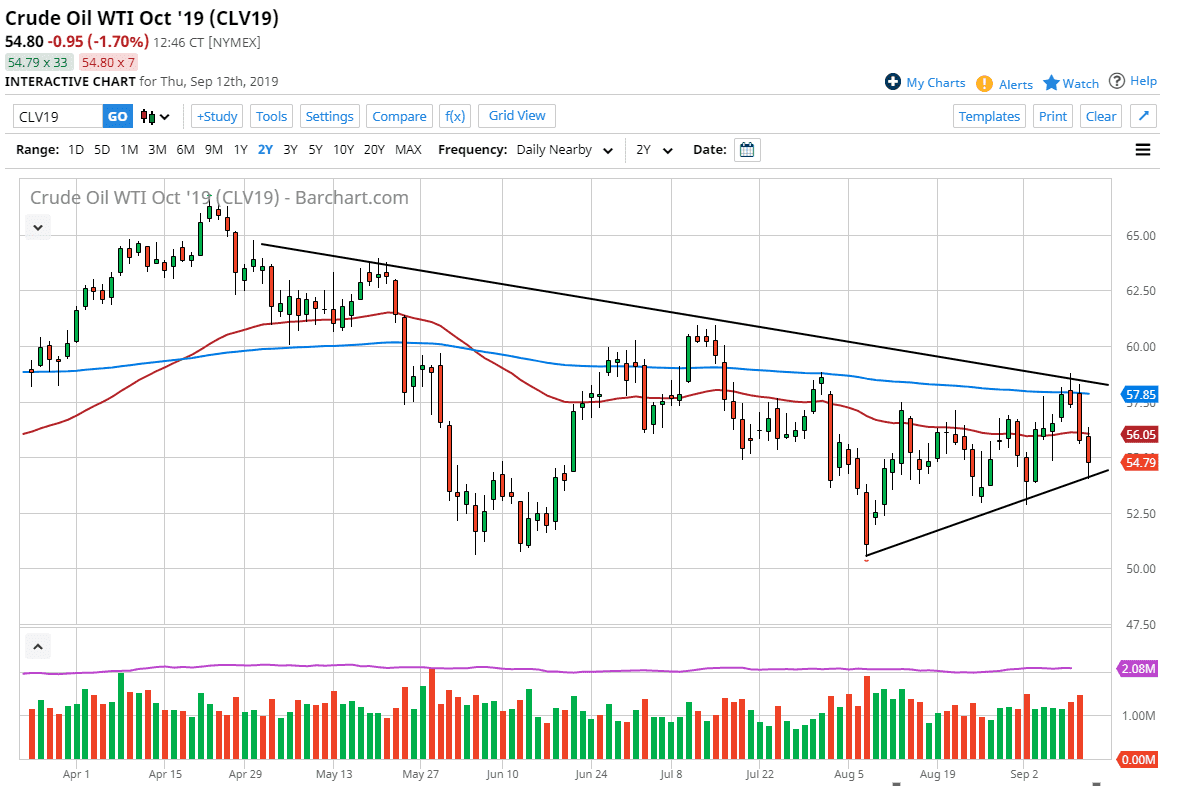

The West Texas Intermediate Crude Oil market has fallen again during the trading session on Thursday, as we broke solidly through the 50 day EMA, reaching down towards what now looks as though it is going to be a significant uptrend line that keeps the market tightened. This makes sense, because there are a lot of questions right now and conflicting reports about what’s going to happen fundamentally when it comes to crude oil.

The OPEC nations have been talking about cutting back production, but it looks now as if they won’t be able to accomplish anything new until December. Beyond that, OPEC nations have been cheating, which they typically will do once they set up an agreement anyway. It’s not uncommon at all to see a country produce more crude oil than they are supposed to do in order to fill their coffers. OPEC also has a major issue in the fact that the Americans are pumping crude oil into the marketplace, and therefore keeping supply relatively high.

We have bounced from that uptrend line though, so it looks as if the market is going to continue to tighten in this range, as we simply don’t know what to do. There are a lot of reasons to think that crude oil could be bearish, not the least of which would be the fact that the world could be entering a bit of an economic slowdown, but there is also the possibility that central banks flooding the markets with cheap money could drive the value of commodities up. They are trying to inflate their economies, and that’s typically what happens. If the Americans and the Chinese come together with some type of trade agreement, in theory that should drive up the value of crude oil because the demand will be much higher. However, we aren’t anywhere near a deal yet, although it has been a bit more consolatory as of late. All things being equal, it looks as if the short-term bounce will probably be sold into, especially somewhere closer to the 200 day EMA which is painted blue. If we were to break down below that uptrend line, then it opens up the door to the $52.50 level, and then possibly even the $51 level after that. To the upside, if we break above the shooting star from the Tuesday session then we could see this market go looking towards $60 rather quickly.