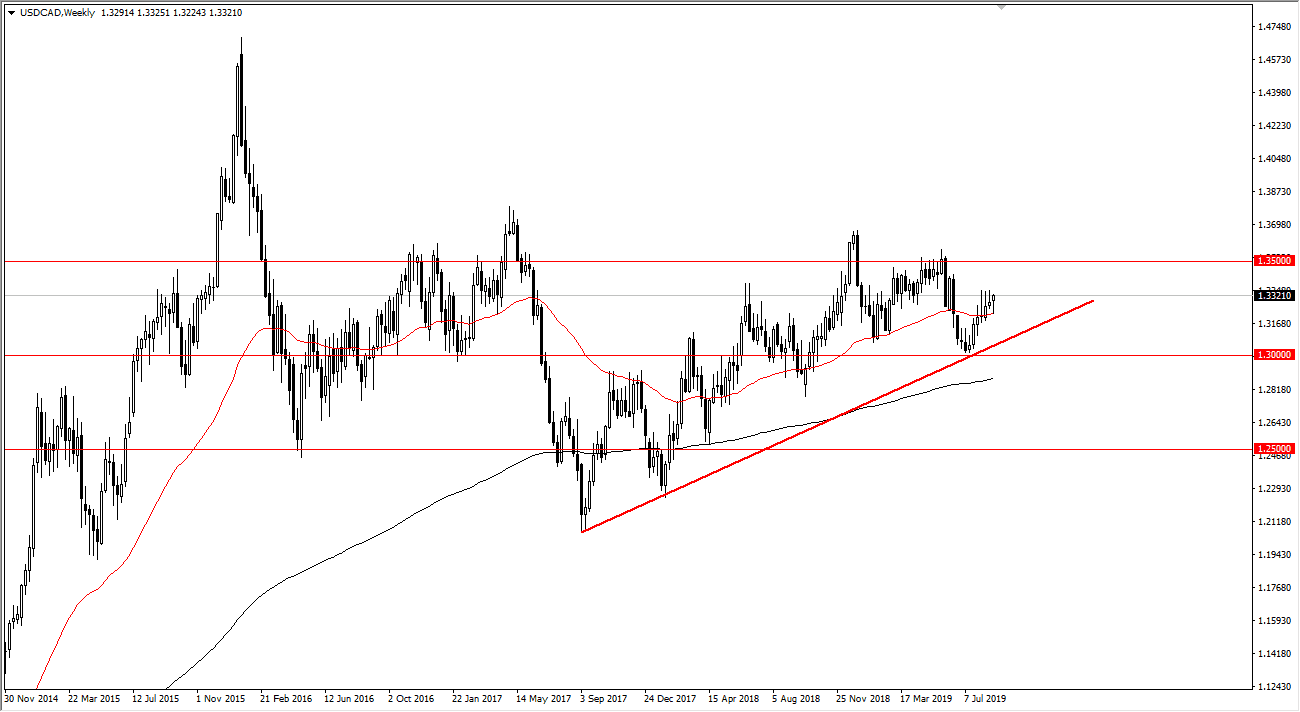

USD/CAD

The US dollar has initially fallen against the Canadian dollar during most of the week, but as you can see has turned around to show signs of life again. Ultimately, it looks as if we are going to test the top of the three previous week so if we can clear the 1.3350 level, I find it very likely that we will then go looking towards 1.35 level over the longer-term. To the downside, expect the 50 week EMA to offer a certain amount of support.

