The Gold markets went back and forth during the trading session on Friday as we continue to see a lot of noise out there. At this point, it looks as if we are most certainly in a bullish market but we also have a lot of supportive levels underneath that need to be tested again. We are a bit overextended, but at this point it’s easy to see that selling this market would be very dangerous to say the least. With that in mind, I’m looking for “value” in the market.

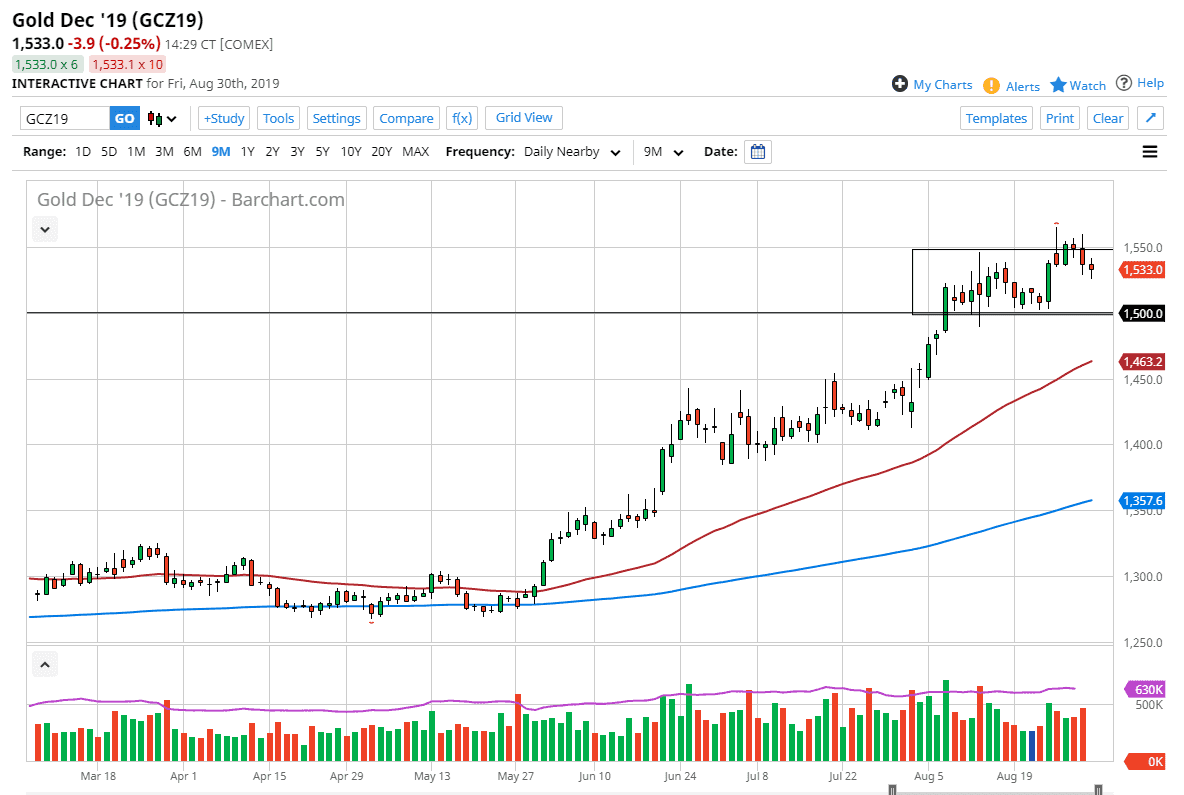

The first support level underneath is the $1500 level, and at this point I think that buyers would be more than willing to come back into this market and push gold higher. Below there, it’s likely that the $1465 level will offer support as it is where the 50 day EMA is. Underneath there even further at the $1450 level, it’s likely that the market will continue to find buyers there as well as it is the top of an ascending triangle. In other words, there are plenty of technical levels between here and there that could turn this market right back around.

Gold of course is bought in times of uncertainty and we have plenty of uncertainty out there to deal with. The US/China trade situation continues to be a major issue, and therefore I think that gold will continue to get a bit of a bid based on that alone. It is through that prism that you have to look at the precious metals complex in general, not just gold. After all, silver has taken off to the upside. I’ve also seen platinum look very strong, so I think at this point anything that gets you away from a fiat currency is probably going to work out over the longer-term.

We have obviously changed the overall trend, and now the market is one that can only be bought. Trying to short this type of market is a great way to lose money, and therefore you should be involved in it. Yes, I do recognize that we are going to go lower, but that should only be thought of as value. Something would have to change fundamentally with the global situation be it on the geopolitical front, the US/China trade front, and so many other issues to make things change at this point.