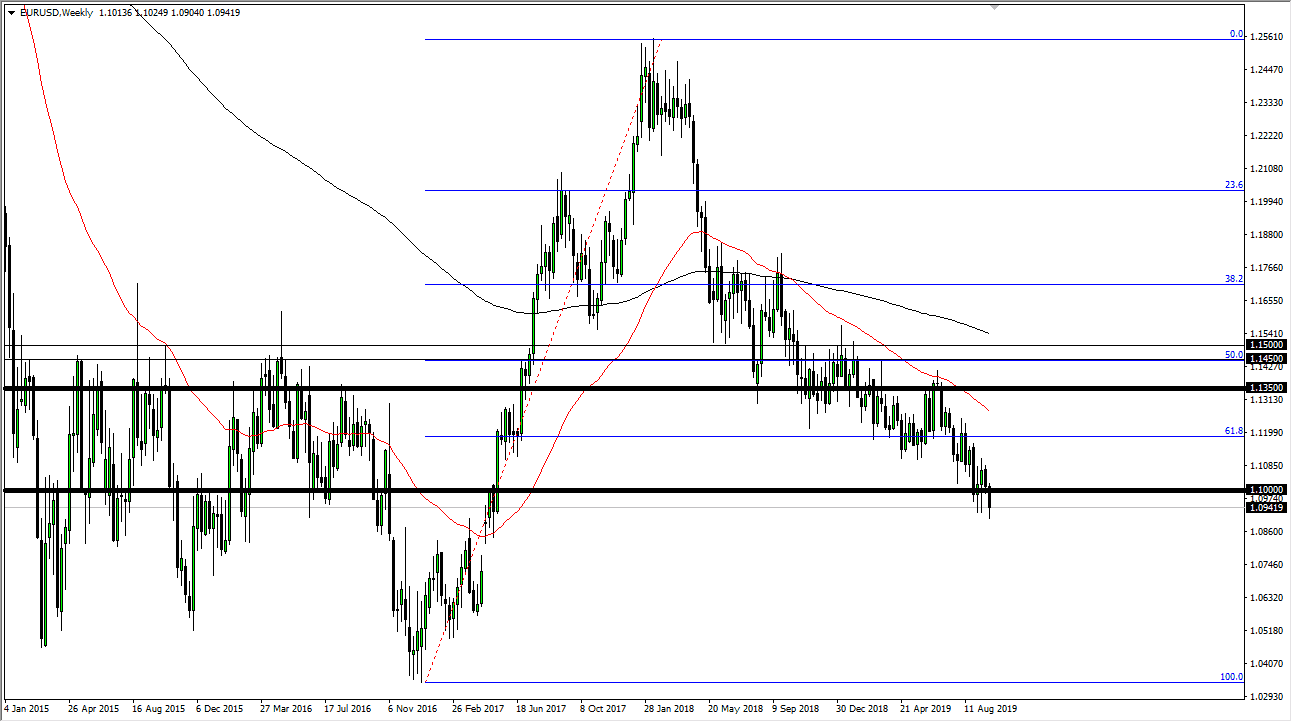

EUR/USD

The Euro has fallen again during the week, and therefore it looks as if we are going to continue the slow grind lower. Quite frankly, I like the idea of fading rallies as they occur, and I believe that in the short term we are likely to see the 1.11 USD pair offer a significant amount of resistance, and it’s going to be difficult to imagine a scenario where we break out above there and go much higher. If we break down below the bottom of the weekly chart, then it’s likely we go looking towards the gap underneath, which will take quite some time to get to as it is at the 1.0750 region.

