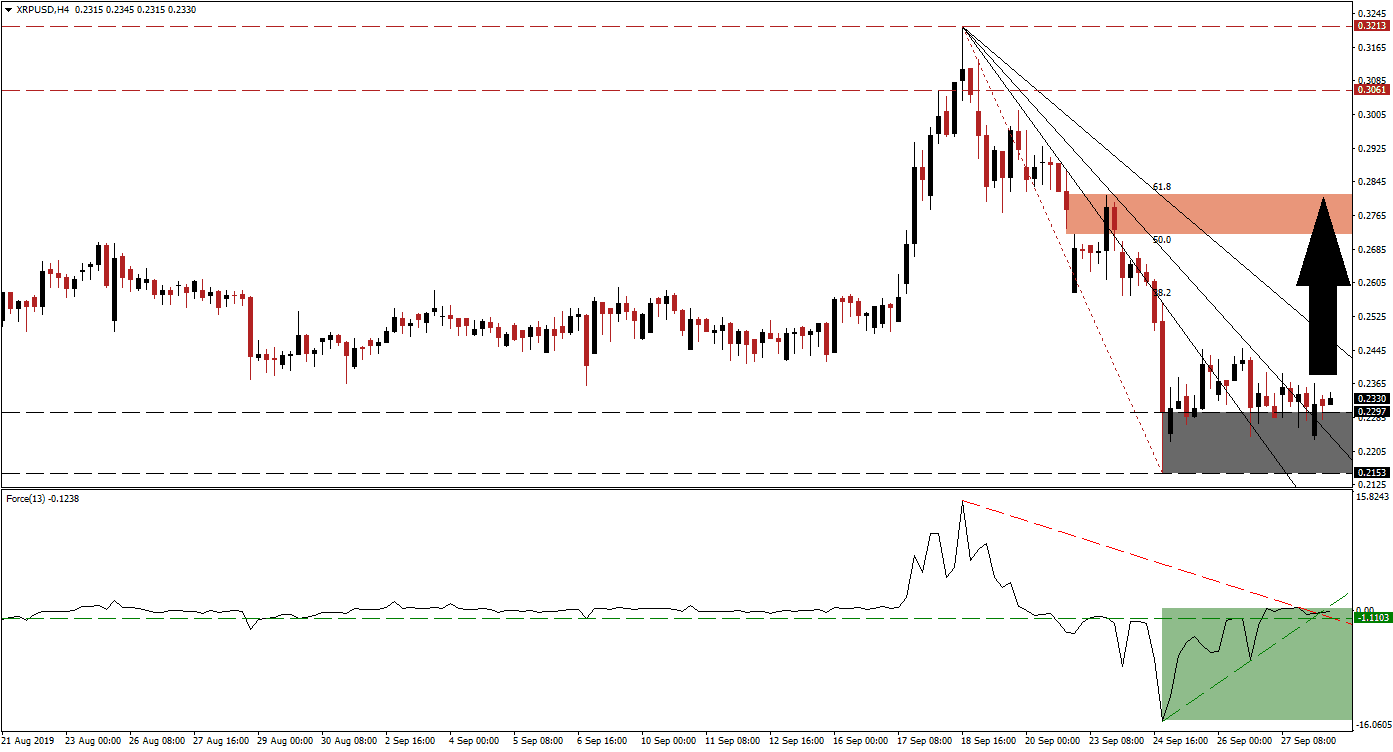

As Bitcoin is dragging down the cryptocurrency market, Ripple stabilized following a volatile rally which was followed by an equally sharp correction. This created a steep Fibonacci Retracement Fan sequence, but as XRP/USD plunged into its support zone, a sideways trend with a bullish bias emerged. This lifted price action above its support zone as well as above its 50.0 Fibonacci Retracement Fan Support Level which is currently moving through its support zone. The increase in bullish pressures is expected to lead to a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level from where more upside is possible.

The Force Index, a next generation technical indicator, has confirmed the breakout in XRP/USD above its support zone by moving above its horizontal resistance level and turning it into support. An ascending support level guided this technical indicator to the upside which also elevated it above its descending resistance level which is marked by the green rectangle. The Force Index remains in negative territory from where it is likely to advance which is expected to invite fresh buy orders in this cryptocurrency pair. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Forex traders should monitor the intra-day high of 0.2448 which represents the peak of the first breakout in the XRP/USD above its support zone. A move high will also take it above its 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. The short-term support zone, located between 0.2153 and 0.2297 as marked by the grey rectangle, has been confirmed and a breakdown below its is unlikely. The fundamental conditions surrounding Ripple are long-term bullish which explains why XRP/USD is not following BTC/USD to the downside.

A breakout above its 61.8 Fibonacci Retracement Fan Resistance Level will clear the path for price action to extend the advance into its next short-term resistance zone. This zone is located between 0.2721 and 0.2812 as marked by the red rectangle. The Force Index should be closely monitored as it is expected to lead price action. The sideways trend in XRP/USD resulted in a sideways trend in the Force Index which temporarily moved it below its ascending support level, turning it into resistance, while maintaining its bullish bias. An advance into positive territory will place bulls in charge and is expected to reverse resistance while attracting fresh buy orders. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

XRP/USD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.2330

- Take Profit @ 0.2810

- Stop Loss @ 0.2235

- Upside Potential: 480 pips

- Downside Risk: 95 pips

- Risk/Reward Ratio: 5.05

Any move in price action below its support zone is unlikely to be sustained as the fundamental picture points towards an extremely oversold XRP/USD. The Force Index should be closely monitored together with the intra-day low of 0.2153, the bottom of the current support zone. The next short-term support level is located between 0.1905 and 0.1972.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.2090

- Take Profit @ 0.1940

- Stop Loss @ 0.2150

- Downside Potential: 150 pips

- Upside Risk: 60 pips

- Risk/Reward Ratio: 2.50