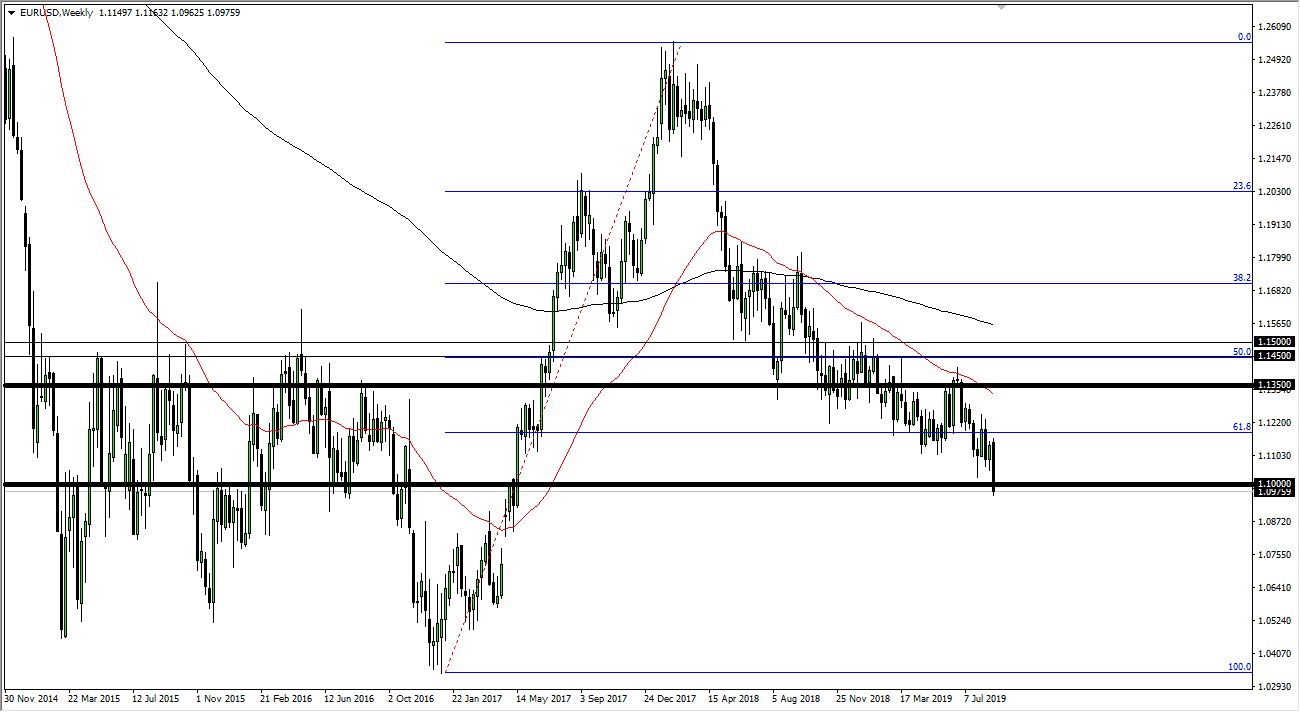

EUR/USD

During the Friday session, the Euro finally broke down below the 1.10 EUR level, which of course is a major breach of support. There is a lot of noise just below so don’t be surprised at all to see if there is a bit of a bounce but I think that bounce is simply going to offer another selling opportunity as this market seems destined to go looking towards the 100% Fibonacci retracement level which is closer to the 104 EUR level. I have no interest in buying this market anymore.

