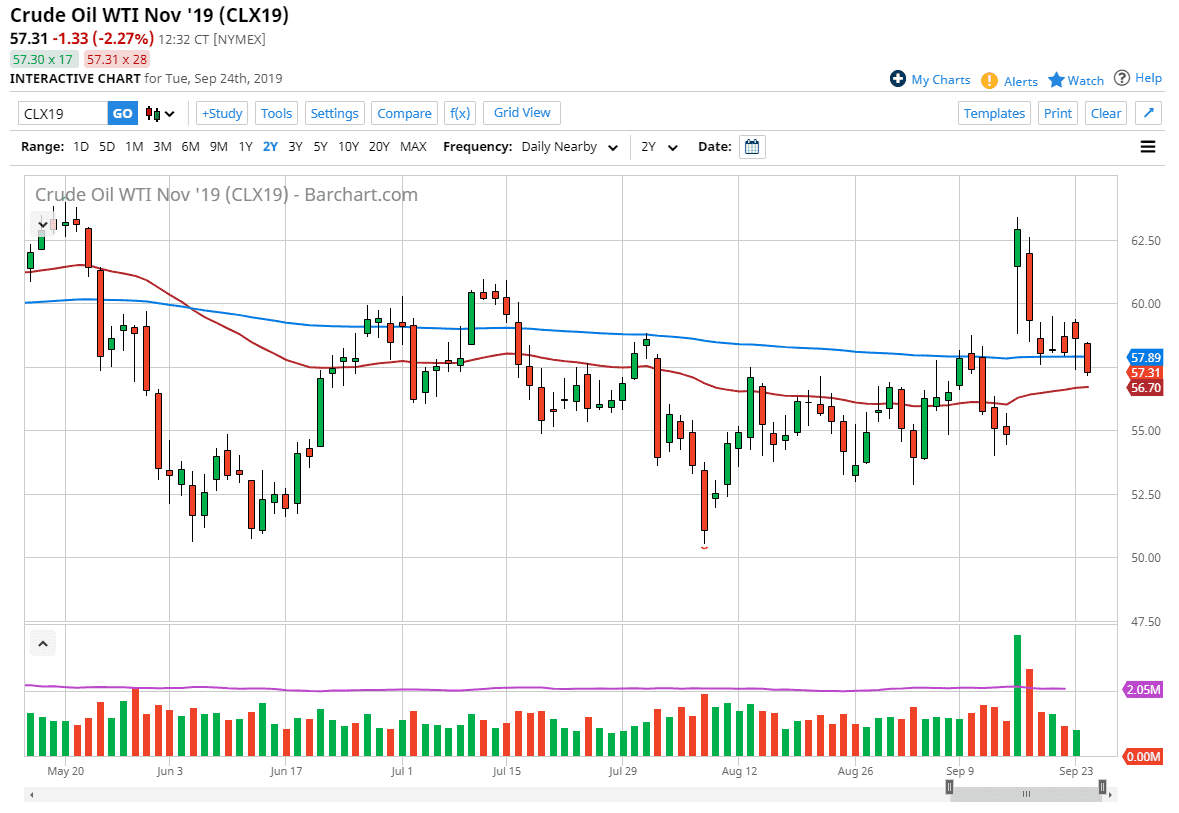

The West Texas Intermediate Crude Oil market has fallen during trading on Tuesday, breaking below the $57.50 level. This was a minor support level that has continued to bring in buyers over the last several days, but now that we are breaking below there it’s very likely that this market will continue to drop. This makes quite a bit of sense considering that the gap that formed was due to the Saudi drone strike, which now has been known to be damaging, but not terminal for the overall global production. With Saudi Arabia going back to full production by the end of the month, it’s very likely that we will continue to see quite a bit of negativity as markets return to where they once were before the sudden shock.

Whether or not we can break down through that gap is a completely different question, and that doesn’t normally happen, at least not right away. The $55 level is approximately where the gap started, so it’s likely that the level will attract a lot of attention. In the short term, breaking down to fill that gap makes quite a bit of sense, as there have only been two gaps in this market that have not been filled over the last 30 years. With that being the case it’s more than likely going to happen sooner rather than later.

However, if we did move in the opposite direction we would probably first go looking towards the $59 level, which was the most recent resistance. Above there you would have the $60 level and then eventually the $62.50 level. It is worth noting however that the market is closing below the 200 day EMA for the first time since the gap higher, so this shows that a certain amount of exhaustion has almost certainly taken over the market, as it had been overdone and now has to rebalance itself. There is a certain amount of fear when it comes to global demand, and of course the trade war is doing absolutely nothing to help that scenario. Beyond that, the strengthening US dollar longer-term has been weighing upon the market as well. Simply put, there is more than enough crude oil out there to satisfy demand at the moment, and the Americans continue to pump out more every year. Crude oil will struggle going forward, but at the outset needs to at least fill the gap.