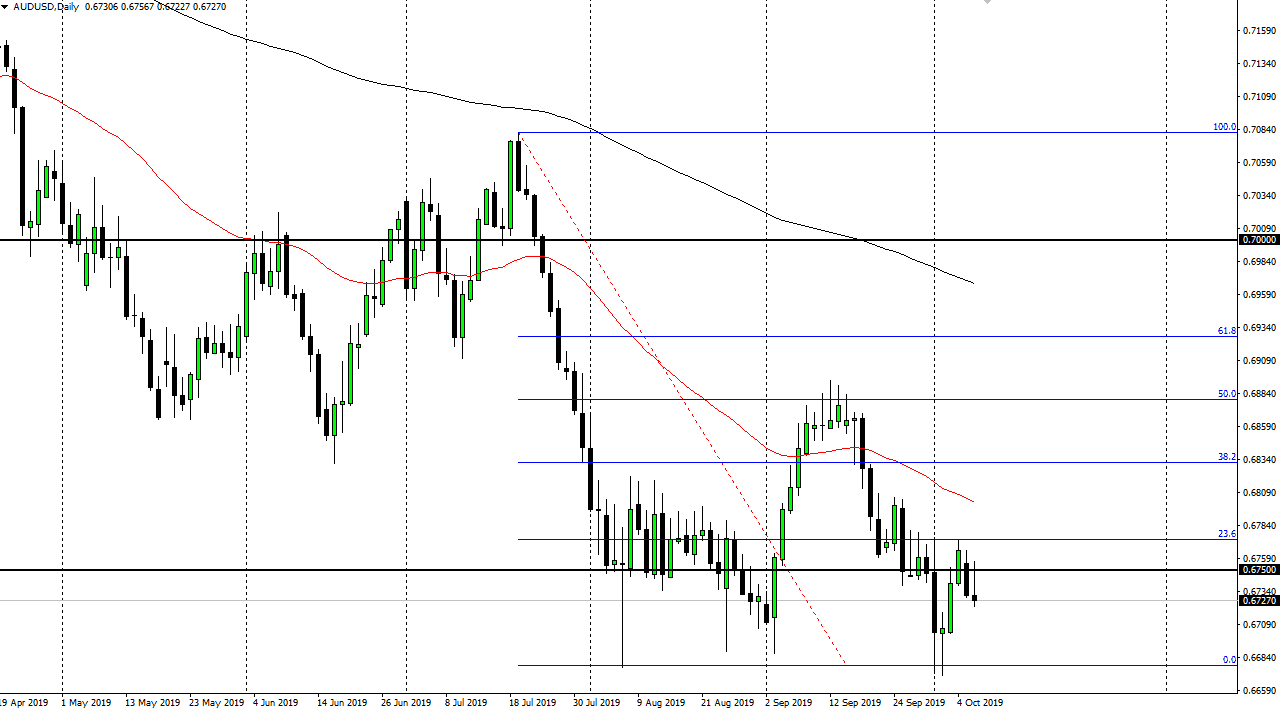

The Aussie dollar tried to rally during the trading session on Tuesday but found enough resistance near the 0.6750 level to turn around and form a big shooting star. If we can break down below the bottom of the shooting star, it’s very likely that the market goes down to the 0.67 level next. At this point, it’s very likely that the bearish pressure could continue on the Aussie dollar based not only on the candlestick, but the fact that the US/China trade talks are going on this week, and quite frankly there is in a whole lot of optimism tied to them.

Remember, the Australian dollar is highly sensitive to the Chinese economy as Australia provides a lot of the raw commodities for not only manufacturing but construction in China, as evident by iron, aluminum, and of course copper. Beyond that, the US dollar gets a bit of a boost by strengthening treasury markets, so with all of that being said it makes sense that we continue to fade rallies. In fact, that’s been the way I have been trading this market for some time, simply shorting rallies that show signs of exhaustion, picking up 20 or 30 pips, and getting out.

I suspect that the market is going to continue lower, but I don’t necessarily think that the market is going to fall apart. I think that we are just going to continue more of the same, as market participants are starting to come to the realization that this deal is not going to be had anytime soon. That being said, if there was good news coming out of Washington DC this week, the market could try to break above the 0.68 handle, which currently deals with the 50 day EMA as well. If we were to break above there, the 0.69 level will be targeted, which is also the scene of the most recent high and the 50% Fibonacci retracement level. That should be massive resistance, and therefore it’s going to be difficult to break above there. That being said, it’s not in less we get some type of deal that we should be able to clear that. I continue to short rallies as they occur, but again, as I have been saying over the last couple of weeks, this is a market that is offering 20 or 30 pips at a time at best.