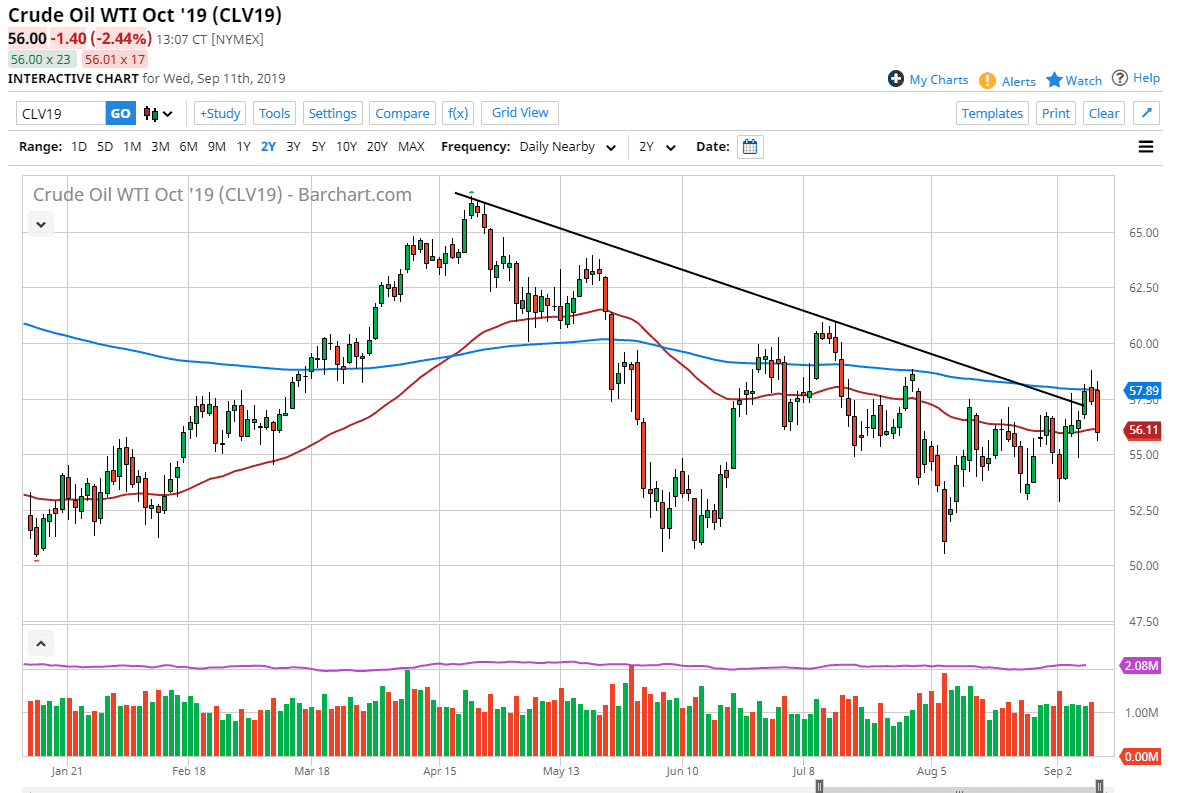

The WTI Crude Oil market fell rather hard during the trading session on Wednesday, even though the inventory number was very strong. That being the case, the market reached down towards the 50 day EMA which is currently parked at roughly $56. All things being equal, the market is probably reacting more to the firing of John Bolton than anything else as he was a well-known hawk when it came to the Iranian policy. Conversely, President Trump has been talking about easing sanctions against the Iranians in order to get them to the negotiation table. That means that we could start to see more supply onto the marketplace, and that does kill part of the thesis of shrinking supply driving crude oil higher.

It’s a bit difficult to discern yet, but right now it looks as if there is quite a bit of support between here and the $55 level. This has been a very significant break down though, so this point it’s very likely that we are probably better off on the sidelines as there is so much in the way of noise at this point. That being said, the one thing that is relatively clear is that the 200 day EMA has held as massive resistance.

Underneath, the $52.50 level is also supported, but right now this looks like it is a very sloppy and confused market. With that being the case it makes quite a bit of sense that you should keep your position size relatively small as the markets try to figure out what happens next. There is no discernible technical pattern at this point, so that of course will keep me on the sidelines as well. That being said, a lot of this is going to come down to the next Tweet that has something to do with the Iranians, and whether it is hawkish or dovish when it comes to attitude. That of course is a moving target, so at this point I think crude oil is going to continue to be very difficult to get your head around in the short term. If we break above the top of the shooting star that was formed during the Tuesday session, then that would obviously be a very bullish sign. If we break down below the $52.50 level that would obviously be a very negative sign. Anything in between is going to be extraordinarily noisy.