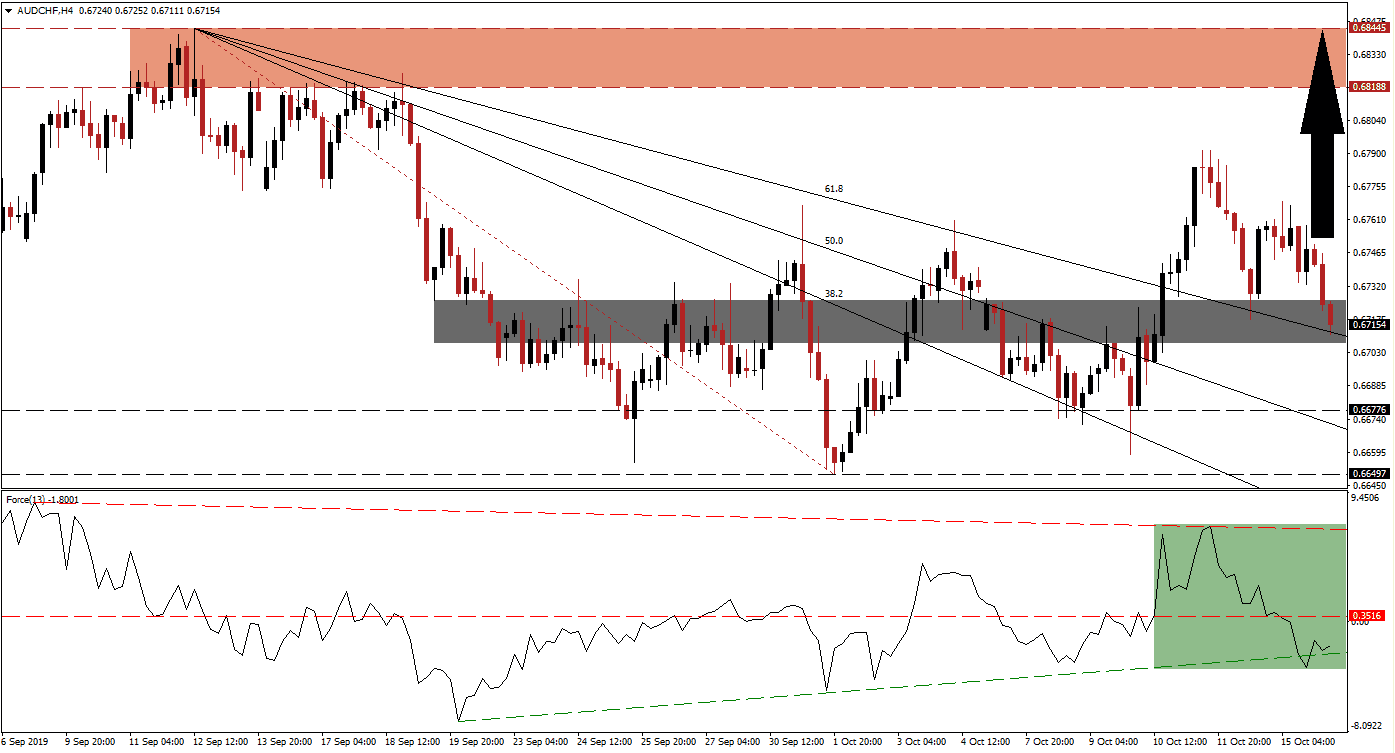

Optimism about a real US-China trade deal is fading quickly, especially after the US House of Representatives passed the “Hong Kong Human Rights And Democracy Act” which supports anti-government protesters. This comes after the hyped-up partial trade deal lacks substance. The Australian Dollar came under selling pressure which pushed the AUD/CHF from its intra-day high of 0.67913 back down into its short-term support zone; the descending 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone. The move lover has also been assisted by the safe-haven status of the Swiss Franc which outperforms during risk-off sessions.

The Force Index, a next generation technical indicator, points towards a potential price action reversal after briefly moving below its ascending support level before recovering. As the AUD/CHF is showing signs of stabilizing at support, the Force Index remains below its horizontal resistance level in negative territory with a bullish bias which is marked by the green rectangle. A sustained move above it, which will turn resistance into support, is expected to lead price action to a breakout above its short-term support zone from where more upside is possible. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Volatility is expected to remain high as the Australian Dollar is the top Chinese Yuan proxy currency, but the latest RBA minutes suggested that another interest rate cut may be off the table as the central bank wants to keep some tools available for potential future shocks; this has taken some of the selling pressure away from the AUD/CHF. The short-term support zone, which is located between 0.67070 and 0.67257 as marked by the grey rectangle, is expected to hold unless a fundamental catalyst will emerge and force a breakdown. Forex traders should monitor the Force Index closely; if the uptrend continues, bullish momentum will continue to build-up.

A move above the intra-day high of 0.67417, confirmed by the Force Index pushing higher, is expected to lead to the addition of new net long positions in the AUD/CHF. This level represents the peak of an advance which took price action from below its short-term support zone, when it was resistance, to above its 61.8 Fibonacci Retracement Fan Resistance Level which turned it into support. This currency pair has recorded a set of higher highs and higher lows which is a bullish development and the current technical picture suggests a continuation of this trend. The next resistance zone is located between 0.68188 and 0.68445 as marked by the red rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

- Long Entry @ 0.67150

- Take Profit @ 0.68250

- Stop Loss @ 0.66950

- Upside Potential: 110 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio:5.50

Should the Force Index reverse and turn its ascending support level into resistance, the AUD/CHF could follow through with a breakdown below its short-term support zone, turn it into resistance, and extend its sell-off into its next long-term support zone. This zone is located between 0.66497 and 0.66776, such a move should be taken advantage of as it represents a great long-term buying opportunity.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 0.66900

- Take Profit @ 0.66600

- Stop Loss @ 0.67050

- Downside Potential: 30 pips

- Upside Risk: 15 pips

- Risk/Reward Ratio: 2.00