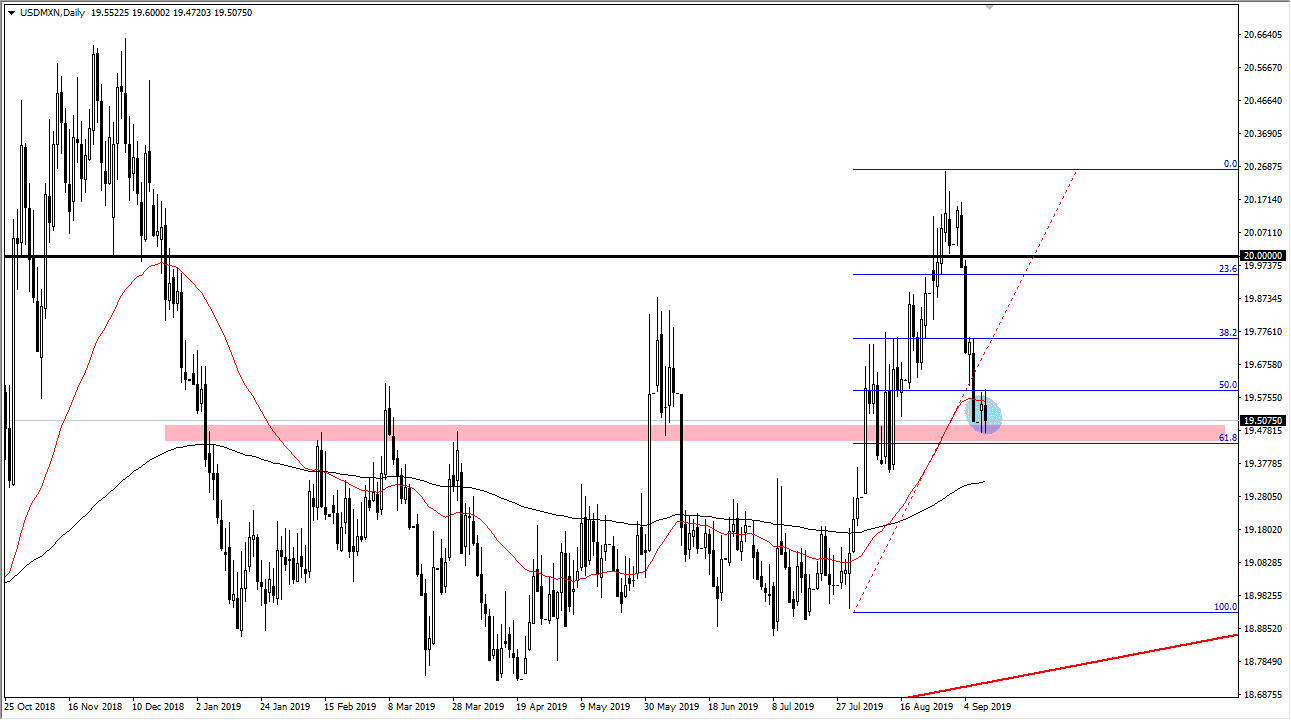

The US dollar has pulled back a bit during the trading session on Tuesday, reaching down towards the 61.8% Fibonacci retracement level yet again. We had seen this action during the Monday session, and we have revisited it during the Tuesday session. It looks as if there is a significant amount of support not only at that area, but just below. This was an area that was previous resistance so it does make a certain amount of sense that market memory should come into play.

Beyond that, you should also keep in mind that the market favors the US dollar in times of financial uncertainty, and that of course is what we have going on now. The Mexican peso represents emerging markets, and that can’t be ignored. This is a market that is going to have to make some type of decision in this region, as we are just below the 50 day EMA but well above the 200 day EMA. If we can turn around and break above the 19.60 pesos level, then it’s likely that we will continue the move to the upside, perhaps reaching towards the 20.00 pesos level next.

If we break down, then start looking for support at the black 200 day EMA which is currently trading near the 19.33 pesos level. Once we break through there, then the trend favors even more retracement back to the 18.95 pesos level, and possibly the uptrend line under there. All things being equal, this is a simple “risk on/risk off scenario, as the markets are at a precipice of a serious decision making. This is a market that is going to continue to be very volatile, but I also recognize that we are likely to see furious US dollar buying if risk assets suddenly tanked. Ultimately, it wouldn’t take much to do that as we have seen as of late. The markets were somewhat quiet during the trading session on Tuesday, so that of course helped the risk profile. However, as volatility in fear enters the market I expect the Mexican peso to get sold off and this pair to start rallying again. It’s in an uptrend anyway, and the selloff probably has been a bit overdone at this point. I continue to look for buying opportunities underneath, but we don’t have them yet so a bit of patient may be needed.