West Texas Intermediate Crude Oil fills the gap and looks to bounce.

West Texas Intermediate Crude Oil broke down significantly during the trading session on Friday to finally fill the gap from the Saudi drone attack, and as that being the case it should see a significant amount of support in this area. At this point, the market could have a bit of a bounce in it but I suspect there’s a lot of noise just waiting to happen that will cause issues.

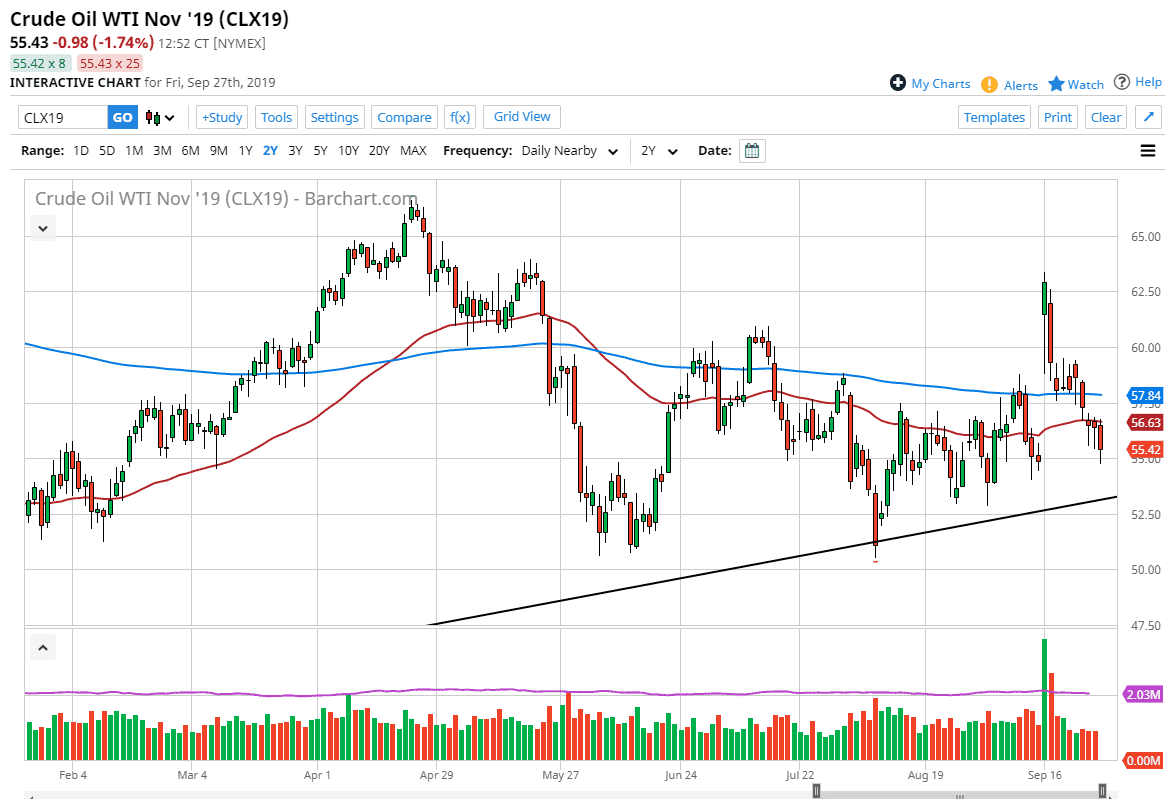

A break down below the candle stick for the Friday session has the market looking towards the uptrend line underneath, which will be even more supportive. Quite frankly, I think at this point crude oil is a bit stuck because the markets are having to deal with a severe lack of demand as global growth is collapsing. The crude oil markets continue to be very noisy, and the 200 day EMA above is massive resistance at the $57.84 level, and it’s likely that we will see a lot of selling pressure in that area.

If the market were to break above that level, then it’s likely that the market probably goes looking towards the $59 level. To the downside, if we were to break down below that uptrend line, then oil will probably break down to the $50 handle. All things being equal, this is a market that continues to be choppy and probably very likely to be more of a back-and-forth sideways market, with day trading a back-and-forth type of system probably be in the way going forward.

The US dollar of course is going to have its influence as well, so if it starts to rally significantly, it’s likely that it will put downward pressure on the crude market going forward. Beyond that, as the global economy starts to slow down the demand is going to be a major issue. I suspect in the short term we may get a small bounce, followed by a pullback as well, especially near the 200 day EMA above. This is an area that will continue to be very sloppy and noisy and quite frankly we need some type of catalyst to move this market in one direction or the other. Expect quite a bit of volatility and stick to the short-term charts in order to profit from what will be a market full of confusion over the next several days.