The US dollar rallied against the South African Rand right off the bat on Monday as we gapped higher and reach above the 14.70 level initially. We did pull back a bit from there, but then turned around to rally again. At this point, the market has showed signs of concern, as money flows away from emerging markets after the drone attack in the Saudi Arabian desert. This was obviously a huge “risk off” move, as money flew into treasuries in the United States and of course away from anything remotely close to commodities.

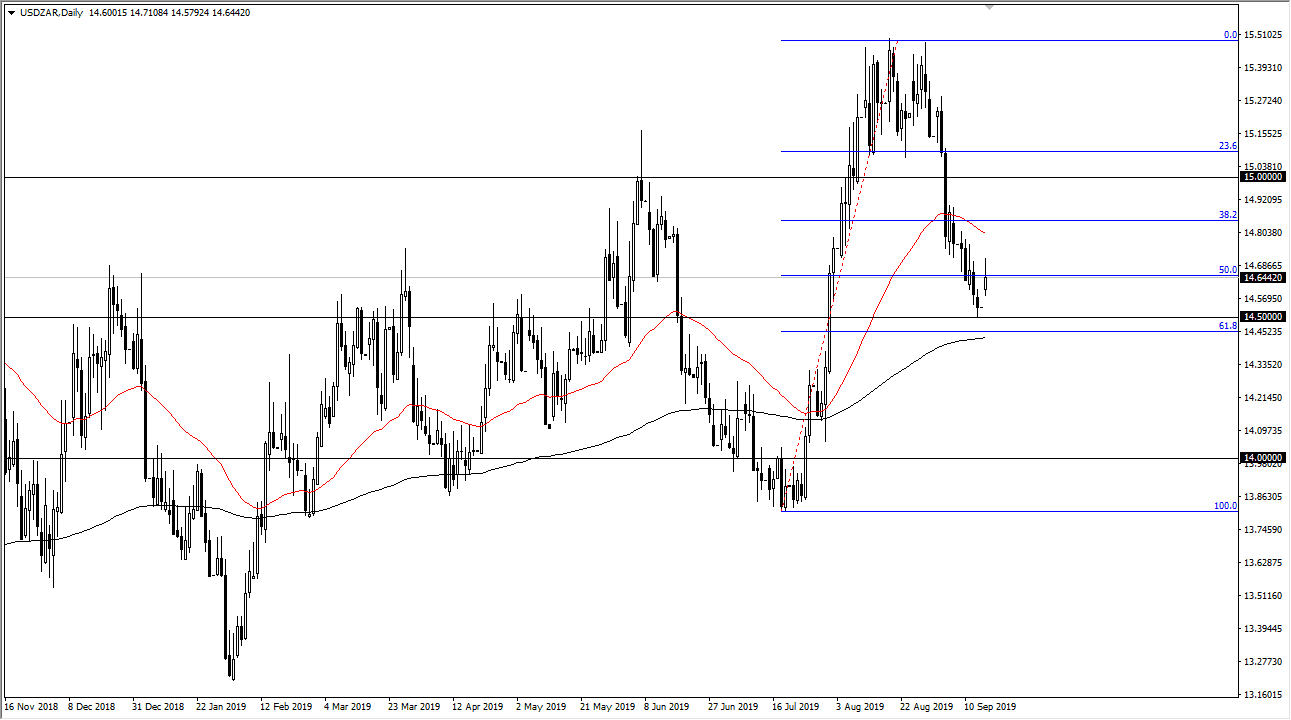

The South African Rand is not only a risky currency, but it is also an emerging market currency so it makes it particularly sensitive to trouble in these types of times. With this, we could also point out that the 14.50 Rand level has offered quite a bit of support, sitting just above the 61.8% Fibonacci retracement level. The 200 day EMA is just underneath there, which of course continues to offer support.

Looking at the candle stick for the trading session on Monday, if we can break above the top of that candlestick it’s likely that we will continue to see a lot of upward momentum as it would show extreme strength. At this point, the 15.00 Rand level should be a target due to the fact that we would be slicing through major resistance, and then it should be a bit of a “beach ball underwater” type of moment.

To the downside, if we were to break down below the black 200 day EMA it would probably send this market down towards the 14.10 Rand level, which was the scene of the most recent surge higher. All things been equal though, it makes quite a bit of sense that the US dollar should continue to strengthen due to the fact that this is a fluid situation in the Middle East, and it’s likely to only get worse before it gets better. Mike Pompeo has already suggested that the US government has proof that the attack on the Saudi desert refining facilities came from Iranian soil. This has a lot of traders concerned, because this could only cause major disruption if anything else. Ultimately, unless the situation calms down, crude oil will more than likely continue to go much higher, especially considering that 5% of the world’s refining capacity was wiped out.