At the beginning of this week, the USD / JPY is expected to be relatively quiet with no drivers. During Friday's trading session, the pair fell to the 107.51 support, as it fail to breach the 108.47 resistance, its highest level in seven weeks. This was accompanied by negative developments in the talks between the US and Chinese negotiating teams in Washington. This has supported the return of investors to safe havens again. The US currency was not supported by the US Federal Reserve's monetary policy announcement last week, as the Fed cut US interest rates as expected, but its monetary policy statement and comments by Governor Jerome Powell left uncertainty dominating the future of the rate cut.

On the other hand, the Bank of Japan kept its monetary policy unchanged at a negative interest rate and pledged further policy easing in case of risks to the Japanese economy. The future of the trade dispute between the United States and China is still the focus of Japanese monetary policy makers due to their close association, and the ongoing situation is adversely affecting Japan. The world's third largest economy signed a trade pact with the United States last week to spite China, and with that, Japan avoids the Trump administration's tariffs.

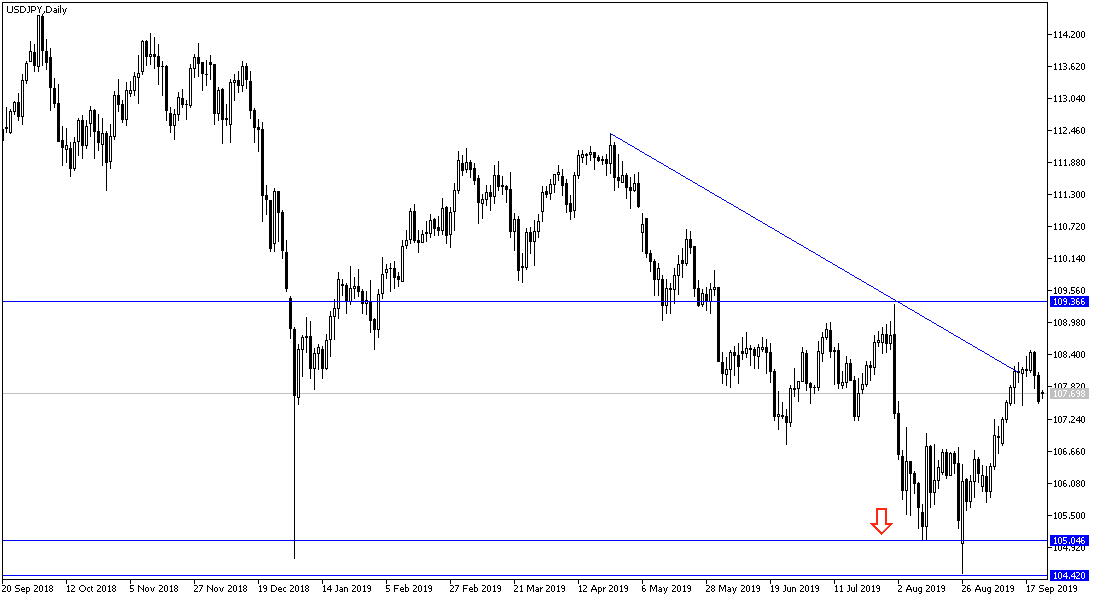

According to the technical analysis of the pair: The return of USD / JPY price above 108.00 resistance will support the continuation of the bullish expectations again and the momentum will be stronger if he succeeded in breaking the 108.47 resistance, depending on the return of investor confidence in resolving the trade dispute between the United States and China, and to reach an agreement between the two Brexit parties. The Japanese yen is extremely sensitive to growing global trade and geopolitical tensions as it is the ideal safe haven for investors in times of uncertainty. On the downside, the closest support levels for the pair are 107.60, 107.00 and 106.45 respectively and the last level threatens the upward correction. Overall I still prefer to buy the pair from every bearish level.

On the economic data front: Today's economic calendar has no significant economic data announcement from either Japan or the United States.