicator will put bears in charge of price action and is likely to lead this currency pair into a corrective phase. You can learn more about the Force Index here.

Australian economic data showed inflation eased slightly during the third-quarter which is challenging the Reserve Bank of Australia which was embarrassed earlier this week for their incorrect wage growth forecasts. Given the persistence of global economic challenges, traders should prepare for a risk-off mood which will benefit the Swiss Franc and its safe haven status. The AUD/CHF is expected to complete a breakdown below its resistance zone, located between 0.68084 and 0.683000 as marked by the red rectangle, which will allow it to close the gap to its 38.2 Fibonacci Retracement Fan Support Level.

Since the beginning of October, price action has advanced and created a series of higher highs and higher lows which represents a bullish development and established a long-term uptrend. The expected corrective phase, which may be partially fueled by a profit-taking sell-off, is expected to keep the uptrend intact. The AUD/CHF is likely to end its sell-off after reaching its next short-term support zone which is located between 0.67202 and 0.67354 as marked by the grey rectangle; the 50.0 Fibonacci Retracement Fan Support Level just crossed above this zone and the 61.8 Fibonacci Retracement Fan Support Level has entered it. You can learn more about the Fibonacci Retracement Fan here.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.68200

Take Profit @ 0.67250

Stop Loss @ 0.68450

Downside Potential: 95 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.80

A reversal in the Force Index which will result in a double breakout, above its horizontal resistance level and above its descending resistance level, may allow the AUD/CHF to attempt a breakout. While the long-term fundamental picture favors more upside, the short-term technical scenario suggests a correction into solid support levels before marching higher. The next resistance zone, should a breakout materialize, is located between 0.69258 and 0.69539.

AUD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.68650

Take Profit @ 0.69500

Stop Loss @ 0.68250

Upside Potential: 85 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.13