For the fifth day in a row, USD / JPY continues the upward correction with gains reaching the 107.50 resistance level recorded at the time of writing, the highest in a month. Supported by risk appetite amid strong signals from the United States and China to sit at the negotiating table again despite the parties imposing more tariffs on each other's products at the beginning of this month. Investors have little faith in Trump's policy, as it was often agreed to negotiate and then resumed with more sanctions. Therefore, investor appetite will remain cautious for further risk in anticipation of any surprise decisions.

The US dollar gained additional support after the release of the official jobs report by the end of last week, which despite mixed results, it still underlines the strength of the US labor market. Before the close, there were important remarks by Federal Reserve Governor Jerome Powell, in which he asserted that the central bank did not expect a recession and would take measures to maintain the country's economic growth. Economists expect the Fed to cut interest rates when they meets next week. The ECB may go first by announcing new monetary stimulus measures on Thursday to help support the region's slowing economy. Jerome Powell remains optimistic about the performance of the US economy and believes that Trump's trade wars increase the risks.

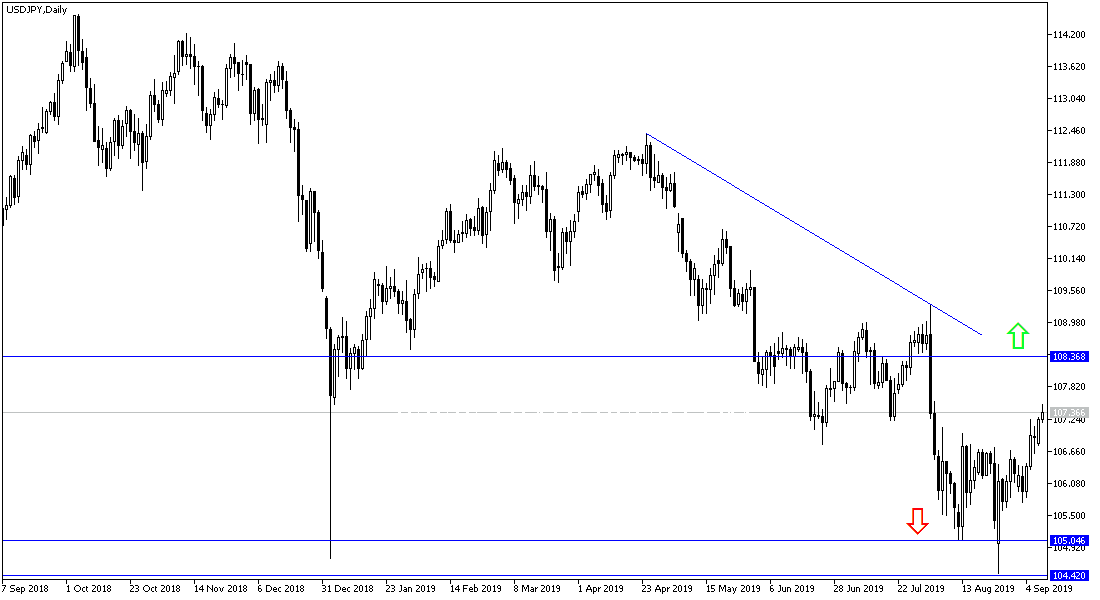

According to the technical analysis of the pair: the bullish correction of the USD / JPY pair will strengthen if it stabilizes above the 108.00 resistance level as shown on the daily chart below. Technical indicators are starting to move higher but need stronger catalysts to complete the correction attempt and confirm its strength. This may not happen quickly as global trade and geopolitical tensions remain supportive of the Japanese yen. On the downside, the closest support levels are currently at 106.85, 106.00 and 105.30, respectively, which could support the return of the downtrend and end the bullish hopes.

On the economic data front: Today's economic calendar has no important Japanese or US economic data, and the pair will react to risk appetite.