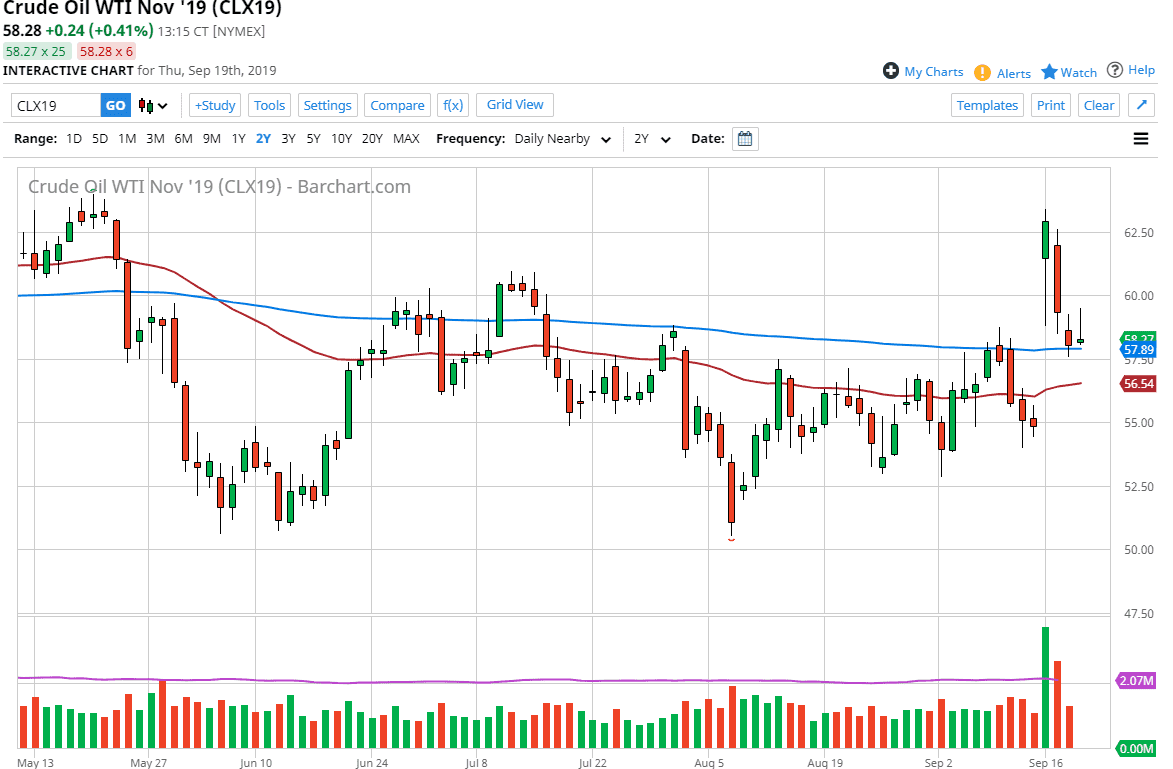

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Thursday but failed and gave up all of the gains. By forming the shooting star looking candle for the trading session, it suggests that we are going to drop down towards the bottom of the gap underneath, which is a technical phenomenon that happens quite a bit. That means that we would probably be looking for a move closer to the $55.20 level.

Even if we rally from here, the fact that we had rallied based upon a drone strike in fear that the global supply was in major disarray but it has since been proven to be overblown, tells me that the supply and demand equation certainly favors lower pricing. At the very least we need to get back to where we were before we have that sudden burst higher, and that of course means filling the gap. Futures markets don’t hang onto gaps very long, a lease not under normal circumstances. With that, it would not surprise me at all to see the end of the week looking very bearish for crude oil in general.

If we can break down below the $57.50 level, I suspect that will be the trigger to go much lower. I also believe that the $60.00 level above is now the “ceiling, based upon the candlestick that we have just formed. I don’t necessarily think that we will break down below the $55 level though, but it of course is possible. If you squint you can see that there is a potential trend line that reaches up towards the $55 level, so therefore I think a simple filled the gap situation makes the most sense.

A lack of global growth, geopolitical tensions and of course the most important thing being the US/China trade talks failing, it’s likely that the demand for crude oil will continue to fall as Chinese internal economic numbers have been horrible. With all of that it’s hard to imagine a scenario where demand suddenly picks up. In fact, the only thing that made this market rally the way it has was the attack. Otherwise, we very easily could have drifted quite a bit lower based upon the recent action. Expect a lot of volatility, but most certainly the easiest trade is to fade this ridiculous move from the beginning of the week.