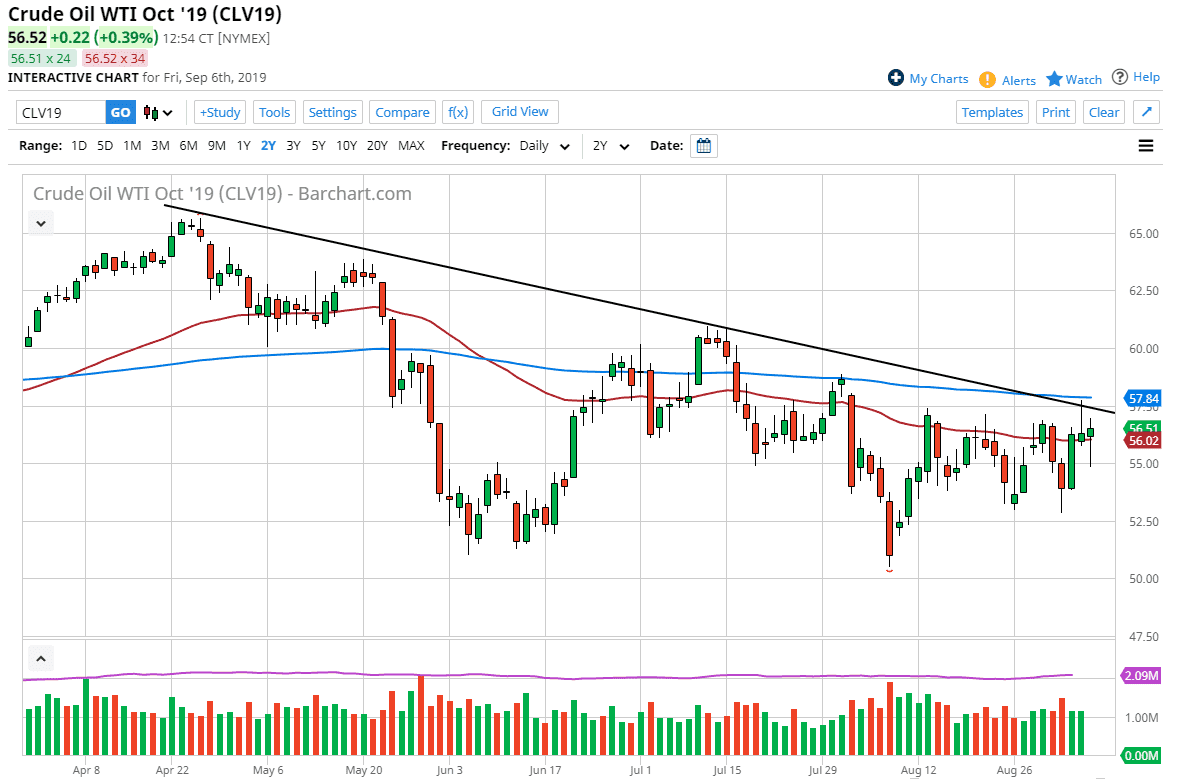

The West Texas Intermediate Crude Oil market initially fell during the trading session on Friday, reaching down to the $55 level early in the day. However, the jobs number came out and through the market into disarray. By the time we closed the open pit session, we did end up forming a bit of a hammer and it now looks as if the market is completely confused in this general vicinity. There is a shooting star just above, where we broke above the downtrend line, which of course is a bullish sign. It also touched the 200 day EMA, and therefore if we can break above the top of that shooting star would be an extraordinarily bullish sign. In other words, I’d be a buyer at that point.

The alternate scenario is that we break down below the $55 level which would clear the candle stick for the Friday session, then I think the market goes looking towards the $52.50 level, perhaps even the $51 level underneath. All things being equal I think that we are going to see a lot of volatility which of course isn’t a huge surprise considering that it is in fact crude oil we are talking about.

You could even make an argument for an inverted head and shoulders but perhaps very noisy. Because of this, not only a break above the trend line is a buy signal, but it is also technically a neckline being broken and that could send buyers into the market as well. It will be interesting to see this plays out, but it clearly looks as if we are trying to move the market in one direction or the other. As soon as we can break out of the range between the shooting star and hammer, then it gives us a bit of a signal for the next move. Either way, I think it is going to be very noisy and bouncy over the next couple of days so I would wait until the breakout before I put any type of money to work. The crude oil markets obviously have a lot to sort out over the next several days, and at this point simply sitting on the sidelines will probably be the most profitable way to trade this market. Simply let the market tell you which way it’s going to go and then follow.