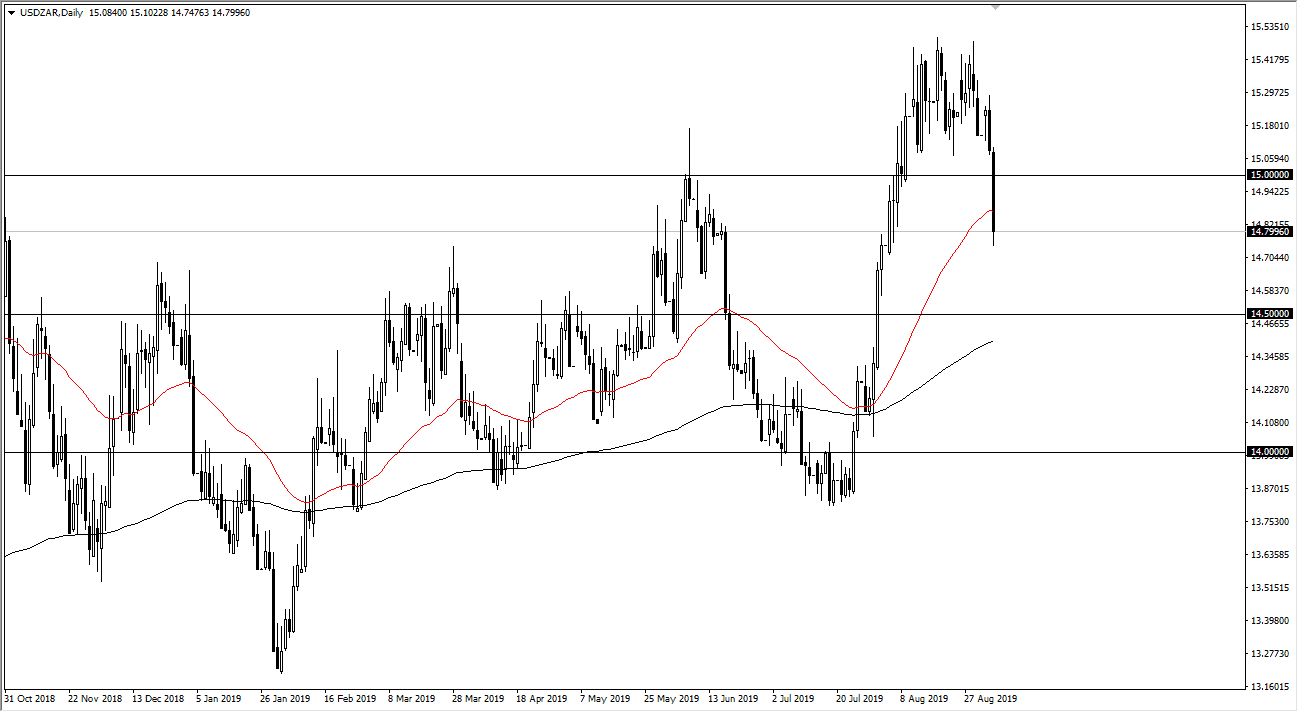

The US dollar has fallen rather hard against the South African Rand during trading on Wednesday, breaking through the 15 Rand level. That being said, we have also sliced slightly through the 50 day EMA which is something that will attract a certain amount of attention. Ultimately, this is a market that will continue to see a lot of volatility and rightfully so as the South African Rand is an emerging market currency. Simply put, this comes down to “risk on” or “risk off” as emerging market currencies do tend to fare better in times of risk appetite increasing.

That being said, it’s a bit difficult to imagine that this is suddenly going to be an extraordinarily bearish market. After all, there are far too many moving pieces around the world right now to suggest that it’s time to start piling into emerging market currencies and assets. At this point, it simply looks like the market may have been overdone, and it needed to pull back a bit. With that in mind I do think that it’s only a matter of time before the buyers come back and started to push the value of the South African Rand back down.

The 14.50 Rand level is a great candidate for support, not only because it is at a midcentury mark, but it is also the 61.8% Fibonacci retracement level and the 200 day EMA. With both of those things working in its favor, I suspect it’s only a matter of time before buyers would jump into the market in that area. If we get some type of bad news between now and then, the market will simply jump from there. The greenback is the ultimate safety currency and it is a bit curious that the US dollar is losing a bit of strength against the Rand in an environment which has seen the bond market performed quite well during the day. With all that being said, I feel it’s only a matter time before this market rallies. If we do break down below the black 200 day EMA though, that could have me rethinking the entire situation. Until then I am simply looking for signs of a bounce or perhaps the candle stick like a hammer to start buying again. The day was pretty impressive for the South African Rand, but when looked at in the big picture, it’s just a simple pull back.