AUD/CHF: Upside Potential After Support Zone Holds

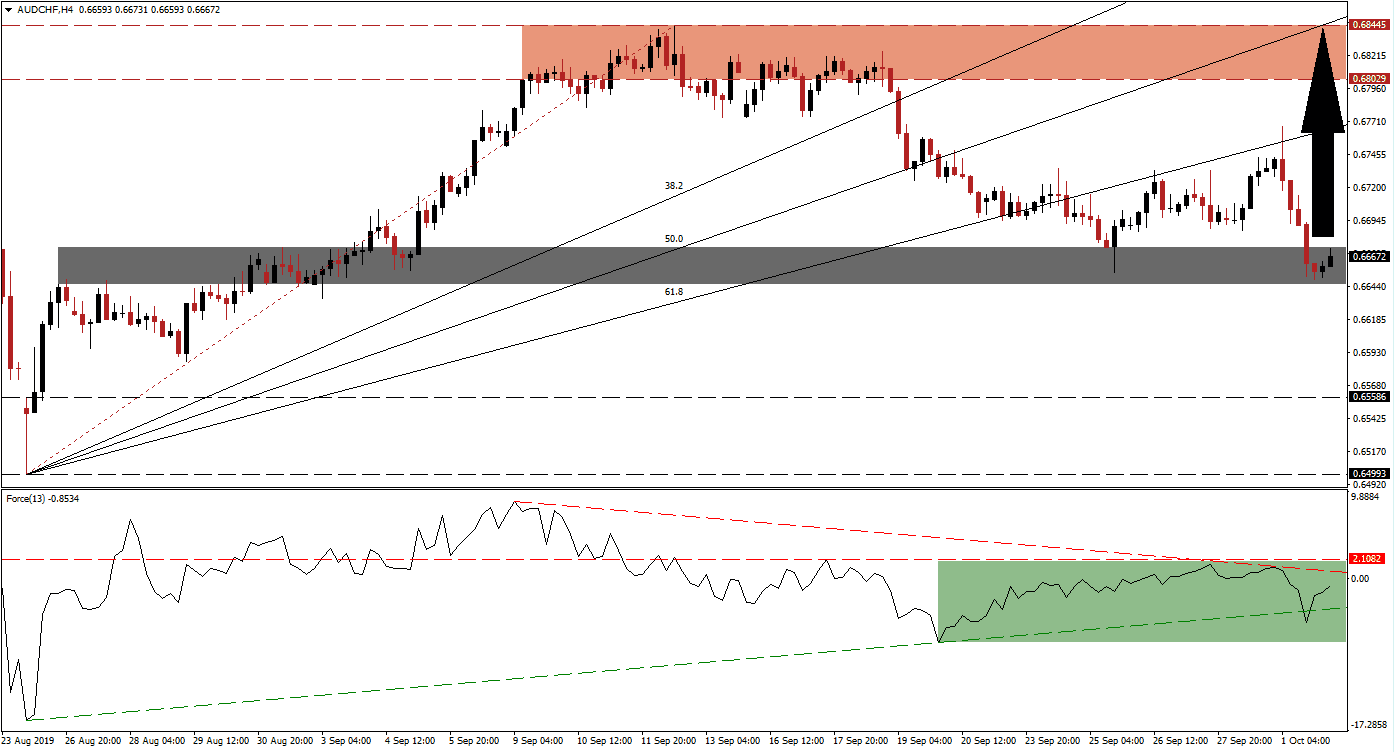

After the RBA cut interest rates to 0.75% as was widely expected, the AUD/CHF dropped from its 61.8 Fibonacci Retracement Fan Resistance Level into its short-term support zone from where bearish momentum eroded quickly. This process was assisted by a string of economic disappointments out of Switzerland while Chinese data surprised to the upside. As price action is gearing up for a breakout, this currency pair should retrace its correction back into it 61.8 Fibonacci Retracement Fan Resistance Level from where an extension into its resistance zone is likely to follow.

The Force Index, a next generation technical indicator, is pointing towards a gradual increase in bullish pressures. A positive divergence formed, within the ascending support level, which indicates that a price action reversal may be imminent. A positive divergence forms when an asset contracts while the technical indicators advances which is marked by the green rectangle. The Force Index remains in negative territory above its ascending support level and is now closing in on its descending resistance level. A successful move above above it will take this technical indicator into positive territory and above its horizontal resistance level, turning it into support. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

CPI data out of Switzerland is expected to show the absence of inflation despite the Swiss National Bank prolonged period of record negative interest rates which are expected to remain in place. Forex traders should monitor the Force Index as it approaches the center line while the AUD/CHF is attempting a breakout above its short-term support zone. This zone is located between 0.66454 and 0.66740 which is marked by the grey rectangle in the chart; a confirmed breakout will clear the path to the upside and into its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

A move in the Force Index above its horizontal resistance level is expected to lead the AUD/CHF to a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support, and back into its resistance zone. While the global economy extends its slowdown, short-term fundamental developments out of Australia, China and Switzerland favor an increase in this currency pair. The resistance zone is located between 0.68029 and 0.68445 which is marked by the red rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.66650

Take Profit @ 0.68400

Stop Loss @ 0.66300

Upside Potential: 175 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 5.00

Should the Force Index sustain a breakdown below its ascending support level, the AUD/CHF is likely to follow through with a breakdown below its short-term support zone. This should lead price action into its next support zone which is located between 0.64993 and 0.65586, where the current Fibonacci Retracement Fan sequence originates. This should be viewed as a good long-term buying opportunity unless the fundamental scenario materially changes which is not expected.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.66150

Take Profit @ 0.65500

Stop Loss @ 0.66450

Downside Potential: 65 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.17