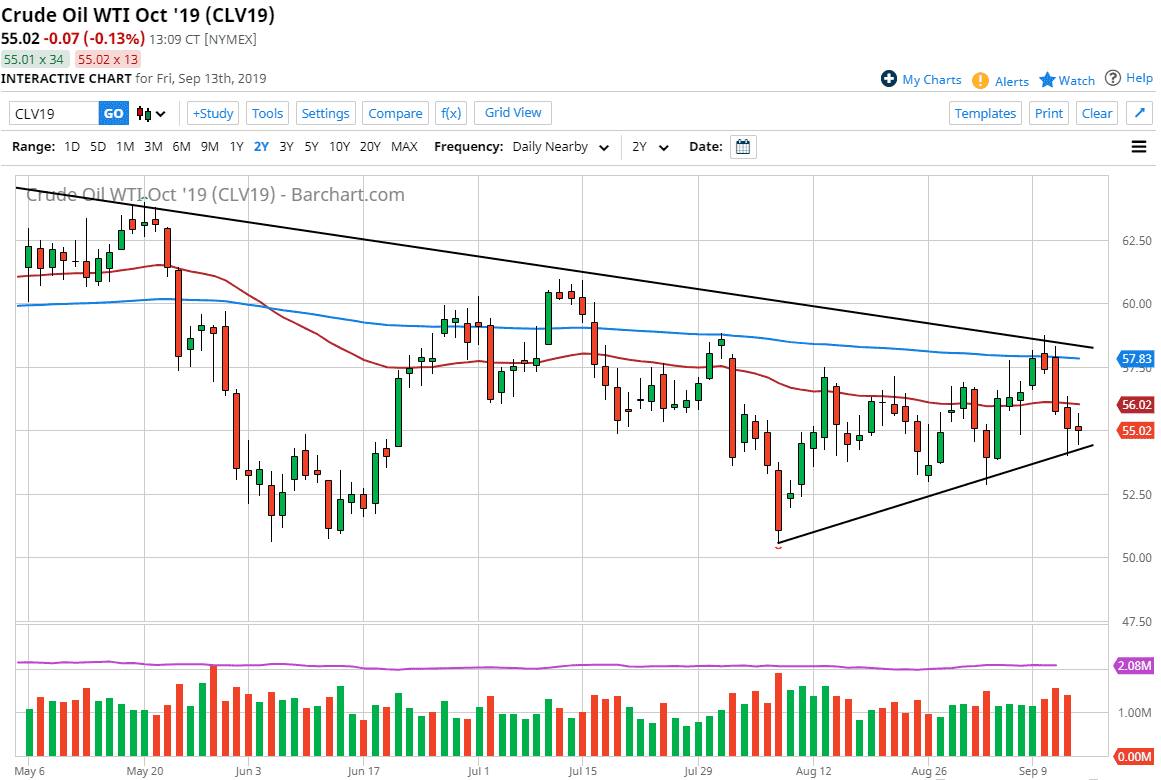

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Friday, dancing around the $55 level. By forming just a slightly negative candle stick, it’s likely that we are going to continue to tighten this overall market. The 50 day EMA just above is going to cause issues, just as the 200 day will as well. At this point, the uptrend line is very supportive, and at this point I think the overall tightening of the market is going to continue as we have a lot of different issues affecting the price and the idea of demand for energy.

As Donald Trump fired John Bolton last week, it gives hope to the idea of the Iranians and the Americans speaking again, and at this point in time it’s likely that the markets are hoping for a little bit of the easing of tensions, thereby possibly offering the Iranian oil to the open market as well. Ultimately, there is also a lot of concern when it comes to global demand as it appears there are a lot of recessions hitting, in various places such as Germany, Italy, Asia, Australia possibly, and a whole host of other nations. That has people worrying about whether or not there is going to be enough demand for crude oil.

You should also pay attention to the US/China trade relations, as the market is trying to extrapolate the demand for crude oil based upon that. The better the trade relations are, the more likely we are going to see oil rise as perceived demand comes into play. Shipping of course uses petroleum, so does trucking and a whole lot. Beyond that, the factories also will be powered by petroleum byproducts as well, so at this point in time it’s very likely that we are going to see this market moved back and forth.

Overall, this is a market that is going to remain very erratic, so it’s very likely that more this choppiness continues. However, if we break down below the hammer from the Thursday session, then we could go down to the $53 level, possibly even the $52.50 level. Alternately, if we break above the top of the 50 day EMA we probably go looking towards the 200 day EMA, just for a short-term move more than anything else.