Conflicting reports were released over the past few hours in regards to the US-China trade talks. Apparently no progress was made during yesterday’s mid-level talks as the forced technology transfer remains off-limits. Another source noted that high level-trade talks will conclude today and not on Friday. On the positive side, the US granted licenses for companies to deal with Huawei which it blacklisted and tariffs may be delayed in exchange for a currency pact. This was enough to rally the Australian Dollar which also received a boost from a spike in inflation expectations which may keep the RBA from cutting interest rates further. The AUD/CAD completed a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level which cleared the path to the upside.

ed by the green rectangle. More upside is now expected from the AUD/CAD which could extend the advance into its next resistance zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

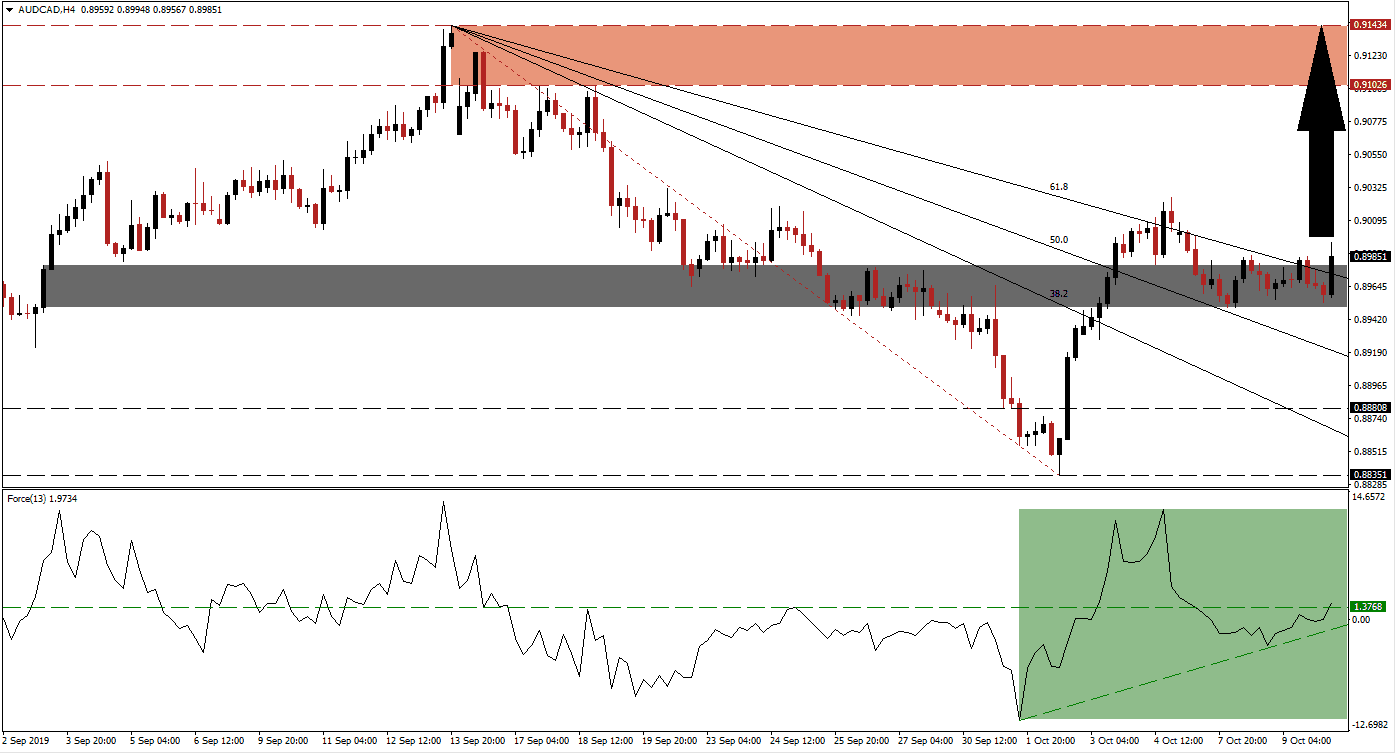

Bullish momentum rose after the AUD/CAD pushed above its short-term resistance zone, turning it into support. This zone is located between 0.89499 and 0.89787 as marked by the grey rectangle. Price action pushed above this zone and briefly pierced above its descending 61.8 Fibonacci Retracement Fan Resistance Level, before reversing back into its converted short-term support zone. A minor sideways trend emerged and during the Asian trading session this currency pair managed another breakout above its 61.8 Fibonacci Retracement Fan Resistance Level which is currently passing through this support zone.The Force Index, a next generation technical indicator, confirmed the breakout in this currency pair as it pushed above its horizontal resistance level turning it into support. Its ascending support level has guided the Force Index higher and bullish momentum continued to expand. The breakout has additional lifted this technical indicator into positive territory which places bulls in control of price action; this is mark

Forex traders should now monitor the intra-day high of 0.90254 which marks the high of the first breakout which was reversed and confirmed the support zone. A move above this level is expected to invite new net long positions in this currency pair. It would also take out the last minor resistance level and allow the AUD/CAD to accelerate into its next resistance zone which is located between 0.91026 and 0.91434 as marked by the red rectangle. As long as the Force Index will remain above its ascending support level, the uptrend will remain intact. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.89850

Take Profit @ 0.91250

Stop Loss @ 0.89400

Upside Potential: 140 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.11

Volatility as a result of fluid developments from today’s trade talks may rise which could reverse the breakout. This is currently no expected and the fundamental picture supports an extension of the breakout in the AUD/CAD, but this mornings equity futures showed that traders should strap in for a wild ride. In case price action reverses and the Force Index completes a breakdown below its ascending support level, this currency pair may retrace back into its long-term support zone which is located between 0.88351 and 0.88808; this should be viewed as an excellent buying opportunity.

AUD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.89150

Take Profit @ 0.88600

Stop Loss @ 0.89400

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20