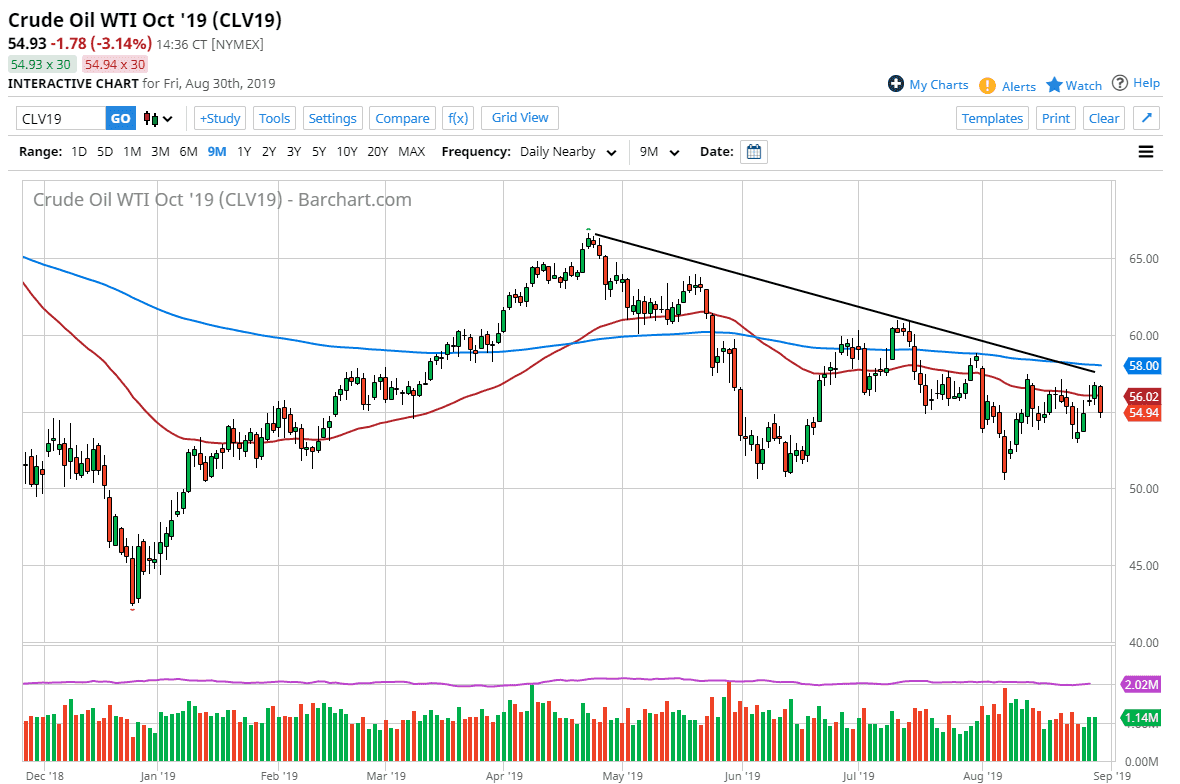

The WTI Crude Oil market initially tried to rally on Friday but then broke down below the 50 day EMA. We have a gap that needed to be filled, and with the announcement that the Russians are very likely to not cut production as much as OPEC wanted, I think at this point the oversupply still continues to be a major issue. Now that the gap is been filled, I think that we will eventually break through it, as there is a serious lack of demand out there for energy and crude oil in particular, so therefore I think we go down towards the lows again.

Having said all of that there is the possibility of the market rallying from here and if it does it’s likely that we will try to reach towards the downtrend line above. That downtrend line should continue to cause quite a bit of resistance, and therefore even if we do rally from here I think it’s only a matter of time before you we get some type of selling opportunity. I don’t necessarily think that the oil market has bottomed yet, so I think it’s only a matter time before we reach down towards those lows again closer to the $51 level.

If we were to break down below the $50 level, then we could go down towards the $45 level. That would be a very negative sign going forward, so having said that it would probably coincide with the lot of “risk off” attitude in the markets out there which wouldn’t be a huge surprise at this point with the US/China issues and of course global trade slowing down. In fact, I suspect that we are only looking for the wrong Tweet to knock things back around. We are starting to show signs of stability though, so I think it’s probably going to continue to be a short-term traders type of market, as the downward momentum continues but obviously we are quite ready to break down. The alternate scenario of course is that we break above the trend line and that of course could send this market towards the $58 level, possibly even the $60 level after that. If we were to clear that’s downtrend line though, that would be a very bullish sign and if it coincided with some type of trade agreement between the Americans and the Chinese, that could be the beginning of a turnaround.