Attempts to bounce the USD/JPY pair around the 108.36 resistance level a month and a half ago have been put on hold for awaiting the announcement of Federal Reserve monetary policy decisions and important remarks by Governor Jerome Powell. Expectations are that the bank may accept a quarter-point US rate cut to stimulate the US economy, which is beginning to be affected by the prolonged trade dispute with China. In recent days, the Trump and Beijing administration have acted to ease tensions ahead of a new round of trade talks in October in Washington. However, most analysts do not expect any significant agreement soon, their trade conflict is mainly due to Beijing's campaign to take over US technological dominance.

The United States and Japan have reached a huge trade agreement as a US move to put pressure on China ahead of their round of talks soon. With the agreement, the United States may exclude Japanese cars from US tariffs. For his part, US President Trump sees the possibility of signing an agreement with China ahead of the upcoming US presidential elections, although Beijing wants to have a deal with another president, Trump said. He threatened harsh conditions on China if the deal was postponed until after he won the election.

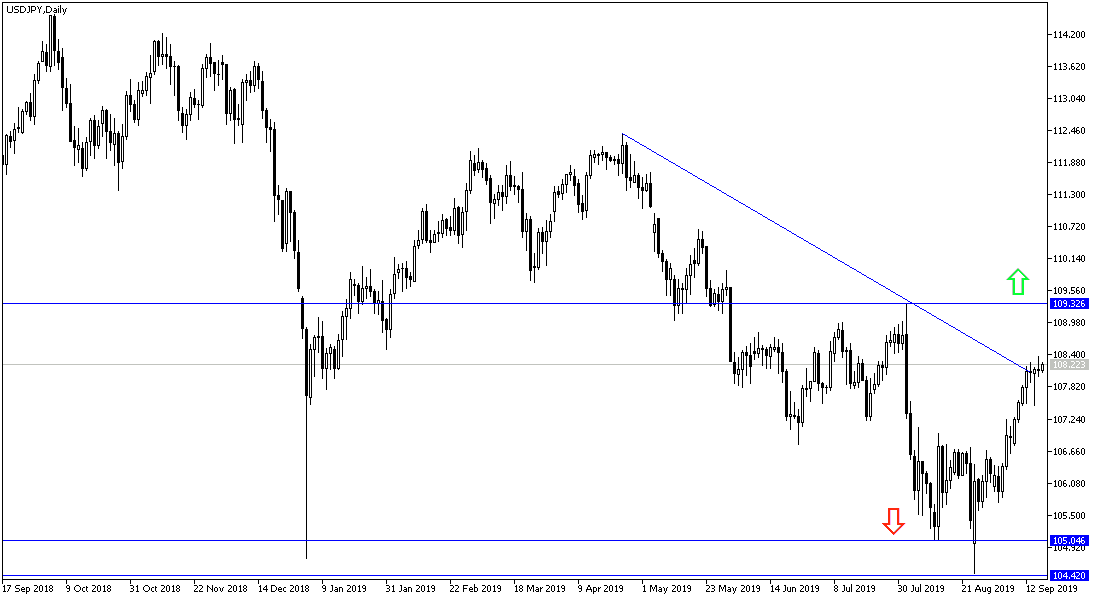

According to the technical analysis of the pair: The current upward correction of the USD / JPY may turn suddenly if the US central bank decides against markets desire, and the supportive to the dollar, with the intention of further easing monetary policy, which paves the way for a further reduction before the end of this year. This confirms that the US economy is already suffering and therefore the closest support levels for the pair are currently at 107.70, 107.00 and 106.20 respectively. The bank abandoning the idea of continuing to ease monetary policy, or not to cut interest rates as expected, would support stronger gains for the pair. Closest resistance levels are currently at 108.85 and 109.30 and 110.00 psychological top respectively.

On the economic data level: After the release of Japan's trade balance figures, today's economic calendar will focus on the release of US housing numbers and oil inventories, followed by the most important decisions for the Federal Reserve's monetary policy and remarks by Governor Jerome Powell.