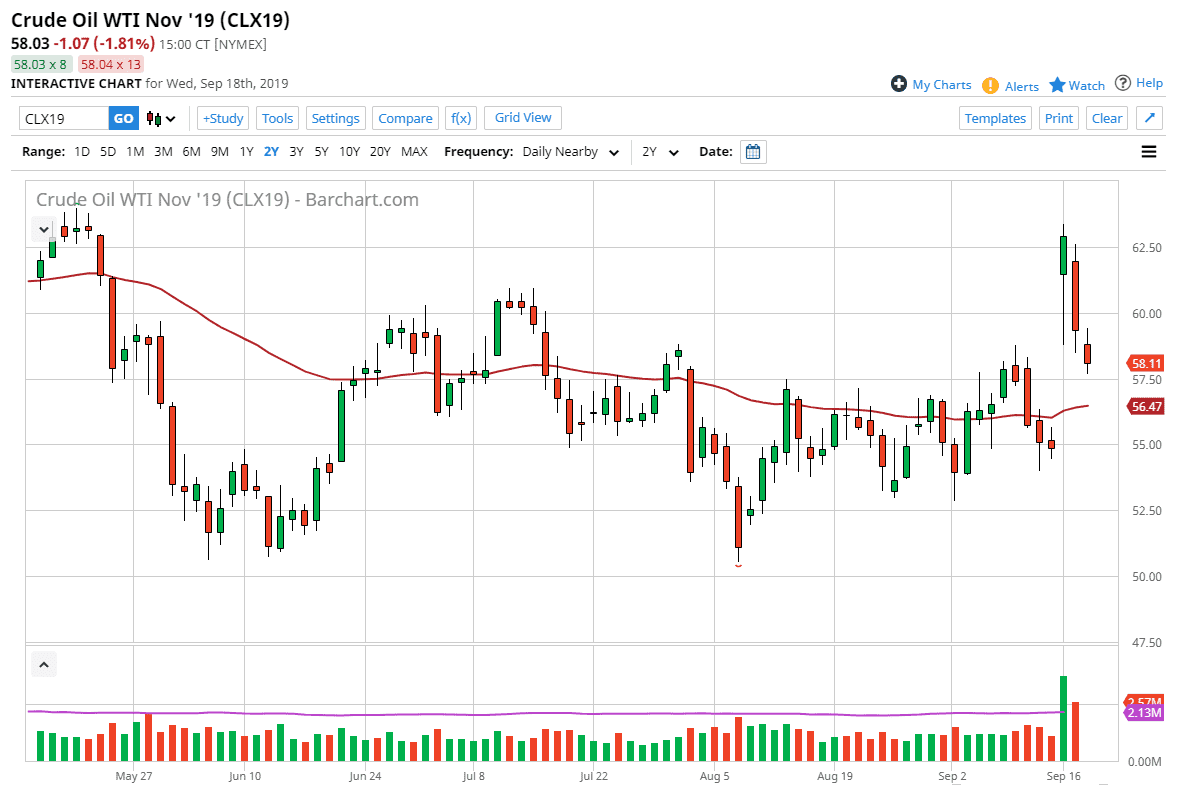

The West Texas Intermediate Crude Oil market dropped a bit during the trading session on Wednesday, as we continue to see a lot of noise. The gap higher from the drone attack in Saudi Arabia did of course dictate that we ended up forming a massive gap. Gaps do tend to get filled, and therefore it’s likely that the market will eventually do so. The gap is all the way down at the $55 level, and therefore it’s likely that’s where we will reach down to that level.

All things being equal, this is a market that has been overdone due to the fact that the Saudi Arabia government has suggested that we should see an increase in output of crude oil rather soon and the fact that the US inventory numbers came out as a build suggest also that we should lose a bit of value here. The gap was obviously overdone, so it’s likely that short-term rallies should be sold off to reach towards the bottom, slicing through the 50 day EMA and then eventually the $55 level. Whether we can break below there is a completely different question, but if you squint you can see where there could be a nice trend line down near that area as well anyway, so that could offer support beyond the gap.

I don’t necessarily believe that the crude oil markets need to collapse, but clearly they had no business gap in the way they did. We had seen the largest gap ever in crude oil markets, so having said that it’s likely that the markets needed to calm down a bit. I think that will be the next move, simply drifting down to lower levels. We will probably have to essentially “reset” closer to the $55 level, so it’s likely that the market will need to bang around in that general vicinity. I believe that we continue to drop and then simply go sideways as we try to figure out what to do next. There is always the possibility of more conflict in the Middle East, so will have to wait and see how that plays out but clearly the downside seems to be the more preferable trade at this point, recognizing that there will be continued volatility as we reach towards the bottom of the gap again. Short-term rallies are to be faded.