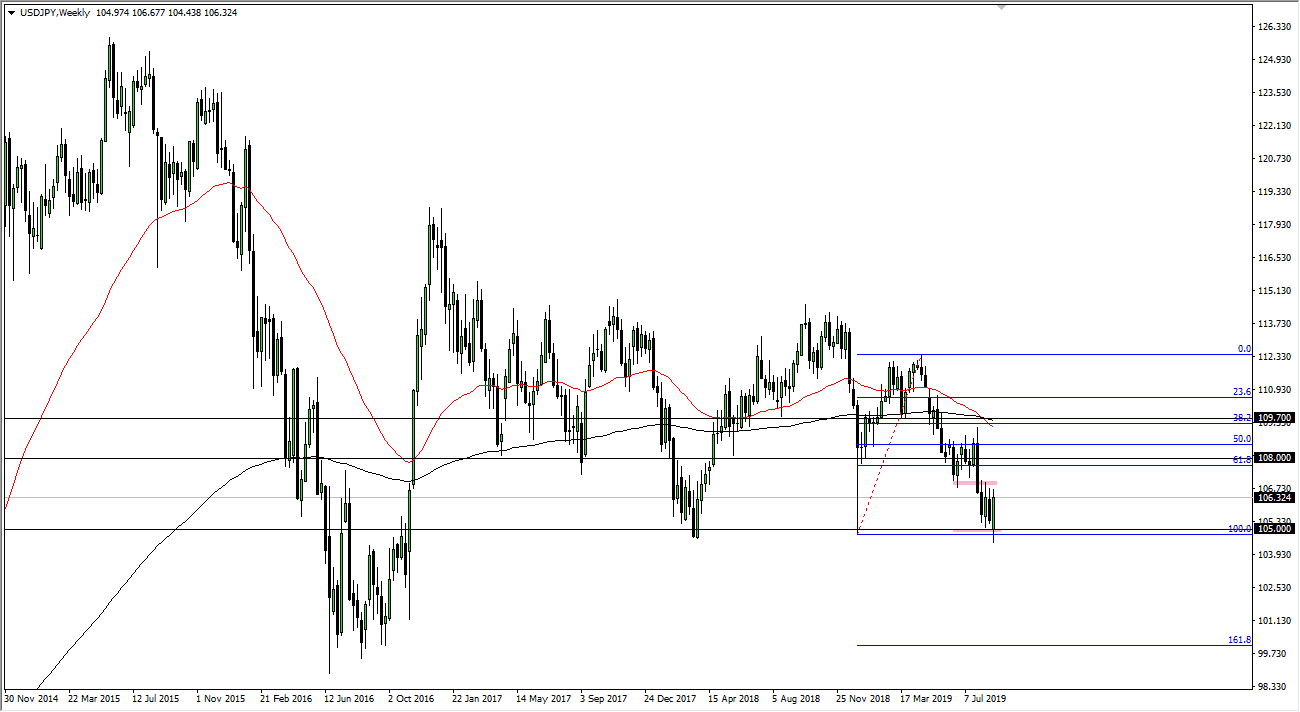

USD/JPY

This is a very sloppy pair right now, but it is starting to “slump” to the downside. I think that the market is trying to break down through the ¥105 level, and if it does we could find ourselves reaching towards the ¥102.50 level, and then possibly the ¥100 level after that. Ultimately, this is a market that is risk appetite driven, and as long as risk appetite is so shaky, it isn’t going to take much to have this market roll over every time it tries to rally.

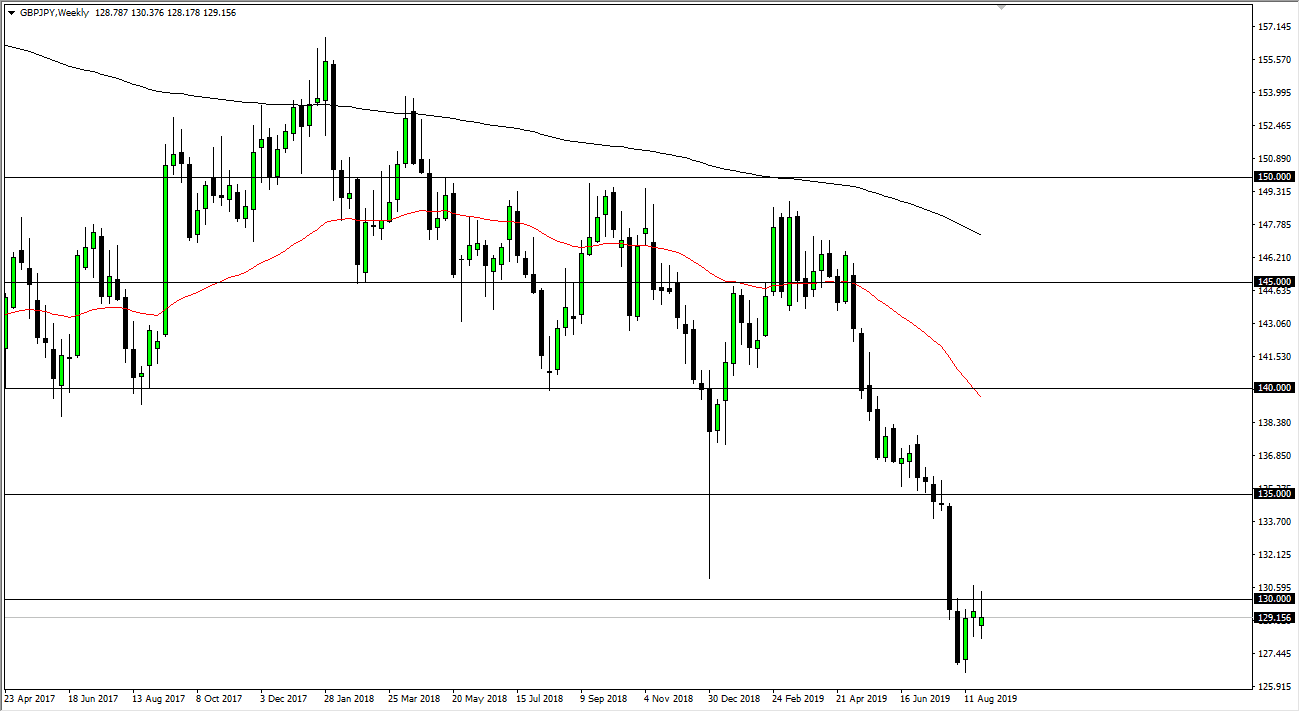

GBP/JPY

The British pound has been all over the place as one would expect, as the Brexit continues to cause major issues. Hooking of the chart though, it’s obvious that the ¥130 level that we have a lot of selling pressure there. The market forming a bit of a shooting star, and I think it’s only a matter of time before we reach down to the ¥126 level. The alternate scenario of course is that we break above the top of the shooting star from the previous week, which could give the market reaching towards the ¥134 level. All things being equal, it’s very likely that the market will continue to be negative though, not only the Brexit but also the risk appetite warrants that move.