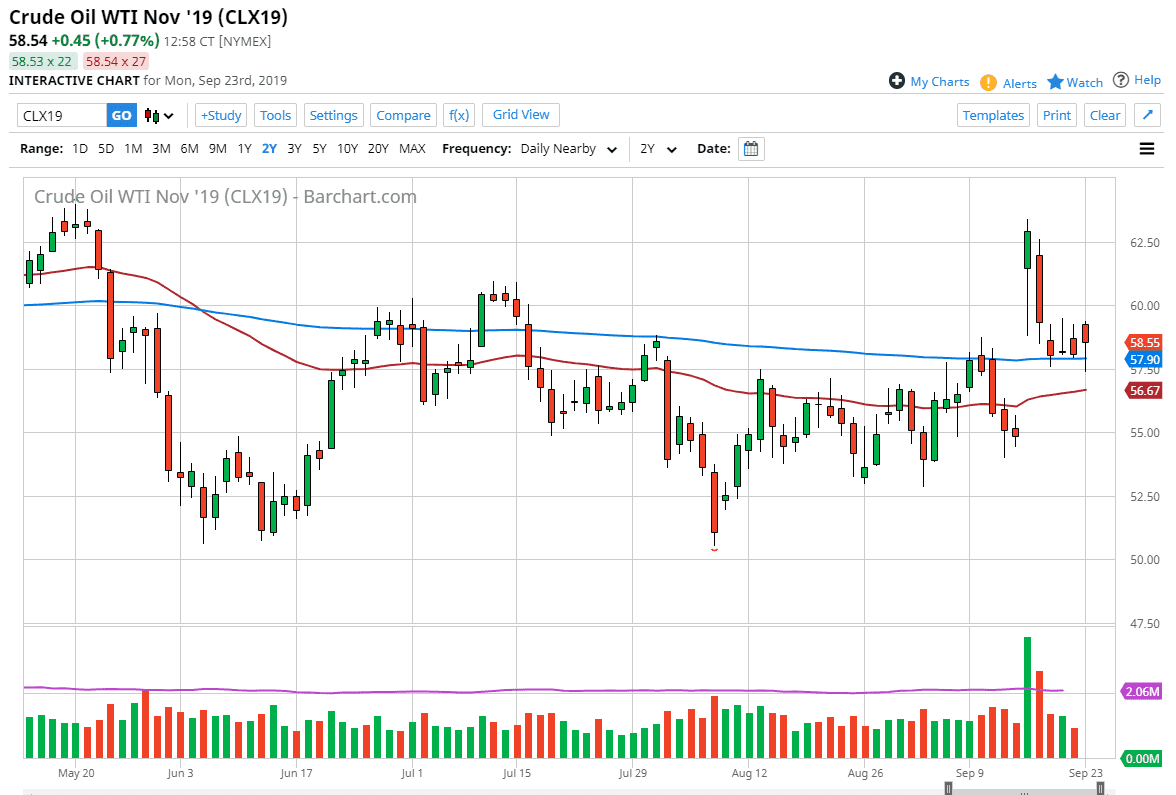

The West Texas Intermediate Crude market initially gapped higher to kick off the week but then slammed through the 200 day EMA to show signs of weakness and reach towards the $57.50 level. However, we have bounced from there again so it just shows how volatile and choppy this market is going to be. The 200 day EMA obviously attract a lot of attention for longer-term traders and shorter time frame based traders alike. Ultimately, there is a big gap underneath that is going to continue to attract a lot of attention and eventually get filled.

Remember, the drone strike in Saudi Arabia was the reason that we had the gap higher, and of course the accompanying fear that global supply was going to be disrupted. The reality is that the damage wasn’t anywhere near as bad as once thought, so the fundamental reason for the gap has all but disappeared. Gaps do get filled, and in fact there’s only been two over the last 30 years that have not been filled. The law of averages suggest that it’s only a matter time before this market falls.

That being said, if we can break down below the $57.50 level then it’s very likely that we go down to the $55 level underneath there. That was essentially where the gap started, and as a result it would be a simple technical move just waiting to happen. That being said, there is a lot of back and forth over the last couple of days so it’s difficult to tell whether or not the market is quite ready to do just that. To the upside, the $59 level continues offer resistance, just as the $57.50 level offer support. If we can break out of that area, then the market can make its move.

If we do rally, the market could go as high as $60, possibly even the $62.50 level. However, I think it’s much more likely that this market breaks below the $57.50 level, and then goes looking to fill that gap at the $55 level underneath. The 50 day EMA is underneath as well, so it could be a bit supportive as well, but at the end of the day it comes down to global demand and whether or not it justifies this price. At this point, it doesn’t seem to be supportive.