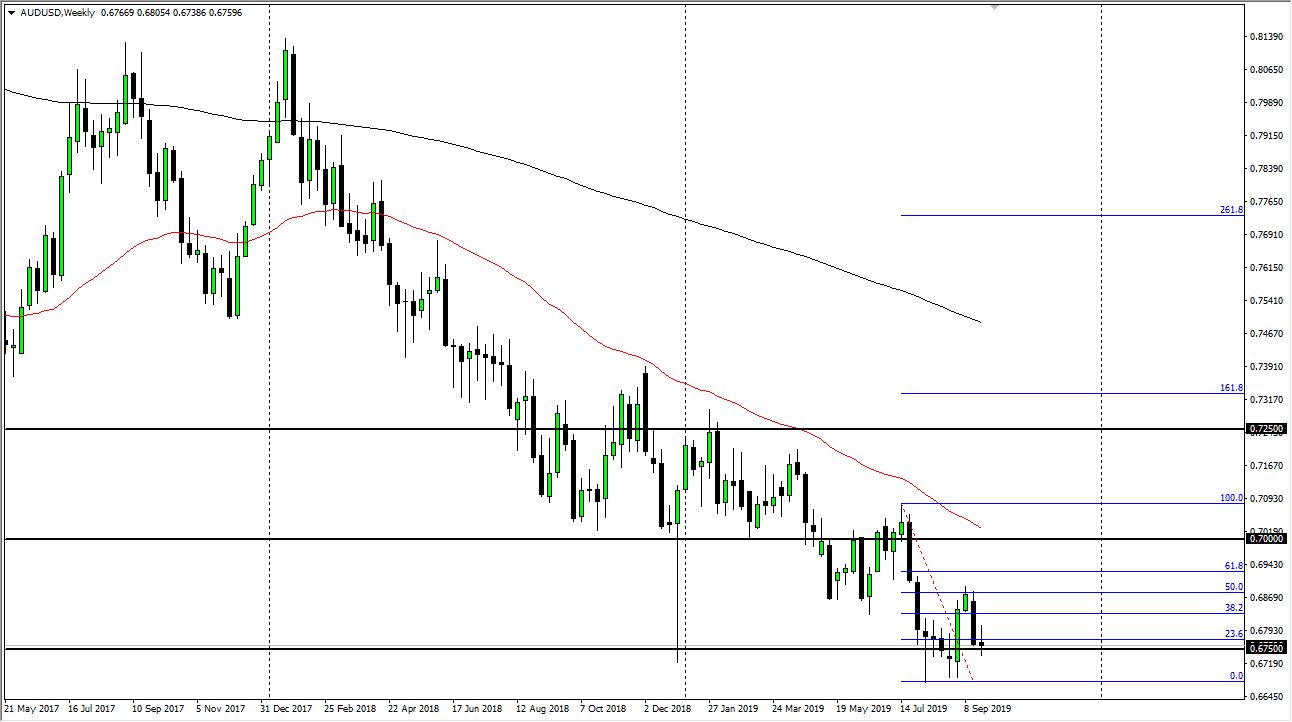

AUD/USD

The Australian dollar has gone back and forth during the course of the week, showing signs of indecision yet again. I think that’s going to continue to be the case in this marketplace and short-term traders are going to be the only ones involved with the Australian dollar until we get some type of catalyst to move this market in one direction or the other. In the meantime, every time we are 50 pips away from the 0.7650 level, it’s likely a reversal trade will work out for short-term scalps.

