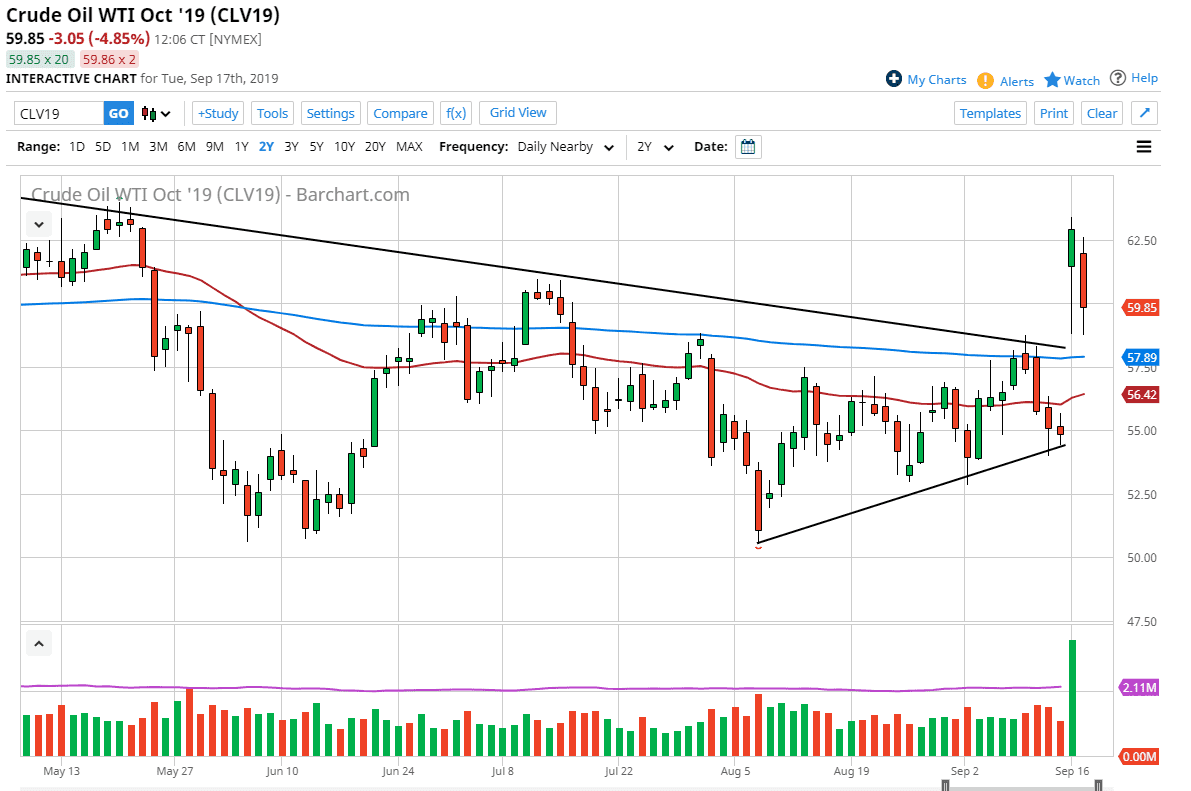

The West Texas Intermediate Crude Oil market has fallen significantly during the trading session on Tuesday as it was reported that the production may come back online within just a few weeks, and that of course is much less destructive than originally thought. The initial gap was due to the worst case scenario, which is not coming true and therefore it’s perfectly acceptable for this market to roll over and go falling towards the bottom of the gap.

We have the 200 day EMA underneath pictured in blue, which of course is an area that longer-term traders will be paying attention to. I believe that this market is ready to break down and reach back down towards the $55 level. This has been a brutal selloff during the day and therefore it’s likely that we will see a bit of follow-through based upon the sheer ferocity of the move.

Underneath, the $55 level should be supportive, it would essentially just send this market right back into the range that it had been in previously. This doesn’t mean that we will get there right away, but typically the gap gets filled in the futures markets, although it can take days, if not weeks. With all things being figured into the equation, if the production of crude oil can be picked up rather quickly, then it makes sense that we would completely re-price back to where we started. After all, the last several days of last week before the attack were actually somewhat soft. There is support just below the candle stick from the trading session on Friday, so perhaps a bounce from there is likely but it isn’t necessarily where we should be seeing some type of longer-term bounce or turn around.

We had previously been forming a bit of a wedge, so that does question whether or not we were going to break higher anyway, which I think at this point could still be the case under the right circumstances, but regardless we are likely to see it much less of a bullish move, so at the very least the gap should be filled over the next several days. With the Federal Reserve coming out with an interest rate decision, it’s probably best to leave this market completely alone in the short term because it will have such a massive effect on the US dollar in general.