The crude oil markets have had a rough go over the last couple of weeks, after initially spiking higher due to the drone attack in Saudi Arabia. The last several sessions, we have reached towards that gap and have finally filled said gap. However, the price action on Monday is horrible and it looks like we may have further to go.

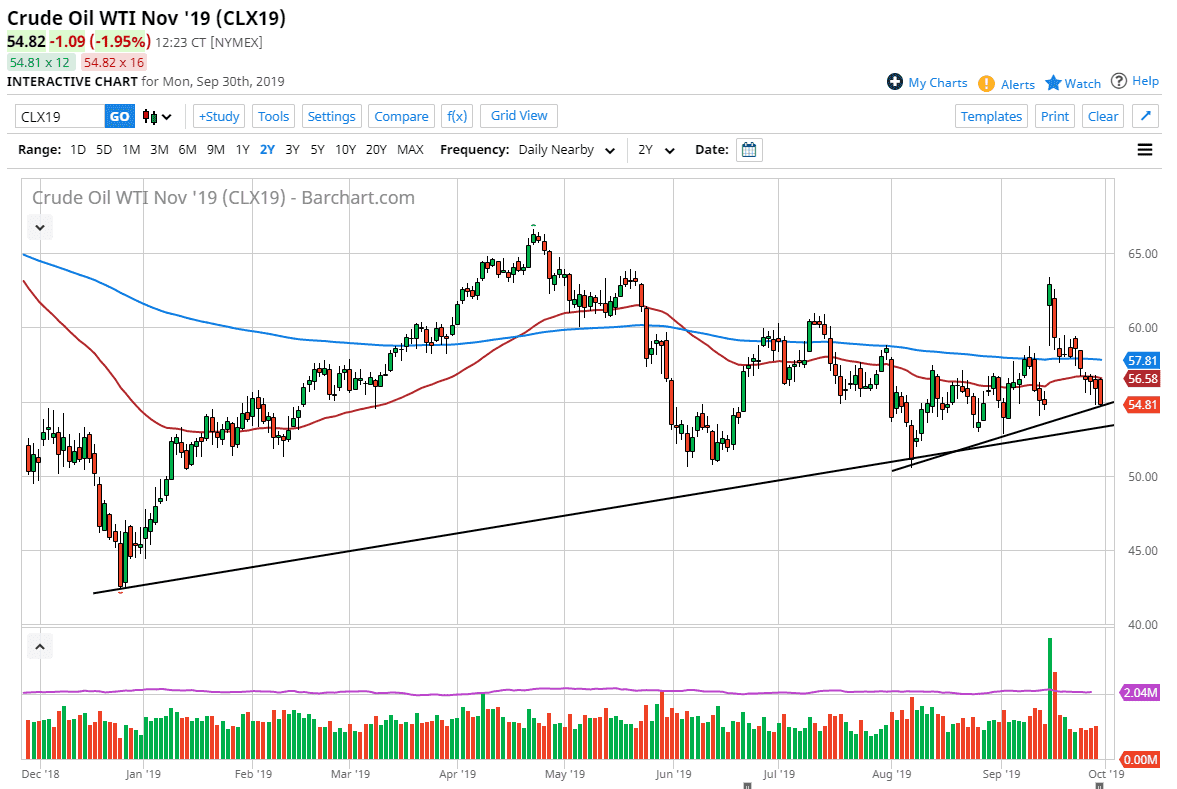

Looking at the chart, I can see that there is an obvious uptrend line underneath that should keep this market somewhat afloat. Underneath this trendline we have another one just below, so I think there are serious amounts of buying orders underneath but I think given enough time that area will have to prove itself. If the uptrend line underneath doesn’t hold, the market could find itself reaching towards the $50 level rather quickly. Quite frankly, one of the things that is most impressive about this downtrend is the fact that we are closing at the very bottom of the candle stick on Monday after forming three hammers previously. That is a very bad sign to say the least.

At this point, I suspect that rallies will be looked at with suspicion, so it’s difficult to imagine a scenario where rallies will stick for any significant amount of time, and quite frankly the only thing I see offering any bit of hope are that trendlines which are being threatened as we speak. To the upside, the 200 day EMA is closer to the $57.80 level, and I think it will continue to offer pretty significant resistance. Quite frankly, if we reach towards that area it’s likely that an exhaustive candle will form that we could start selling again. If we were to close above the 200 day EMA though, then one would have to think something has fundamentally changed in the way the market is behaving. That being said, things look horrible right now and until things change you have to assume that selling is the way to go going forward.

I do believe that there will be a significant amount of support near the $50 level, so therefore if we were to break down below that level it could really open up the “trapdoor” for the market. I would fully anticipate $50 to hold though, unless something has changed with the demand/supply issue. Right now, they’re just simply isn’t enough global demand for power to drive this market higher.