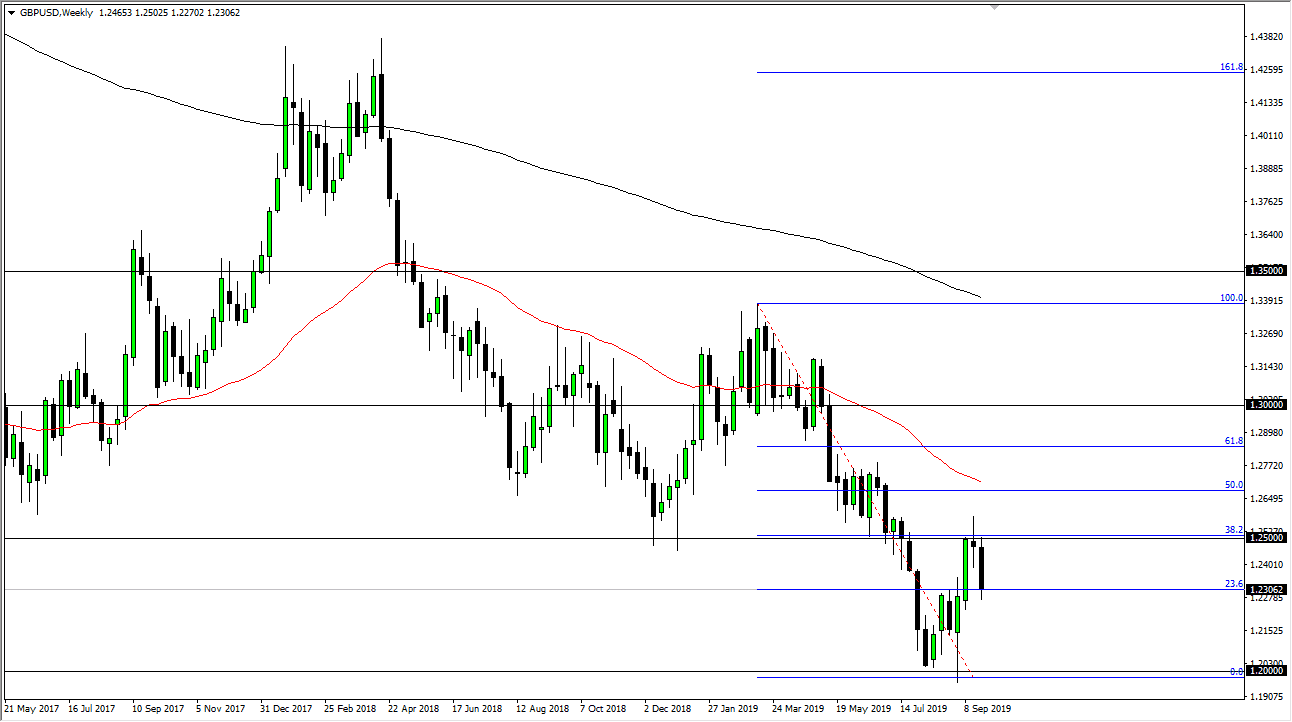

GBP/USD

The British pound has broken down during the week, crashing into the 1.23 level. However, the Friday session saw some buying in that area and support so it makes sense that we will probably continue to see a bit of stability in this area. I suspect that we get a short-term bounce, followed by selling yet again as the 1.25 level above should be resistance, as it is not only a large, round, psychologically significant figure but it is also the 38.2% Fibonacci retracement level.

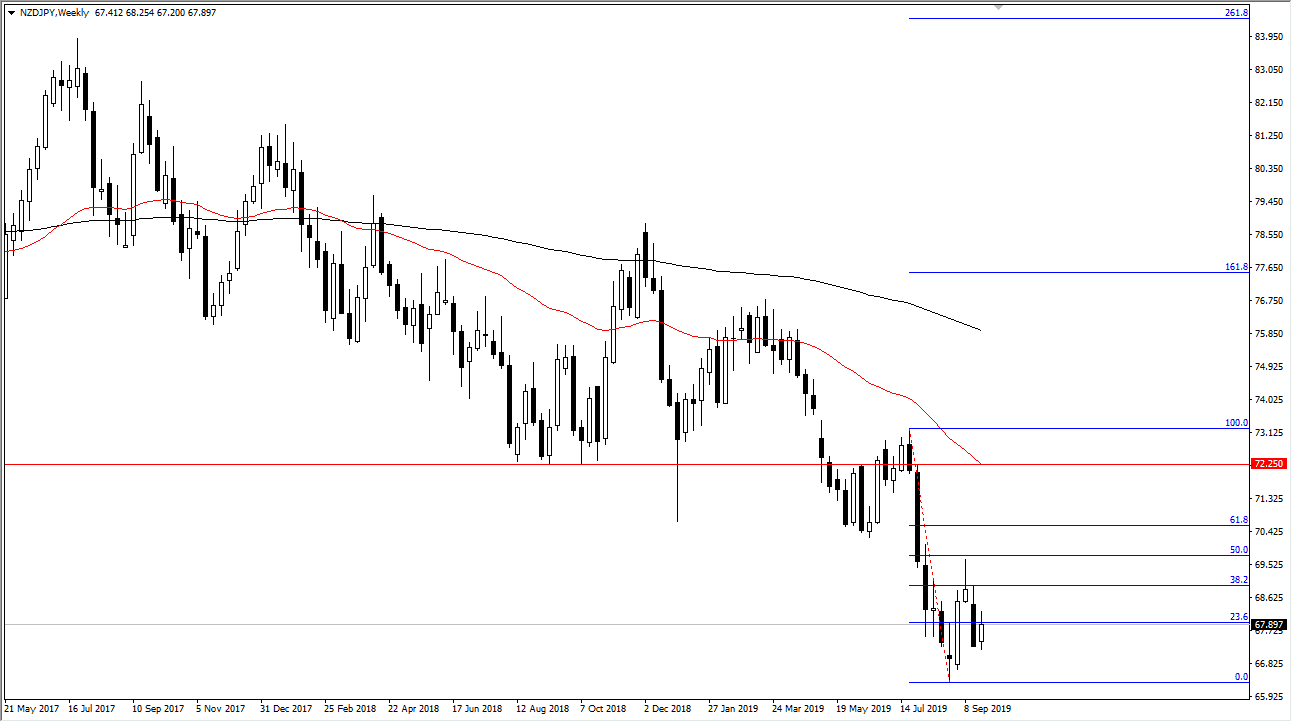

NZD/JPY

The New Zealand dollar has rallied a bit during the trading week, but still finds itself in the lot of trouble so it’s likely that we are going to continue to fade rallies going forward. That being the case it’s likely that we will eventually go looking towards the ¥66 level again. I continue to think that the ¥70 level above it looks massive, and I think it should continue to be a major barrier for sellers to jump in and push this market to the downside.