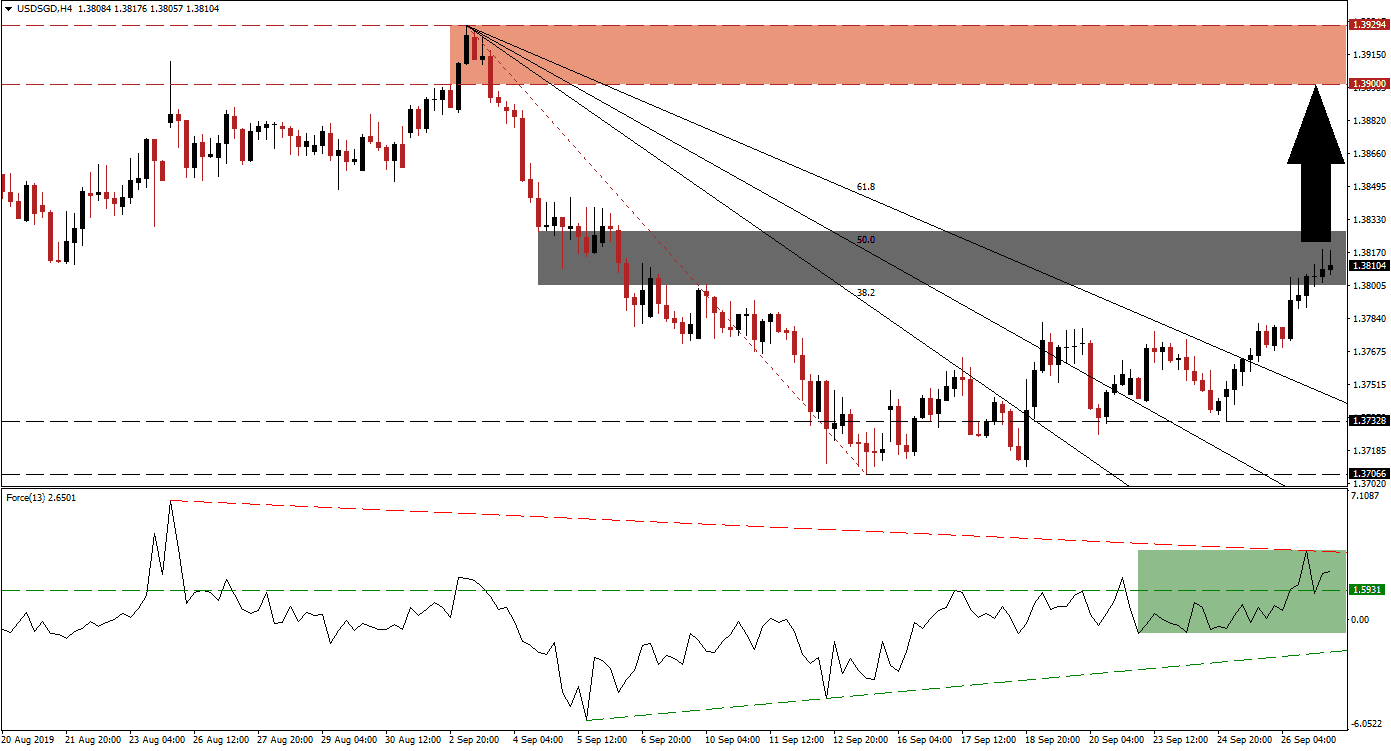

Yesterday’s industrial production data out of Singapore showed a much bigger contraction in August than economists anticipated which resulted in a sell-off in the Singapore Dollar. It also highlighted that the global economy appears to be in worse shape than markets have priced in. The USD/SGD accelerated into its short-term resistance zone, slowly turning it into support; this zone is located between 1.38011 and 1.38273 which is marked by the grey rectangle. Price action completed a breakout through its entire Fibonacci Retracement Fan Resistance sequence turning it into support and with bullish momentum on its side, the current resistance/support zone conversion should be closely monitored.

The Force Index, a next generation technical indicator, advanced together with price action. As the USD/SGD descended into its support zone between 1.37066 and 1.37328, this technical indicator started to advance and formed a positive divergence which signalled that the sell-off is nearing its end. As price action pushed through its Fibonacci Retracement Fan Resistance sequence, the Force Index created a series of higher highs which moved it above its horizontal support level where it is currently located as marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Economic worries out of Singapore have trumped political issues out of the US which provided a fundamental boost to the rally in the USD/SGD. As long as the Force Index can maintain its upward momentum, a breakout above its short-term support zone is possible to extend the rally further to the upside. The intra-day high of 1.38439 will come in play if price action will march higher, this level represents the high before price action accelerated to the downside from where the current rally emerged.

A successful move above 1.38439 will clear the path for the USD/SGD to advance into its next resistance zone which is located between 1.39000 and 1.39294 as marked by the red rectangle. A breakout needs to be confirmed by the Force Index with a higher high of its own which would take it above its descending resistance level. This trade will come down to fundamental economic factors which are weaker in Singapore than they are in the US. Baring a negative surprise out of the US economic data today, this currency pair should be able to extend its breakout series. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.38000

Take Profit @ 1.39100

Stop Loss @ 1.37700

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

Should the Force Index reverse and move below its horizontal support level followed by a breakdown in the USD/SGD below its short-term support zone, a retracement down to its 61.8 Fibonacci Retracement Fan Support Level is possible. This level is approaching the top range of its next support zone, with the rest of the Fibonacci Retracement Fan Support below it.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.37650

Take Profit @ 1.37200

Stop Loss @ 1.37850

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25