The West Texas Intermediate Crude oil market, as well as the Brent market, spiked after an attack in Saudi Arabia that has wiped out half of their refinery capacity. Because of this, it’s likely that we are going to continue to see bullish pressure, because we don’t know how long it’s going to take to get that production back online.

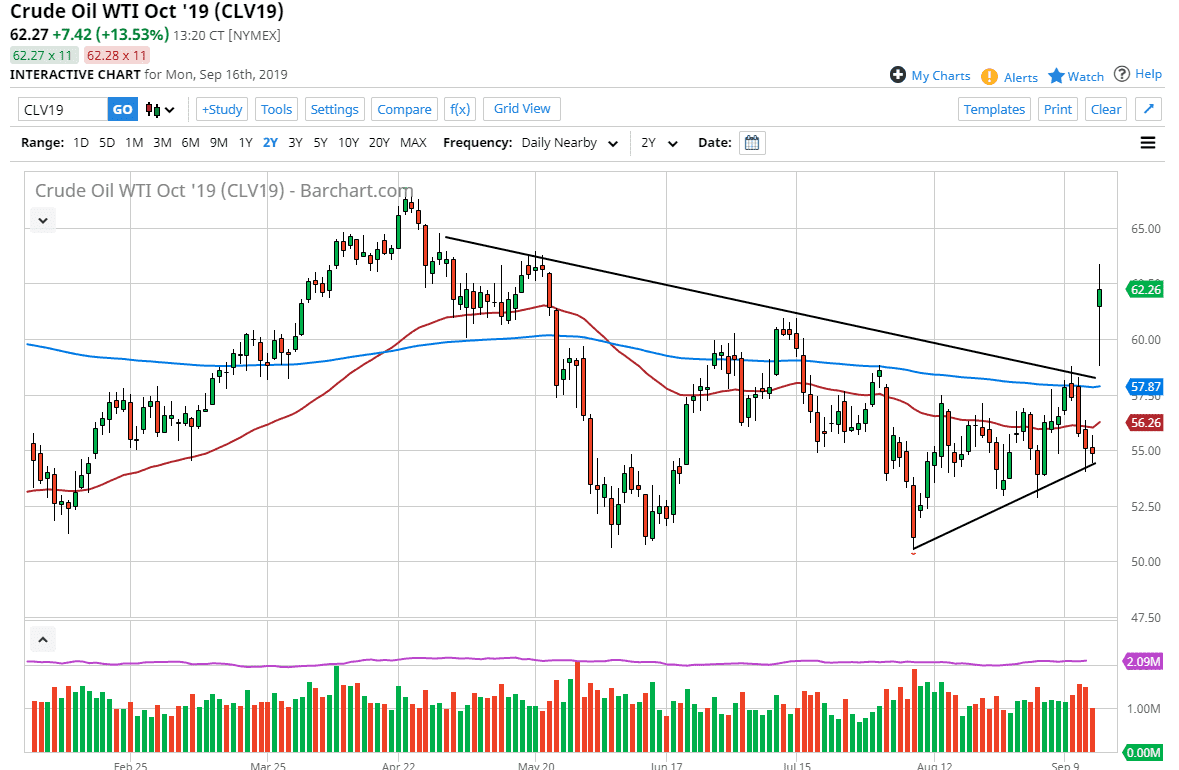

Looking at the gap, we have broken above the $62.50 level, pulled back rather drastically, and then shot straight back up in the air. This has been an extraordinarily volatile session, but one thing it is would be bullish. Buying dips continues to work, and the 200 day EMA underneath could offer plenty of support, which is currently at the $57.87 level. This candlestick is very bullish and it does suggest that perhaps we probably will get some forward momentum.

Adding even more fuel to the fire, the Americans are now starting to talk about how the attack was almost certainly done from the Iranian desert, and therefore people are starting to become concerned about war as well. It looks as if the market is probably going to continue to go higher for the meantime, and selling is all but impossible at this point. The market will more than likely have to worry about a lack of supply, something that we have not had to think about for some time. The action over the last couple of days has completely wiped out the original narrative. Beyond all of this, the group that is supposedly responsible for this suggests that there are plenty of targets “within striking distance”, and that of course will have people concerned as well.

To the downside, the 50 day EMA will be supportive as well, and if we break down below that level it will probably take some type of good news when it comes to supply, something that I’m not necessarily going to be holding my breath for. The action yesterday was absolutely monstrous, and it looks very likely that we are going to go higher just based upon the internal action that I was paying attention to during the session. There were huge sweeps higher as far as order flow with concerned, even later in the day, long after I normally see them. Look for dips, take advantage of value.