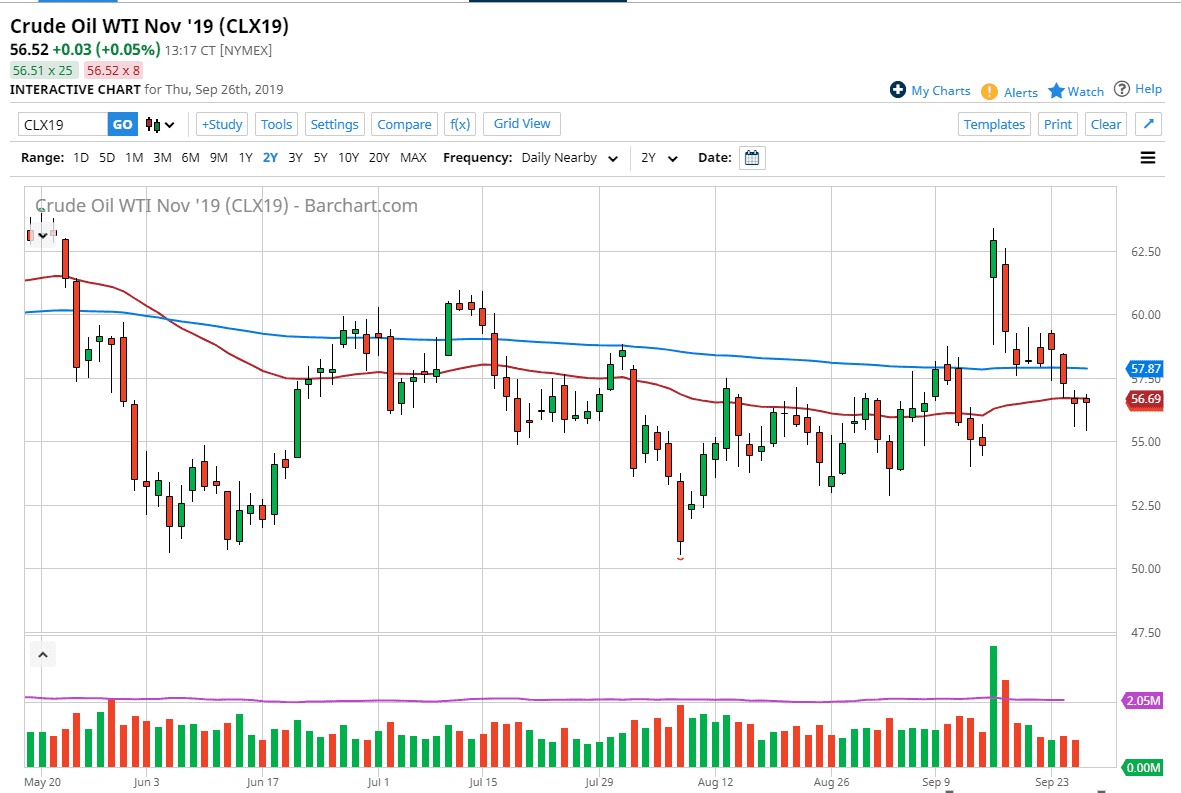

The West Texas Intermediate Crude Oil market initially fell during the trading session on Thursday but has seen a bit of a bounce to form a hammer yet again as it did during the previous session. The $55 level underneath is the bottom of the gap from the drone attack in the oil fields of Saudi Arabia, and we have now tested the bottom of that gap a couple of days in a row. This shows that there is a significant amount of support underneath at roughly the $55 level so it’s likely we will see buyers come back into this market every time it gets close. That being said though, if we were to break down below the $54.75 level, that would of course be a very negative sign.

To the upside, the 200 day EMA sits at roughly $57.80, so therefore I would anticipate a certain amount of resistance and that area as per typical reaction, and at this point if the market were to break above there then it could go looking towards the $59 level above which has been resistance recently as well. I don’t necessarily expect to see crude oil to rally significantly though, because there is so much in the way of noise and of course concerns out there when it comes to global demand. After all, if the global economy is starting to slow down there’s no reason to think that crude oil suddenly going to be in huge demand. With that in mind, I believe that we go sideways overall, and perhaps we are trying to form a new consolidation area between the $55 level on the bottom and the $59 level on the top.

Ultimately, we will eventually break out in one direction or the other, but we need some type of catalyst to make that happen. Right now, I just don’t see what it is, but once that happens it should be rather violent. In the short term I expect to see a lot of back-and-forth trading on short-term charts, so therefore crude oil traders will have to keep that in mind as the market is going to be susceptible to a lot of choppy and back and forth trading. All things being equal, this is a market that is going to be more of a day trading type of environment.